NAND Flash Prices Begin to Recover in 2Q25

As production cuts and inventory rebuilding take effect, says TrendForce

This is a Press Release edited by StorageNewsletter.com on March 27, 2025 at 2:03 pmTrendForce Corp. reports that NAND flash suppliers began reducing production in the 4th quarter of 2024, and the effects are now starting to show.

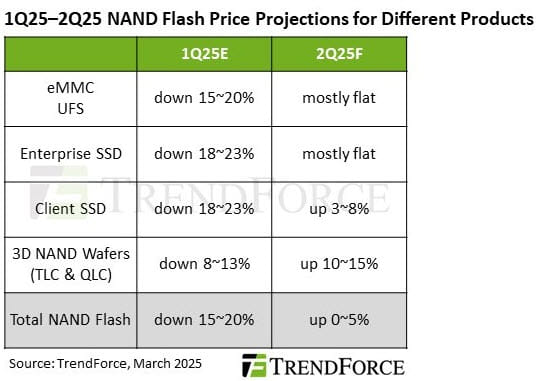

In anticipation of potential US tariff increases, consumer electronics brands have accelerated production, further driving up demand. Concurrently, inventory restocking is underway across the PC, smartphone, and data center sectors. As a result, NAND flash prices are expected to stabilize in the second quarter of 2025, with prices for wafers and client SSDs projected to rise.

Client SSD prices to rise 3-8% while enterprise SSD prices to remain flat

After 3 consecutive quarters of inventory depletion, client SSD demand is rebounding as OEMs resume production early. The upcoming end of Windows 10 support and the launch of new-gen CPUs are expected to drive replacement demand for PCs. Meanwhile, the DeepSeek effect is accelerating the adoption of edge AI, further fueling client SSD demand.

With production cuts and supply adjustments gradually restoring balance, client SSD contract prices are projected to rise 3% to 8% Q/Q in Q2.

Technologies like DeepSeek have significantly lowered AI model training costs, spurring strong demand for storage solutions in China. In North America, however, demand is more polarized: server brand orders have been weaker than expected, while CSPs are increasing procurement as NVIDIA’s Blackwell platform begins shipping. Consequently, enterprise SSD orders are expected to see slight Q/Q growth in Q2.

On the supply side, some vendors slashed PCIe 4.0 SSD prices by over 20% in Q1 to clear inventory. Suppliers have adjusted capacity to stabilize prices, and some server clients have pulled in orders earlier than planned. As such, enterprise SSD contract prices are expected to hold steady in Q2.

eMMC and UFS prices hold steady as NAND Flash wafer prices to rise 10-15%

TrendForce notes that shipments of smart TVs, tablets, and Chromebooks are expected to rise in Q2. Coupled with a stable demand for mid-to-low-end smartphones in emerging markets and subsidy policies in China, eMMC orders are seeing an uptick.

On the supply side, previous oversupply and price declines drove NAND flash makers into losses, prompting production cuts to rebalance the market. To return to profitability, suppliers have raised wafer prices for module makers, who in turn are less able to compete with low prices, easing pricing pressure on the original suppliers. As a result, eMMC contract prices are projected to remain flat in Q2.

UFS demand remains stable, supported by high-end smartphones and increasing storage requirements in automotive applications. On the supply side, overall NAND flash capacity adjustments have reduced UFS availability, and Q2 contract prices are expected to remain unchanged from the previous quarter.

In the NAND flash wafer market, prices have hit bottom and inventory restocking is underway. Both module makers and OEMs are increasing procurement, while the rebound in enterprise SSD demand is driving interest in high-end wafer products. With reduced wafer supply from production cuts and new pricing strategies for high-layer NAND flash in response to recovering demand, Q2 NAND flash wafer contract prices are expected to rise by 10% to 15%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter