Pure Storage: Fiscal 4Q25 and Full Year 2025 Financial Results

Full year 2025 revenue surpasses $3 billion for the first time, a 12% Y/Y growth

This is a Press Release edited by StorageNewsletter.com on February 27, 2025 at 2:02 pmPure Storage, Inc. announced financial results for its fiscal 4th quarter and full year 2025 ended February 2, 2025.

“Pure Storage delivered solid fourth quarter and full year results as we fundamentally transform data storage and management for enterprises and hyperscalers,” said Charles Giancarlo, CEO and chairman, Pure Storage. “We are enabling customers to modernize legacy storage architectures into enterprise data clouds with Fusion, our most revolutionary advancement this year, which unlocks the full potential of data, while significantly improving operations, data management, and economics for customers.”

“Pure Storage delivered solid fourth quarter and full year results as we fundamentally transform data storage and management for enterprises and hyperscalers,” said Charles Giancarlo, CEO and chairman, Pure Storage. “We are enabling customers to modernize legacy storage architectures into enterprise data clouds with Fusion, our most revolutionary advancement this year, which unlocks the full potential of data, while significantly improving operations, data management, and economics for customers.”

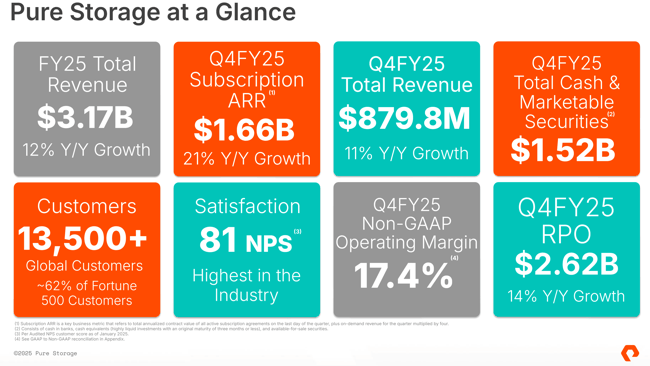

4th Quarter and Full Year Financial Highlights:

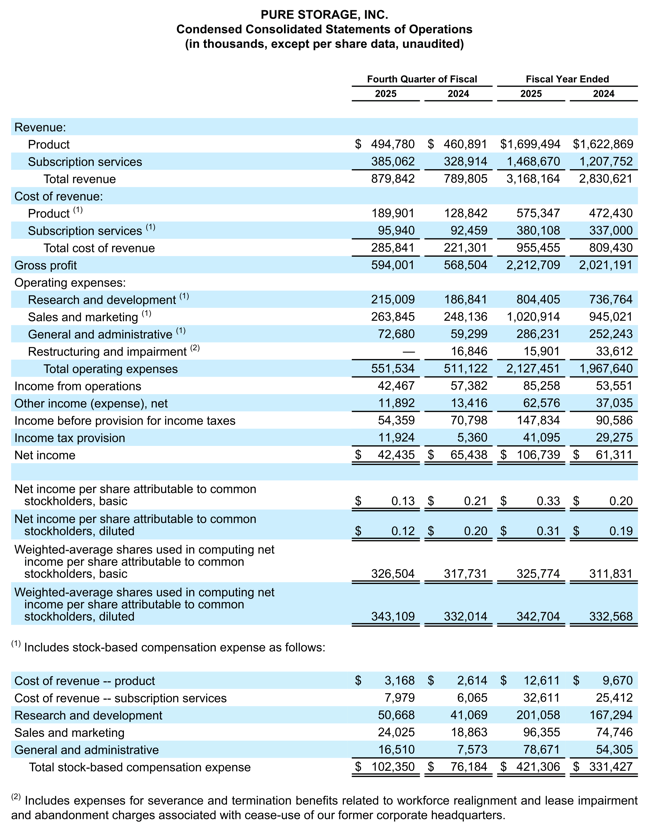

- Q4 revenue $879.8 million, up 11 % year-over-year

- Full-year revenue $3.2 billion, up 12% year-over-year

- Q4 subscription services revenue $385.1 million, up 17% year-over-year

- Full-year subscription services revenue $1.5 billion, up 22% year-over-year

- Q4 subscription annual recurring revenue (ARR) $1.7 billion, up 21% year-over-year

- Remaining performance obligations (RPO) $2.6 billion, up 14% year-over-year

- Q4 GAAP gross margin 67.5%; non-GAAP gross margin 69.2%

- Full-year GAAP gross margin 69.8%; non-GAAP gross margin 71.8%

- Q4 GAAP operating income $42.5 million; non-GAAP operating income $153.1 million

- Full-year GAAP operating income $85.3 million; non-GAAP operating income $559.4 million

- Q4 GAAP operating margin 4.8%; non-GAAP operating margin 17.4%

- Full-year GAAP operating margin 2.7%; non-GAAP operating margin 17.7%

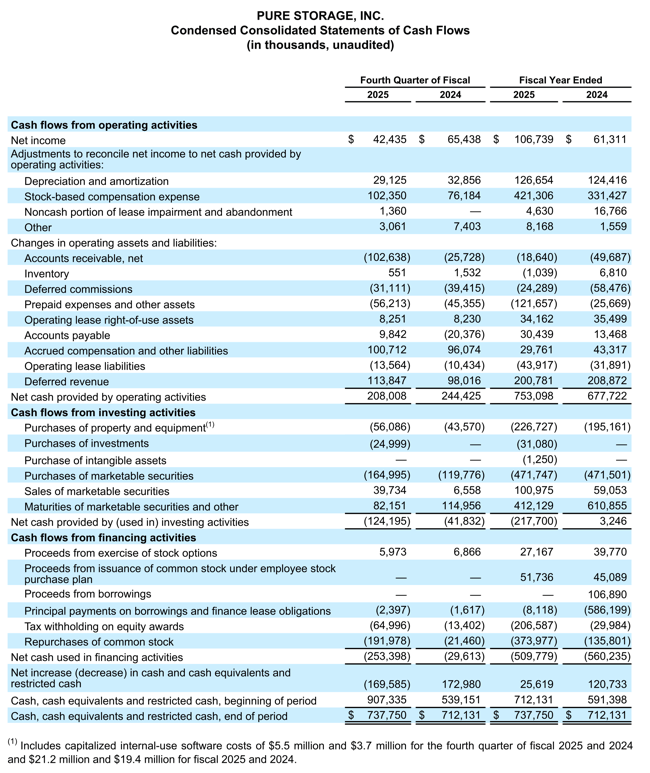

- Q4 operating cash flow $208.0 million; free cash flow $151.9 million

- Full-year operating cash flow $753.1 million; free cash flow $526.4 million

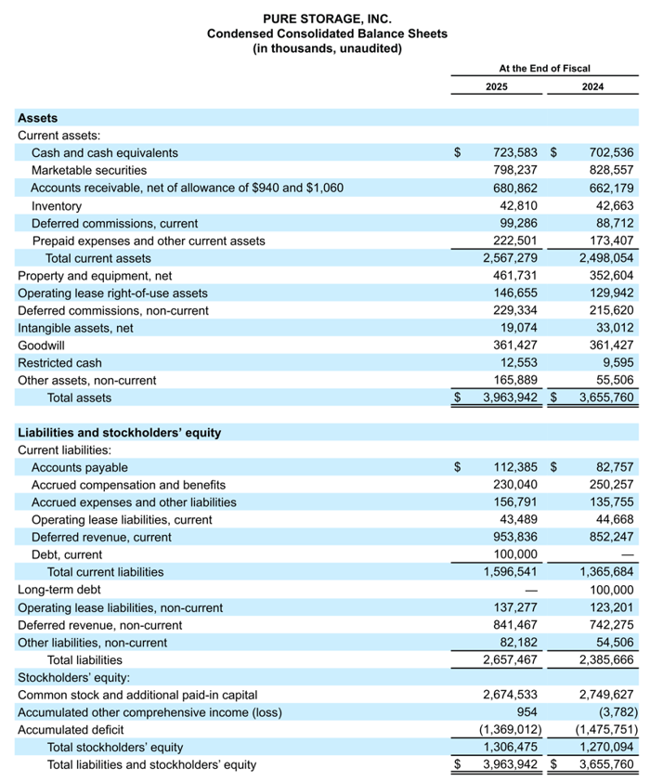

- Total cash, cash equivalents, and marketable securities $1.5 billion

- Returned approximately $192 million and $374 million in Q4 and FY25, respectively, to stockholders through share repurchases of 3.1 million shares and 6.7 million shares, respectively.

- Authorized incremental share repurchases of up to an additional $250 million under its stock repurchase program.

“We achieved a major financial milestone in fiscal year 2025, surpassing $3 billion in total revenue for the first time while delivering strong operating profit,” said Kevan Krysler, CFO, Pure Storage. “It was a pivotal year marked by industry-leading innovation, setting the stage for sustainable long-term growth.”

• Continued Hyperscale Progress

- Achieved an industry-first design win with a top-four hyperscaler, bringing Pure’s DirectFlash software into massive-scale environments traditionally dominated by HDDs.

- Announced a strategic collaboration with Kioxia and expanded its partnership with Micron Technology, enabling high-capacity, energy-efficient solutions for hyperscale environments.

• Market-Leading Platform Innovation

- Released Pure Fusion v2, unlocking the ability for customers to operate their storage environments as enterprise data clouds, mirroring the benefits and efficiencies of hyperscaler operations.

- Expanded the Pure/IE family, which offers customers better economics, superior power and density efficiencies compared to disk and is displacing disk in data centers.

- Unveiled VMware-to-Azure migration solutions, providing enterprises with greater flexibility in hybrid cloud strategies.

- Announced major enhancements to the Portworx platform, which has experienced significant growth as enterprises increasingly adopt cloud-native applications and Al/ML solutions and transition from traditional VMware to modern VMs-on-Container and Kubernetes architectures.

• Accelerating Enterprise Al Adoption

- Achieved certification of FlashBlade//S500 with NVIDIA OGX SuperPOD, optimizing Al training environments for performance, power efficiency, and scalability; also introduced validated reference architectures for NVIDIA OVX-ready solutions and BasePod certification.

- Launched the Pure Storage GenAI Pod, a full-stack GenAl solution designed to simplify and accelerate enterprise Al deployments.

- Partnered with CoreWeave, making its storage a standard option for Al workloads in CoreWeave’s high-performance cloud.

• Strengthening Partner Ecosystem and Channel Growth

- Unveiled a revamped Reseller Partner Program, designed to improve profitability for partners and give them increased autonomy while accelerating the transition from hard disk to all-flash storage.

Industry Recognition and Accolades

- Named a leader for the eleventh consecutive year in the Gartner Magic Quadrant for Primary Storage Platforms and the 4th consecutive year in the Gartner Magic Quadrant for File and Object Storage Platforms.

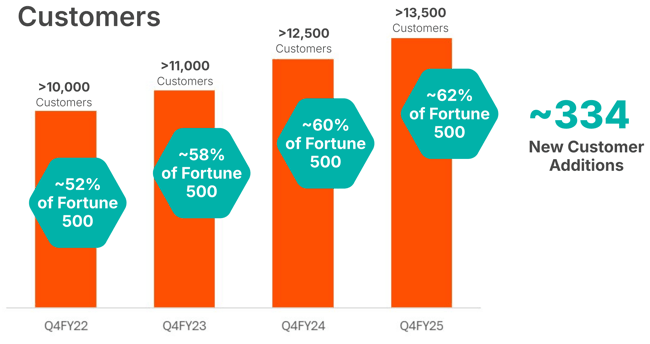

- Achieved a world-class Net Promoter Score (NPS) of 81, representing nine consecutive years of achieving an 80+ NPS while growing from hundreds to 13,000 customers.

- Recognized in Forbes’ Most Trusted Companies in America 2025 and Fortune’s Best Places to Work in Technology 2024.

- Recognized by the Science Based Targets Initiative (SBTi) for Pure Storage’s Scope 1 and 2 greenhouse gas (GHG) emissions reduction targets as aligned with a 1.5°C trajectory – the most ambitious designation available.

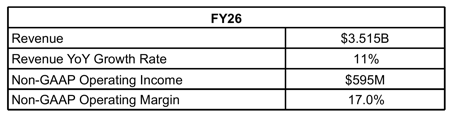

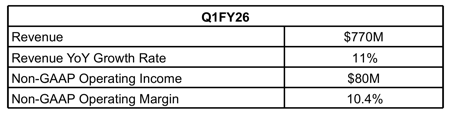

First Quarter and FY26 Guidance

These statements are forward-looking and actual results may differ materially. Refer to the Forward Looking Statements section below for information on the factors that could cause our actual results to differ materially from these statements. Pure has not reconciled its guidance for non-GAAP operating income and non-GAAP operating margin to their most directly comparable GAAP measures because certain items that impact these measures are not within Pure’s control and/or cannot be reasonably predicted. Accordingly, reconciliations of these non-GAAP financial measures guidance to the corresponding GAAP measures are not available without unreasonable effort.

These statements are forward-looking and actual results may differ materially. Refer to the Forward Looking Statements section below for information on the factors that could cause our actual results to differ materially from these statements. Pure has not reconciled its guidance for non-GAAP operating income and non-GAAP operating margin to their most directly comparable GAAP measures because certain items that impact these measures are not within Pure’s control and/or cannot be reasonably predicted. Accordingly, reconciliations of these non-GAAP financial measures guidance to the corresponding GAAP measures are not available without unreasonable effort.

Stock Repurchase Authorization

Pure’s audit committee has approved incremental share repurchases of up to an additional $250 million under its stock repurchase program. The authorization allows Pure to repurchase shares of its Class A common stock opportunistically and will be funded from available working capital. Repurchases may be made at management’s discretion from time to time on the open market through privately negotiated transactions, transactions structured through investment banking institutions, block purchase techniques, 10b5-1 trading plans, or a combination of the foregoing. The repurchase program does not have an expiration date, does not obligate Pure to acquire any of its common stock, and may be suspended or discontinued by the company at any time without prior notice.

Resources:

Host teleconference on fiscal 4th quarter and full year 2025 February 26, 2025:

Earnings Release

Earnings Presentation

Prepared Remarks

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter