Backblaze: Fiscal 4Q24 and Full Year 2024 Financial Results

22% revenue growth in B2 cloud storage, 18% revenue growth overall in Q4 2024 and Q4 adjusted EBITDA more than doubled Y/Y to 14%

This is a Press Release edited by StorageNewsletter.com on February 28, 2025 at 2:02 pmBackblaze, Inc. announced results for its fourth quarter and year ended December 31, 2024.

“Record Q4 sales bookings capped a strong year, validating early traction in our Go-To-Market transformation,” said Gleb Budman, CEO, Backblaze. “Not only did we increase sales productivity and won an over $1 million ACV customer in the quarter, we also saw AI starting to meaningfully contribute to the business, with 3 AI companies now in our top 10 customers in December 2024.“

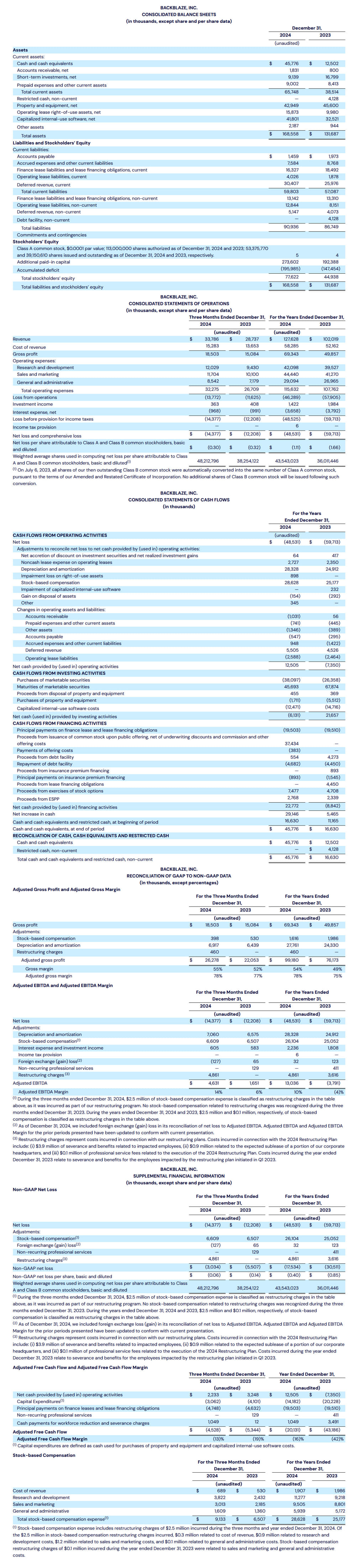

Fourth Quarter 2024 Financial Highlights:

- Revenue of $33.8 million, an increase of 18% Y/Y.

- B2 Cloud Storage revenue was $17.1 million, an increase of 22% Y/Y.

- Computer Backup revenue was $16.7 million, an increase of 13%Y/Y.

- Gross profit of $18.5 million, or 55% of revenue, compared to $15.1 million or 52% of revenue, in Q4 2023.

- Adjusted gross profit of $26.3 million, or 78% of revenue, compared to $22.1 million or 77% of revenue in Q4 2023.

- Net loss was $14.4 million compared to a net loss of $12.2 million in Q4 2023.

- Net loss per share was $0.30 for compared to a net loss per share of $0.32 in Q4 2023.

- Adjusted EBITDA was $4.6 million, or 14% of revenue, compared to $1.7 million or 6% of revenue in Q4 2023.

- Non-GAAP net loss of $3.0 million compared to non-GAAP net loss of $5.5 million in 2023.

- Non-GAAP net loss per share of $0.06 compared to a non-GAAP net loss per share of $0.14 in 2023.

- Cash and short-term investments totaled $54.9 million as of December 31, 2024.

Full-Year 2024 Financial Highlights:

- Revenue of $127.6 million, an increase of 25% Y/Y.

- B2 Cloud Storage revenue was $63.3 million, an increase of 36% Y/Y.

- Computer Backup revenue was $64.3 million, an increase of 16% Y/Y.

- Gross profit of $69.3 million, or 54% of revenue, compared to $49.9 million or 49% of revenue, in 2023.

- Adjusted gross profit of $99.2 million, or 78% of revenue, compared to $76.2 million or 75% of revenue in 2023.

- Net loss was $48.5 million compared to a net loss of $59.7 million in 2023.

- Net loss per share was $1.11 compared to a net loss per share of $1.66 in 2023.

- Adjusted EBITDA was $13.0 million, or 10% of revenue, compared to $(3.8) million or (4)% of revenue in 2023.

- Non-GAAP net loss of $17.5 million compared to non-GAAP net loss of $30.5 million in 2023.

- Non-GAAP net loss per share of $0.40 compared to a non-GAAP net loss per share of $0.85 in 2023.

- Net cash provided by operating activities during the year ended December 31, 2024 was $12.5 million, compared to cash used in operating activities of $7.4 million during the year ended December 31, 2023.

- Adjusted free cash flow during the year ended December 31, 2024 was $(20.1) million, compared to $(43.2) million during the year ended December 31, 2023.

Fourth Quarter 2024 Operational Highlights:

- Annual recurring revenue (ARR) was $136.7 million, an increase of 16% Y/Y.

- B2 Cloud Storage ARR was $70.2 million, an increase of 22% Y/Y.

- Computer Backup ARR was $66.5 million, an increase of 11% Y/Y.

- Net revenue retention (NRR) rate was 116% compared to 109% in Q4 2023.

- B2 Cloud Storage NRR was 123% compared to 122% in Q4 2023.

- Computer Backup NRR was 109% compared to 100% in Q4 2023.

- Gross customer retention rate was 90% in Q4 2024 compared to 91% in Q4 2023.

- B2 Cloud Storage gross customer retention rate was 89% in Q4 2024 compared to 90% in Q4 2023.

- Computer Backup gross customer retention rate was 90% in Q4 2024 compared to 91% in Q4 2023.

- Number of customers was 507,647 vs. 511,942 in Q4 2023.

- B2 Cloud Storage number of customers was 107,616 vs. 97,842 in Q4 2023.

- Computer Backup number of customers was 417,845 vs. 431,745 in Q4 2023.

- Total Annual Average Revenue Per Customer (ARPU) was $268 vs. $228 in Q4 2023.

- B2 Cloud Storage ARPU was $645 vs. $577 in Q4 2023.

- Computer Backup ARPU was $159 vs. $140 in Q4 2023.

Recent Business Highlights

- Signed A Deal for Over $1 Million in Annual Contract Value: An existing customer expanded into a Powered by Backblaze white label partnership to unlock greater market opportunities.

- AI Tailwinds Accelerate: 65% more AI customers year over year drove a nearly 10-fold increase in AI related data, with 3 AI companies now in our top 10 customers in December 2024.

- B2 Cloud Storage Crossed Over 50% of Company Sales: Fastest growing offering is now also the dominant part of the business.

- Executed a Successful Secondary Offering: This oversubscribed offering reinforces our balance sheet with $37 million in net proceeds.

- Unlocked $8 Million in Annualized Cost Savings: Increased operating efficiency enables re-investment in sales capacity.

- Named the ‘Easiest to Use’ and the ‘Fastest Implementation’ Object Storage Solution: G2, a popular software review site, recognized Backblaze in their Winter 2025 Report.

Financial Outlook based on information available as of the date of this press release,

For the first quarter of 2025 we expect:

- Revenue between $34.1 million to $34.5 million.

- Adjusted EBITDA margin between 13% to 15%.

- Basic weighted average shares outstanding of 54.0 million to 54.3 million shares.

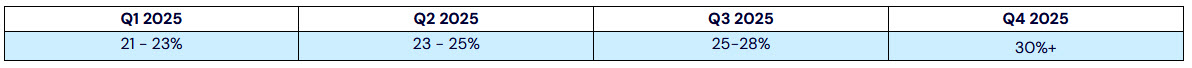

For full-year 2025 we expect:

- Revenue between $144.0 million to $146.0 million.

- Adjusted EBITDA margin between 16% to 18%.

- For Y/Y growth in our B2 business, refer to table below:

Backblaze hosted a conference on February 25, 2025. An archive of the webcast will be available shortly after its completion on the Investor Relations section of the Backblaze website.

Non-GAAP Financial Measures

To supplement the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use (i) non-GAAP adjusted gross profit and margin, (ii) adjusted EBITDA and adjusted EBITDA margin, (iii) non-GAAP net income (loss), and (iv) adjusted free cash flow and adjusted free cash flow margin. These non-GAAP financial measures exclude certain items and are not prepared in accordance with GAAP; therefore, the information is not necessarily comparable to other companies and should be considered as a supplement to, not a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. We present these non-GAAP measures because management believes they are a useful measure of our performance and provide an additional basis for assessing our operating results. Please see the appendix attached to this press release for a reconciliation of non-GAAP adjusted gross margin and adjusted EBITDA margin to the most directly comparable GAAP financial measures.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses and other factors in the future. For example, stock-based compensation expense-related charges are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict with reasonable accuracy and subject to constant change.

Adjusted Gross Profit (and Margin)

We believe adjusted gross profit (and margin), when taken together with our GAAP financial results, provides a meaningful assessment of our performance and is useful to us for evaluating our ongoing operations and for internal planning and forecasting purposes.

We define adjusted gross margin as gross profit, excluding stock-based compensation expense, depreciation and amortization and restructuring charges within cost of revenue, as a percentage of adjusted gross profit to revenue. We exclude stock-based compensation, which is a non-cash item, and restructuring costs because we do not consider it indicative of our core operating performance. We exclude depreciation expense of our property and equipment and amortization expense of capitalized internal-use software because these may not reflect current or future cash spending levels to support our business. We believe adjusted gross margin provides consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this metric eliminates the effects of depreciation and amortization.

Adjusted EBITDA and Adjusted EBITDA Margin

We define adjusted EBITDA as net loss adjusted to exclude depreciation and amortization, stock-based compensation, interest expense, net, investment income, income tax provision, realized and unrealized gains and losses on foreign currency transactions, impairment of long-lived assets, restructuring costs, legal settlement costs, and other non-recurring charges. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by revenues for the period. We use adjusted EBITDA and Adjusted EBITDA Margin to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that adjusted EBITDA and Adjusted EBITDA Margin, when taken together with our GAAP financial results, provides meaningful supplemental information regarding our operating performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. We consider Adjusted EBITDA and Adjusted EBITDA Margin to be important measures because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis.

Non-GAAP Net Income (Loss)

We define non-GAAP net income (loss) as net income adjusted to exclude stock-based compensation, realized and unrealized gains and losses on foreign currency transactions, restructuring costs, legal settlement costs, and other items we deem non-recurring. We believe that non-GAAP net income (loss), when taken together with our GAAP financial results, provides meaningful supplemental information regarding our operating performance by excluding certain items that may not be indicative of our business, results of operations, or outlook.

Adjusted Free Cash Flow and Adjusted Free Cash Flow Margin

We define adjusted free cash flow as net cash provided by (used in) operating activities less purchases of property and equipment, capitalized internal-use software costs, principal payments on finance leases and lease financing obligations, as reflected in our consolidated statements of cash flows, and excluding restructuring costs, legal settlement costs, and other non-recurring charges. Adjusted free cash flow margin is calculated as adjusted free cash flow divided by revenue.

Key Business Metrics:

Annual Recurring Revenue (ARR)

We define annual recurring revenue (ARR) as the annualized value of all Backblaze B2 and Computer Backup arrangements as of the end of a period. Given the renewable nature of our business, we view ARR as an important indicator of our financial performance and operating results, and we believe it is a useful metric for internal planning and analysis. ARR is calculated based on multiplying the monthly revenue from all Backblaze B2 and Computer Backup arrangements, which represent greater than 98% of our revenue for the periods presented for the last month of a period by 12. Our annual recurring revenue for Computer Backup and B2 Cloud Storage is calculated in the same manner as our overall annual recurring revenue based on the revenue from our Computer Backup and B2 Cloud Storage solutions, respectively.

Net Revenue Retention Rate (NRR)

Our overall net revenue retention rate (NRR) is a trailing four-quarter average of the recurring revenue from a cohort of customers in a quarter as compared to the same quarter in the prior year. We calculate our overall net revenue retention rate for a quarter by dividing (i) recurring revenue in the current quarter from any accounts that were active at the end of the same quarter of the prior year by (ii) recurring revenue in the current corresponding quarter from those same accounts. Our overall net revenue retention rate includes any expansion of revenue from existing customers and is net of revenue contraction and customer attrition, and excludes revenue from new customers in the current period. Our net revenue retention rate for Computer Backup and B2 Cloud Storage is calculated in the same manner as our overall net revenue retention rate based on the revenue from our Computer Backup and B2 Cloud Storage solutions, respectively.

Gross Customer Retention Rate

We use gross customer retention rate to measure our ability to retain our customers. Our gross customer retention rate reflects only customer losses and does not reflect the expansion or contraction of revenue we earn from our existing customers. We believe our high gross customer retention rates demonstrate that we serve a vital service to our customers, as the vast majority of our customers tend to continue to use our platform from one period to the next. To calculate our gross customer retention rate, we take the trailing four-quarter average of the percentage of cohort of customers who were active at the end of the quarter in the prior year that are still active at the end of the current quarter. We calculate our gross customer retention rate for a quarter by dividing (i) the number of accounts that generated revenue in the last month of the current quarter that also generated recurring revenue during the last month of the corresponding quarter in the prior year, by (ii) the number of accounts that generated recurring revenue during the last month of the corresponding quarter in the prior year.

Number of Customers

We define a customer at the end of any period as a distinct account, as identified by a unique account identifier, that has paid for our cloud services, which makes up substantially all of our user base. In Q4 2023, we refined our customer definition to include end-user customers that purchase through a reseller. This resulted in no impact to previously reported metrics other than a 1% decrease to the 120% NRR metric reported for Q3 2023.

Annual Average Revenue Per User

We define annual average revenue per user (Annual ARPU) as the annualized value for the average revenue per customer. Annual ARPU is calculated by dividing our revenue for the last month of a period by the total number of customers as of the last day of the same period, and then multiplying the resulting quotient by 12. Our annual average revenue per user for Computer Backup and B2 Cloud Storage is calculated in the same manner based on the revenue and number of customers from our Computer Backup and B2 Cloud Storage solutions, respectively.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter