WW Enterprise Storage Market Perfectly Flat in 2Q16 – IDC

Hitachi, Dell and HPE growing, IBM, EMC and NetApp decreasing Y/Y

This is a Press Release edited by StorageNewsletter.com on September 19, 2016 at 2:58 pmTotal worldwide enterprise storage systems factory revenue remained flat year over year, posting 0.0% growth and $8.8 billion during 2Q16, according to the IDC Corp.‘s Worldwide Quarterly Enterprise Storage Systems Tracker.

Total capacity shipments were up 12.9% year over year to 34.7EBs during the quarter.

Revenue growth declined within the group of original design manufacturers (ODMs) that sell directly to hyperscale datacenters. This portion of the market was down 21.5% year over year to $794.7 million.

Sales of server-based storage were up 9.8% during the quarter and accounted for almost $2.4 billion in revenue.

External storage systems remained the largest market segment, but the $5.7 billion in sales represented flat 0.0% year-over-year growth.

“After a slow start to the year, the enterprise storage system market remained steady during the second quarter,” said Liz Conner, research manager, storage systems. “Spending on all flash deployments continues to grow and help drive the market. The decreasing cost of flash media, coupled with increasing use cases, high density deployments, and availability of flash-based storage products, have resulted in rapid adoption throughout the market.“

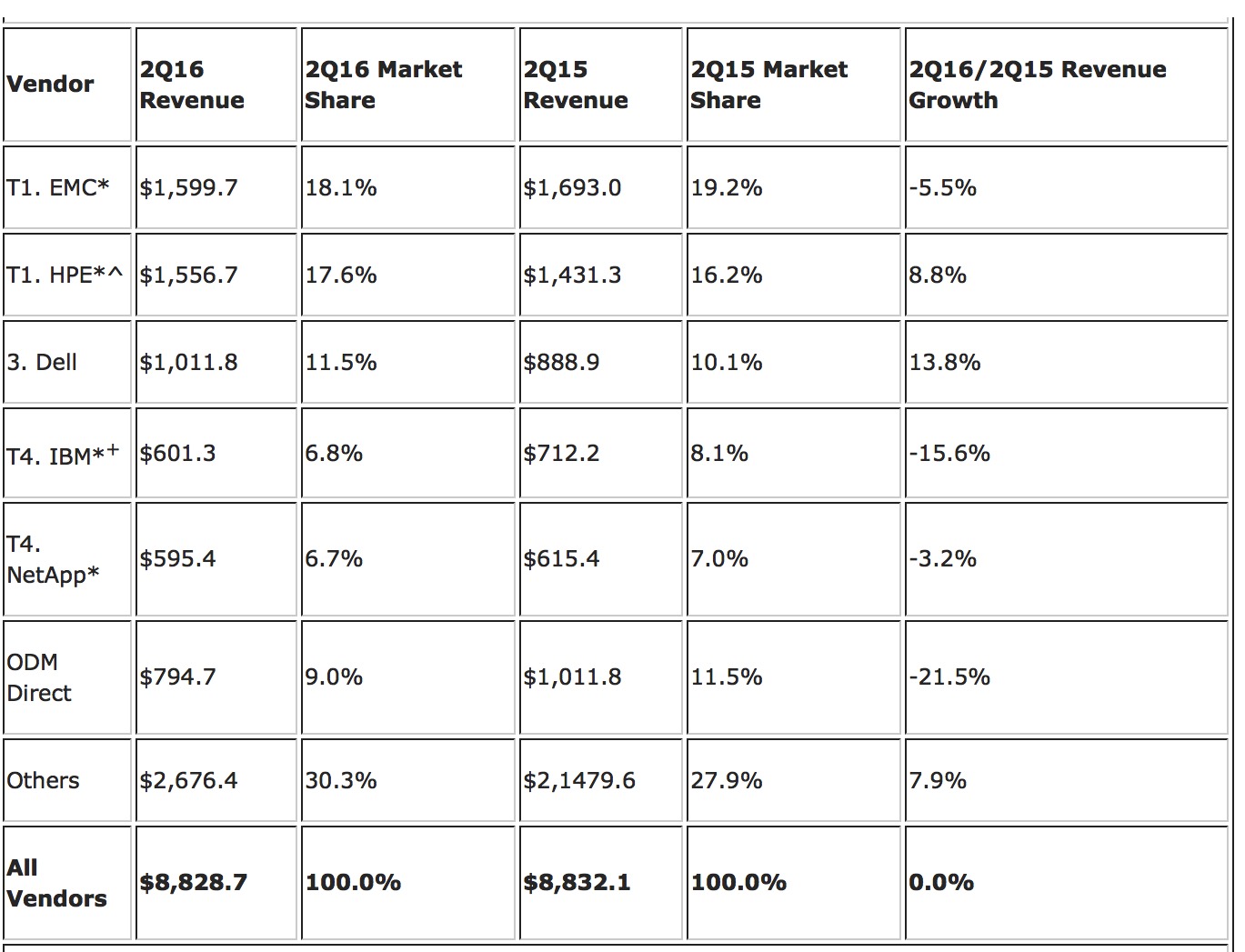

2Q16 Total Enterprise Storage Systems Market Results

EMC and HPE remained in a statistical tie* for the top position within the total worldwide enterprise storage systems market, accounting for 18.1% and 17.6% of spending respectively. HPE’s year-over-year growth rate as reported by IDC was impacted by the start of the H3C partnership in China that began in May of 2016; as a result, a portion of HPE-designed storage systems were rebranded for the China market and do not count in HPE’s market data from that point forward. Dell held the next position with a 11.5% share of revenue during the quarter. IBM and NetApp accounted for 6.8% and 6.7% of global spending respectively. As a single group, storage systems sales by ODMs selling directly to hyperscale data center customers accounted for 9.0% of global spending during the quarter.

Top 5 Vendors, WW Total Enterprise Storage Systems Market, 2Q16

(revenue in $ million)

(Source: IDC Worldwide Quarterly Enterprise Storage Systems Tracker, September 16, 2016)

Notes:

* IDC declares a statistical tie in the worldwide enterprise storage systems market when there is less than 1% difference in the revenue share of two or more vendors.

^ HPE’s 2Q16 revenue excludes the H3C business being rebranded in China.

+ IBM’s 2Q16 revenue excludes x86 servers due to the sale of that business to Lenovo.

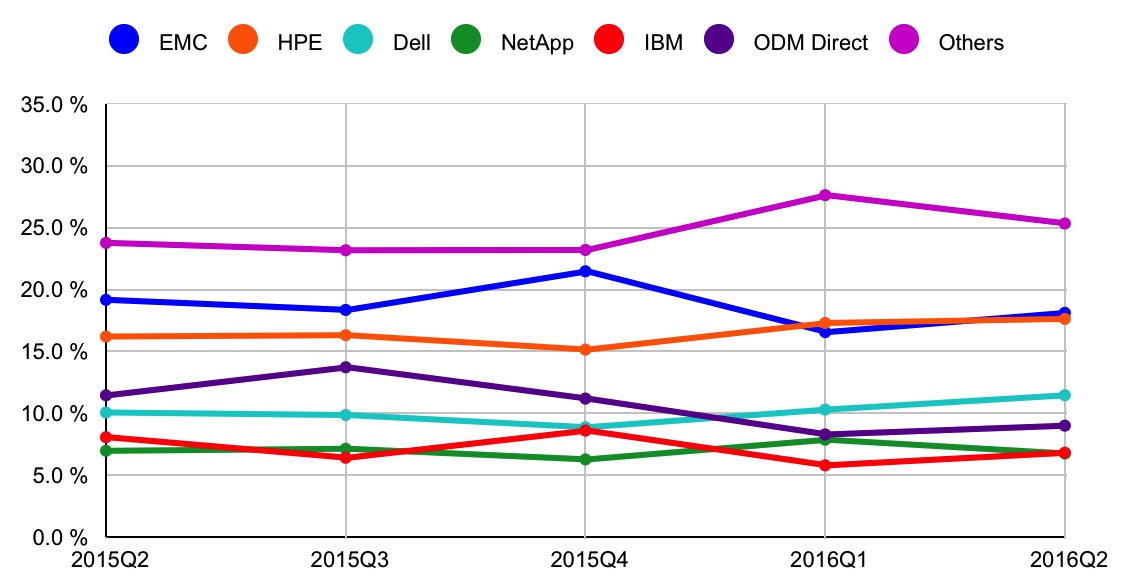

Top 5 Vendors, WW External Enterprise Storage Systems Market, 2Q15-2Q16

(shares based on revenue)

(Source: IDC Worldwide Quarterly Enterprise Storage Systems Tracker, 2Q16)

Notes:

* IDC declares a statistical tie in the worldwide enterprise storage systems market when there is less than one% difference in the revenue share of two or more vendors.

^ HPE’s 2Q16 revenue as reported by IDC excludes the H3C business being rebranded in China.

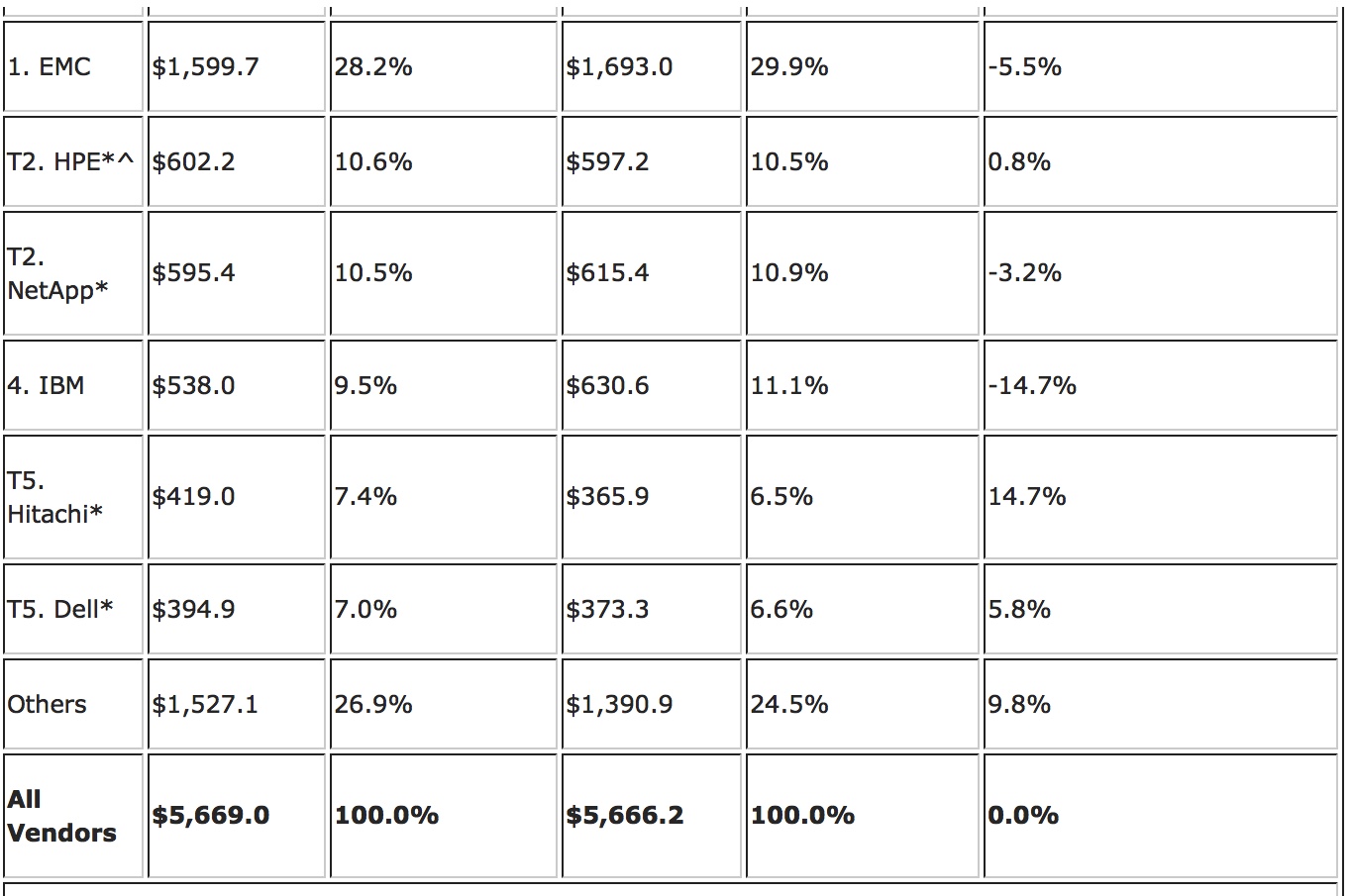

2Q16 External Enterprise Storage Systems Results

EMC was the largest external enterprise storage systems supplier during the quarter, accounting for 28.2% of worldwide revenues. HPE and NetApp finished in a statistical tie* for the number 2 position, each with 10.6% and 10.5% of market share. IBM finished the quarter in the number 4 position with 9.5% share of worldwide revenues. Hitachi and Dell rounded out the top 5 in a statistical tie* with a 7.4% and 7.0% share, respectively, of worldwide external enterprise storage revenue during the quarter.

Top 5 Vendors, Worldwide External Enterprise Storage Systems Market, 2Q16

(revenue in $ million)

(Source: IDC Worldwide Quarterly Enterprise Storage Systems Tracker, June 3, 2016)

Flash-Based Storage Systems Highlights

The total all-flash array market generated almost $1.1 billion in revenue during the quarter, up 94.5% year over year. The hybrid flash array segment of the market continues to be a significant part of the overall market with $2.3 billion in revenue and 26.1% market share.

Taxonomy Notes

- IDC defines a disk storage system as a set of storage elements, including controllers, cables, and (in some instances) HBAs, associated with three or more disks. A system may be located outside of or within a server cabinet and the average cost of the disk storage systems does not include infrastructure storage hardware (i.e. switches) and non-bundled storage software.

- The information in this quantitative study is based on a branded view of the disk storage systems sale.

- Revenue associated with the products to the end user is attributed to the seller (brand) of the product, not the manufacturer. OEM sales are not included in this study. In this study, HDS sales do not reflect their OEM sales to Sun Microsystems and HPE.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter