FalconStor: Fiscal 4Q24 and Full Year 2024 Financial Results

Strong hybrid cloud Annual Recurring Revenue growth and profitability

This is a Press Release edited by StorageNewsletter.com on March 5, 2025 at 2:02 pm- 91% Y/Y increase in total hybrid cloud Annual Recurring Revenue (ARR) run-rate for full year 2024

- 12% EBITDA for full year 2024

- 7% net income for full year 2024

FalconStor Software, Inc. announced financial results for its fourth quarter and full year 2024, which ended on December 31, 2024.

“Our 2024 results highlight FalconStor’s continued transformation into a high-growth, high-margin recurring revenue business,” said Todd Brooks, CEO, FalconStor Software. “While total revenue declined vs. 2023 with our continued aggressive shift away from one-time perpetual licenses, we achieved a 91% increase in Hybrid Cloud ARR run-rate and now derive 80% of total revenue from recurring sources, providing long-term stability and predictability. Our disciplined execution has enabled us to maintain strong profitability for the second consecutive year, with 12% EBITDA and 7% net income, positioning us to increase strategic investment in the launch of new IBM watsonx-based AI solutions in 2025.”

“As our recurring business continues to scale, our partnerships with IBM, global IBM-focused partners like Kyndryl/Skytap and Converge/Google Cloud, and regional IBM partners, remain the core drivers of our growth. In 2024, we deepened our collaboration across IBM Power, Storage, and watsonx business units strengthening our role in IBM’s hybrid cloud ecosystem. We are well positioned for 2025 and beyond to generate total revenue growth and continued levels of healthy profitability as we bring new innovations to market, helping enterprise customers modernize and optimize their data protection strategies.“

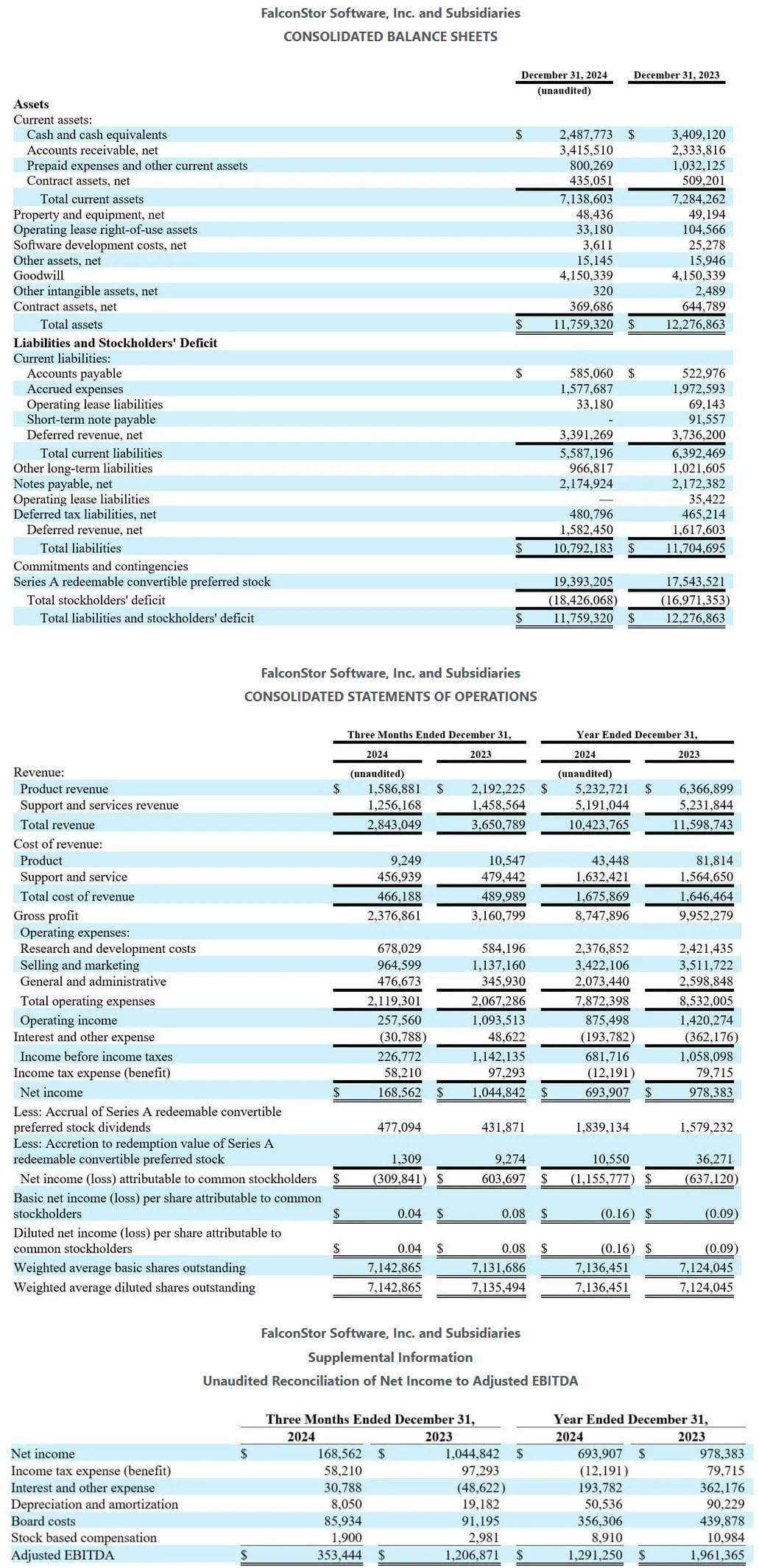

Fourth Quarter 2024 Financial Results

- Hybrid Cloud ARR Run-Rate: 91% increase compared to fourth quarter of fiscal 2023

- Ending Cash: $2.5 million, compared to $3.4 million in the fourth quarter of fiscal year 2023

- Total Revenue: $2.8 million, compared to $3.7 million in the fourth quarter of fiscal year 2023

- Total Cost of Revenue: $0.5 million, compared to $0.5 million in the fourth quarter of fiscal year 2023

- Total Operating Expenses: $2.1 million, compared to $2.1 million in the fourth quarter of fiscal year 2023

- Non-GAAP EBITDA: $0.4 million, compared to $1.2 million in the fourth quarter of fiscal year 2023

- GAAP Net Income: $0.2 million, compared to $1.0 million in the fourth quarter of fiscal year 2023

Full Year 2024 Financial Results

- Total Revenue: $10.4 million, compared to $11.6 million during the full year of 2023

- Total Cost of Revenue: $1.7 million, compared to $1.6 million during the full year of 2023

- Total Operating Expenses: $7.9 million, compared to $8.5 million during the full year of 2023

- Non-GAAP EBITDA: $1.3 million, compared to $2.0 million during the full year of 2023

- GAAP Net Income: $0.7 million, compared to $1.0 million during the full year of 2023

“We continue to exercise disciplined expense management and operational efficiency, while pursuing growth and innovation,” said Vincent Sita, CFO, FalconStor.

Non-GAAP Financial Measures

The non-GAAP financial measures used in this press release are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. The Company’s management refers to these non-GAAP financial measures in making operating decisions because they provide meaningful supplemental information regarding the Company’s operating performance. In addition, these non-GAAP financial measures facilitate management’s internal comparisons to the Company’s historical operating results and comparisons to competitors’ operating results. We include these non-GAAP financial measures (which should be viewed as a supplement to, and not a substitute for, their comparable GAAP measures) in this press release because we believe they are useful to investors in allowing for greater transparency into the supplemental information used by management in its financial and operational decision-making. The non-GAAP financial measures exclude (i) depreciation, (ii) amortization, (iii) restructuring expenses, (iv) severance expenses, (v) board expenses, (vi) stock based compensation, (vii) non-operating expenses (income) including income taxes and interest & other expenses (income). For a reconciliation of our GAAP and non-GAAP financial results, please refer to our Reconciliation of Net Income (Loss) to Adjusted EBITDA presented in this release.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter