HPE: Fiscal 1Q25 Financial Results

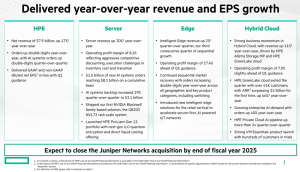

Revenue at $7.9 billion, up 16% from the prior-year period, fourth consecutive quarter of Y/Y revenue growth

This is a Press Release edited by StorageNewsletter.com on March 10, 2025 at 2:03 pmHewlett Packard Enterprise Development LP (HPE) announced financial results for the first quarter ended January 31, 2025.

“HPE achieved our fourth consecutive quarter of Y/Y revenue growth, increasing revenue by double digits in Q1,” said Antonio Neri, president and CEO, HPE. “I am particularly proud of the exciting innovation we introduced in the quarter, which was met with customer enthusiasm. HPE has a proven track record of consistent, disciplined execution, but we could have executed better in some areas in the quarter. I am confident in our ability to keep winning in the market, which will, in turn, drive shareholder returns.“

“We are pleased that we met our revenue guidance estimate as we navigated the quarter,” said Marie Myers, executive VP and CFO, HPE. “We took actions in the quarter to streamline costs, which helped us offset other impacts to profitability. We continue to align our strategy and execution with long-term growth trends that will fuel our performance.“

First Quarter Fiscal 2025 Financial Results

- Revenue: $7.9 billion, up 16% from the prior-year period in actual dollars and 17% in constant currency (1)

- Annualized Revenue Run-Rate (ARR) (2): $2.1 billion, up 45% from the prior-year period in actual dollars and 46% in constant currency (1)

- Gross margins:

◦ GAAP of 29.2%, down 720 basis points from the prior-year period and down 160 basis points sequentially

◦ Non-GAAP(1) of 29.4%, down 680 basis points from the prior-year period and down 150 basis points sequentially

- Diluted net Earnings Per Share (EPS):

◦ GAAP of $0.44, up 52% from the prior-year period and down 56% sequentially, above our guidance range of $0.31 and $0.36

◦ Non-GAAP (1) of $0.49, up 2% from the prior-year period and down 16% sequentially, within our guidance range of $0.47 to $0.52

- Cash flow from operations: $(390) million, a decrease of $454 million from the prior-year period

- Free Cash Flow (FCF) (1)(3): $(877) million, a decrease of $395 million from the prior-year period

- Capital returns to common shareholders: $223 million in the form of dividends and share repurchases

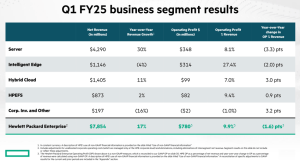

First Quarter Fiscal 2025 Segment Results

- Server revenue was $4.3 billion, up 29% from the prior-year period in actual dollars and up 30% in constant currency (1), with 8.1% operating profit margin, compared to 11.4% from the prior-year period.

- Intelligent Edge revenue was $1.1 billion, down 5% from the prior-year period in actual dollars and 4% in constant currency (1), with 27.4% operating profit margin, compared to 29.4% in the prior-year period.

- Hybrid Cloud revenue was $1.4 billion, up 10% from the prior-year period in actual dollars and 11% in constant currency (1), with 7.0% operating profit margin, compared to 4.0% from the prior-year period.

- Financial Services revenue was $873 million, flat from the prior-year period in actual dollars and up 1.6% in constant currency (1), with 9.4% operating profit margin, compared to 8.5% from the prior-year period. Net portfolio assets of $13.0 billion, down 2% from the prior-year period in actual dollars and up 1% in constant currency (1). The business delivered return on equity of 16.4%, up 1 point from the prior-year period.

Dividend

The HPE Board of Directors declared a regular cash dividend of $0.13 per share on the company’s common stock, payable on or about April 18, 2025, to stockholders of record as of the close of business on March 21, 2025.

Fiscal 2025 Second Quarter Outlook

HPE estimates revenue to be in the range of $7.2 billion and $7.6 billion. HPE estimates GAAP diluted net EPS to be in the range of $0.08 to $0.14 and non-GAAP diluted net EPS (1) to be in the range of $0.28 to $0.34. Fiscal 2025 second quarter non-GAAP diluted net EPS estimate excludes net after-tax adjustments of approximately $0.20 per diluted share primarily related to a cost reduction program, stock-based compensation, acquisition, disposition and other charges, amortization of intangible assets, and H3C divestiture related severance costs.

Fiscal 2025 Outlook

HPE estimates fiscal 2025 revenue growth of 7% to 11%, in constant currency (1) (5), and fiscal 2025 GAAP operating profit growth to be in the range of negative 24% to negative 9% and non-GAAP operating profit (1) (4) growth to be negative 10% to 0%. HPE estimates GAAP diluted net EPS (6) to be in the range of $1.15 and $1.35 and non-GAAP diluted net EPS(1) to be in the range of $1.70 to $1.90. Fiscal 2025 non-GAAP diluted net EPS estimate excludes net after-tax adjustments of approximately $0.55 per diluted share, primarily related to stock-based compensation expense, a cost reduction program, acquisition, disposition and other charges, amortization of intangible assets, and H3C divestiture related severance costs. HPE estimates free cash flow(1)(3)(5) of approximately $1 billion.

Juniper Networks Proposed Transaction Update

On January 30, 2025, the US Department of Justice filed a complaint in the US District Court for the Northern District of California seeking to block the proposed merger of HPE and Juniper Networks, Inc. On February 10, 2025, HPE and Juniper filed answers to the Department of Justice’s complaint disputing those claims. The court set a trial commencement date of July 9, 2025. HPE intends to vigorously defend vs. the Department of Justice’s overreaching interpretation of antitrust laws and will demonstrate how the transaction will provide customers with greater innovation and choice, positively change the dynamics in the networking market by enhancing competition, and strengthen the backbone of US networking infrastructure.

Resources:

Download the Q1 FY25 full financial tables

Q1 2025 Earnings Presentation

(1) A description of HPE’s use of non-GAAP financial information is provided below under ‘Use of non-GAAP financial information and key performance metrics.‘

(2) Annualized Revenue Run-Rate (ARR) is a financial metric used to assess the growth of the Consumption Services offerings. ARR represents the annualized revenue of all net HPE GreenLake cloud services revenue, related financial services revenue (which includes rental income from operating leases and interest income from finance leases), and software-as-a-Service, software consumption revenue, and other as-a-Service offerings, recognized during a quarter and multiplied by four. We use ARR as a performance metric. ARR should be viewed independently of net revenue and is not intended to be combined with it.

(3) Free cash flow represents cash flow from operations, less net capital expenditures (investments in property, plant & equipment (‘PP&E’) and software assets less proceeds from the sale of PP&E), and adjusted for the effect of exchange rate fluctuations on cash, cash equivalents, and restricted cash.

(4) FY25 non-GAAP operating profit excludes costs of approximately $1.2 billion primarily related to stock-based compensation, a cost reduction program, acquisition, disposition and other charges, amortization of intangible assets, and H3C divestiture related severance costs.

(5) Hewlett Packard Enterprise provides certain guidance on a non-GAAP basis. In reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, Hewlett Packard Enterprise is unable to provide a reconciliation to the most directly comparable GAAP financial measure without unreasonable efforts, as the Company cannot predict some elements that are included in such directly comparable GAAP financial measure. These elements could have a material impact on the Company’s reported GAAP results for the guidance period. Refer to the discussion of non-GAAP financial measures below for more information.

(6) On March 6, 2025, HPE announced a cost reduction program intended to reduce structural operating costs and continue advancing its ongoing commitment to profitable growth. The program is expected to be implemented through fiscal year 2026 and deliver gross savings of approximately $350 million by fiscal year 2027 through reductions in its workforce. In order to achieve these cost savings, HPE estimates cash charges of approximately $350 million over the next two years, with approximately $250 million to be incurred in fiscal year 2025, and the remaining $100 million to be incurred in the fiscal year 2026.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter