Cloud Native Storage Market to Exceed $100.09B by 2032

Driven by cloud-native tech adoption and digital transformation as per findings from SNS Insider

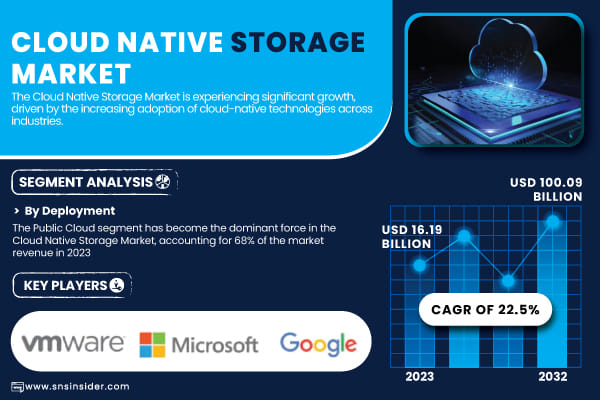

This is a Press Release edited by StorageNewsletter.com on February 10, 2025 at 2:02 pmThe SNS Insider Pvt LTD‘s report indicates that the Cloud Native Storage Market size was USD 16.19 Billion in 2023 and is expected to reach USD 100.09 Billion by 2032, growing at a CAGR of 22.5% over the forecast period of 2024-2032.

Surge in Cloud Native Storage Adoption Fueled by Digital Transformation and Data Growth

The Cloud Native Storage Market is expanding rapidly due to the increasing adoption of cloud-native technologies across industries. Solutions for containerized applications and micro-services ensure scalability, automation, and cloud integration.

Government initiatives, such as the US ‘Cloud Smart’ strategy, are fueling market growth, as it is promoting cloud adoption across sectors, including BFSI, healthcare, retail, IT, telecom, and manufacturing. The increase in big data, IoT, and AI demand scalable storage solutions, making cloud-native storage a necessity for the management of ever-increasing data volumes and digital transformation.

Major Players Analysis Listed in Report are:

- Microsoft (Azure Blob Storage, Azure Kubernetes Service (AKS))

- IBM, (IBM Cloud Object Storage, IBM Spectrum Scale)

- AWS (Amazon S3, Amazon EBS (Elastic Block Store))

- Google (Google Cloud Storage, Google Kubernetes Engine (GKE))

- Alibaba Cloud (Alibaba Object Storage Service (OSS), Alibaba Cloud Container Service for Kubernetes)

- VMWare (VMware vSAN, VMware Tanzu Kubernetes Grid)

- Huawei (Huawei FusionStorage, Huawei Cloud Object Storage Service)

- Citrix (Citrix Hypervisor, Citrix ShareFile)

- Tencent Cloud (Tencent Cloud Object Storage (COS), Tencent Kubernetes Engine)

- Scality (Scality RING, Scality ARTESCA)

- Splunk (Splunk SmartStore, Splunk Enterprise on Kubernetes)

- Linbit (LINSTOR, DRBD (Distributed Replicated Block Device))

- Rackspace (Rackspace Object Storage, Rackspace Managed Kubernetes)

- Io (Robin Cloud Native Storage, Robin Multi-Cluster Automation)

- MayaData (OpenEBS, Data Management Platform (DMP))

- Diamanti (Diamanti Ultima, Diamanti Spektra)

- Minio (MinIO Object Storage, MinIO Kubernetes Operator)

- Rook (Rook Ceph, Rook EdgeFS)

- Ondat (Ondat Persistent Volumes, Ondat Data Mesh)

- Ionir (Ionir Data Services Platform, Ionir Continuous Data Mobility)

- Trilio (TrilioVault for Kubernetes, TrilioVault for OpenStack)

- Upcloud (UpCloud Object Storage, UpCloud Managed Databases)

- Arrikto (Kubeflow Enterprise, Rok (Data Management for Kubernetes)

Cloud Native Storage Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 16.19 Billion |

| Market Size by 2032 | US$ 100.09 Billion |

| CAGR | CAGR of 22.5 % from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers |

• Rising Adoption of Cloud-Native Architectures and Containerized Applications Enhances Demand for Cloud-Native Storage Solutions • Increasing Data Growth and the Need for Scalable, Cost-Effective Storage Solutions Driving Market Expansion |

Segment Analysis:

By Deployment:

The Public Cloud segment has emerged as the dominant force in the Cloud Native Storage Market, contributing 68% of market revenue in 2023. The dominant growth in this segment is because cloud infrastructures are increasingly adopted as offering flexible, scalable, and cost-efficient storage solutions. There is a lot of expansion in cloud-native storage offerings from major public cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud to satisfy growing enterprise demands.

The Private Cloud segment is experiencing the highest CAGR of 23.44%, reflecting a shift toward more tailored and secure cloud storage options. Private clouds offer the scalability of public clouds but with enhanced security, making them suitable for organizations that require more control over their data and wish to comply with regulatory requirements. Innovations such as VMware Tanzu Kubernetes Grid and IBM’s Cloud for Financial Services are making private cloud adoption possible, offering enhanced scalability, security, and compliance.

By End Use

In 2023, the M&E segment holds the largest revenue share 24% in the Cloud Native Storage Market. This is due to the fastest-growing mode of digital content creation, streaming services, and the need for efficient management of large multimedia files. Cloud storage solutions are a necessity in managing and distributing HD videos, graphics, and other media content across global platforms.

The Banking, Financial Services, and Insurance (BFSI) segment is poised for the highest growth in the forecast period. With the continued digital transformation journey of financial institutions and the adoption of cloud-native technologies, the need for secure, scalable, and compliant storage solutions is increasing. Major cloud services providers, such as IBM’s Cloud for Financial Services and Oracle’s Autonomous Database on Cloud, offer specific storage solutions to meet the BFSI sector’s stringent regulatory requirements.

Regional Development

North America is currently the dominant region in the Cloud Native Storage Market, accounting for around 37% of the global market share in 2023. With the fast adoption of cloud technologies, superior digital infrastructure, and the leading presence of big players such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, this dominance will be propelled forward. Regional growth will continue to be supported by the increase in demand from these leading vendors for cloud-native storage solutions.

The AsiaPac (APAC) region is expected to grow at the fastest pace, with an estimated CAGR of 24.06% during the forecast period. Growth drivers for this segment include rapid digitalization in the APAC region, high penetration of mobile Internet, and business adoption of cloud by various sectors like retail, telecom, and manufacturing. Companies like Alibaba Cloud and TCS, which provide scalable solutions to businesses dealing with large data volumes, lead cloud-native storage adoption in the region.

Recent Developments:

- In August 2023, Microsoft enhanced its Azure Elastic SAN service to support private endpoints, improving volume sharing via SCSI (Small Computer System Interface) Persistent Reservation.

- In August 2023, AWS expanded its global infrastructure by opening the AWS Israel (Tel Aviv) Region, providing enhanced cloud-native storage services for businesses and government organizations in Israel.

SNS Insider is a market research and consulting agency that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Get a Sample Report of Cloud Native Storage Market (registration required)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter