DDN Raises $300 Million From Blackstone

Valuing the company at $5 billion

This is a Press Release edited by StorageNewsletter.com on January 10, 2025 at 2:02 pmDDN (DataDirect Networks Inc.) announced an investment of $300 million from Blackstone, the world’s largest alternative asset manager, valuing the company at $5 billion.

This investment cements DDN’s position as the choice for organizations seeking to implement scalable, reliable, and secure AI applications that deliver tangible business outcomes with up to 10x returns. With this groundbreaking deal, DDN is poised for historic growth in 2025 following a record-breaking 400% growth in AI revenue in 2024.

Building on its 2-decade heritage of powering the world’s most demanding AI and HPC workloads-including over 500,000 NVIDIA GPUs for organizations ranging from top financial services, life sciences, and Sovereign AI customers to AI hyperscalers and cloud providers such as xAI, NVIDIA and Lambda-DDN is primed to redefine the enterprise AI infrastructure landscape.

By combining DDN’s data intelligence with NVIDIA’s AI Enterprise Platform and advanced GPU technology, businesses achieve faster time to market, reduced operational costs, and superior AI-driven insights.

Driving Transformative AI Outcomes for Enterprises

- Optimizing LLMs and RAG: DDN’s platform enables instant data ingestion, real-time processing, and up to 100x faster insight generation-accelerating enterprise deployments of LLMs, Gen AI, and RAG for customer-facing applications, predictive analytics, and operational improvements.

- Purpose-Built AI Infrastructure: DDN’s next-gen platform delivers speed, efficiency, and reliability, shrinking model training time from weeks to hours while offering up to 15x faster checkpointing. Enterprises can deploy mission-critical AI workloads with the same capabilities trusted by the most advanced AI hyperscalers.

- Game-Changing Performance: By maximizing GPU utilization and delivering massive data throughput-including scalable IO for unstructured data-DDN’s platform eliminates bottlenecks and powers continuous inferencing for real-time decision-making.

- 10x Business Value: Through energy, space, and cooling reductions of up to 10x, DDN’s advanced architectures deliver an exceptional ROI that turbocharges AI-driven innovation without sacrificing operational efficiency or sustainability.

- Seamless Deployment Across Environments: DDN’s flexible, software-defined approach integrates across on-premises, cloud, and edge ecosystems, ensuring organizations can adapt as AI needs evolve-without compromising performance or security.

- Data Management and Security: Built-in secure multi-tenancy, granular access controls, and dynamic performance allocation empower enterprises to streamline complex AI workflows while keeping sensitive data protected for enterprises and Sovereign AI deployments.

“DDN’s track record for delivering cutting-edge AI and HPC platforms to thousands of customers globally is just scratching the surface of the transformative impact they’ll have on the enterprise AI market. We see DDN as the clear leader in scaling enterprise-grade solutions that drive meaningful business returns for modern AI deployments,” said Jas Khaira, Sr. managing director, Blackstone.

“Blackstone’s support accelerates our mission to redefine the enterprise AI infrastructure category and scale at an even faster rate,“ said Alex Bouzari, CEO and co- founder, DDN.“By fueling our mission to push the boundaries of data intelligence, we can empower organizations worldwide with next-level AI solutions that drive groundbreaking innovation and deliver 10x returns on their investments.“

Profitable record-breaking Growth

DDN has been highly profitable and privately owned for over 2 decades, achieving significant global success without external funding. The growth of AI presents a once-in-a-generation opportunity, prompting DDN to accept outside investment for the first time.

This infusion of capital positions DDN to:

- Bring the powers of supercomputing and HPC technology to the enterprise AI world.

- Challenge industry giants in AI and data management with performance and scale.

- Meet surging demand for enterprise AI solutions worldwide.

“This investment enables us to execute our strategy to bring HPC-grade AI solutions to enterprises, transforming industries and delivering measurable outcomes,“ said Paul Bloch, president and Co- founder, DDN. “Our teams are laser-focused on solving real business challenges, from accelerating LLM deployments to enhancing inferencing, so our customers can unlock their data’s potential and achieve tangible ROI faster than ever before.“

Powering the World’s Most Demanding AI Applications

DDN’s fully scalable AI training platforms enable organizations across healthcare, autonomous vehicles, financial services, and more to process and analyze massive datasets, cutting costs and time to insight. With a track record of delivering tangible business outcomes, DDN stands at the forefront of enterprise AI and HPC-bringing simplicity, security, and speed to every stage of the AI lifecycle.

Below, we publish also the press release from Blackstone

Comments

Press release from Blackstone:

Blackstone Invests $300 Million at a $5 billion Valuation in DDN AI and Data Intelligence Solutions Leader, to Fuel Further Rapid Growth

DDN (DataDirect Networks Inc.) announced it has received a $300 million investment from funds managed by Blackstone Tactical Opportunities (Blackstone) at a $5 billion valuation.

The investment will be used to help fund DDN’s continued rapid growth as it serves its customers’ fast-expanding AI and HPC software and infrastructure needs.

Founded in 1998, DDN has 1,000s of customers and supports over 500,000 NVIDIA GPUs for organizations ranging from top financial services, life sciences, and public sector clients to AI hyperscalers and cloud providers such as xAI and Lambda. DDN high-performance data intelligence platform is used to power NVIDIA clusters. DDN’s solutions help make data rapidly accessible for analysis and processing at high throughput and low latency – which are critical to helping power highly data-intensive AI and HPC workloads and ensuring maximum GPU utilization for the best performance and return on investment possible. Building on its two-decade heritage as a leader in high-performance storage, the company is a partner of choice for leading organizations seeking to implement scalable, reliable, and secure AI applications that deliver tangible business outcomes. DDN’s platform enables rapid data ingestion, real-time processing, and significantly faster insight generation- accelerating enterprise deployments of LLMs, Gen AI, and RAG for customer-facing applications, predictive analytics, and operational improvements.

“Blackstone’s support accelerates our mission to redefine the enterprise AI infrastructure category and scale at an even faster rate,” said Alex Bouzari, CEO and co-founder, DDN. “By fueling our mission to push the boundaries of data intelligence, we believe we can empower organizations worldwide with next-level AI solutions that drive groundbreaking innovation and deliver significant returns on their investments.”

“This investment enables us to execute our strategy to bring enterprise-grade AI solutions to companies of all sizes, transforming industries and delivering measurable outcomes,” said Paul Bloch, president and co-founder, DDN. “DDN is laser-focused on solving real AI business challenges, from accelerating LLM deployments to enhancing inferencing, so our customers can unlock their data’s potential and achieve tangible ROI faster than ever.”

Jas Khaira, head, Blackstone Tactical Opportunities, Americas, said: “The digital infrastructure powering the AI revolution continues to be among our highest conviction investment themes at Blackstone. DDN’s solutions are trusted by many of the most important AI companies in the world and are critical to the next phase of development for transformative AI deployments. We are thrilled to be the first institutional investor in DDN and help further strengthen its market leadership for high-intensity AI workloads.”

John Watson, managing director, Blackstone, said: “Alex and Paul have built a highly innovative business that is poised to help further propel the exponential growth in artificial intelligence. We’re excited to partner with them and their team to further expand DDN’s reach and solutions in the years to come for the benefit of their customers.”

Blackstone is a leader in investing in the digital infrastructure driving AI innovation. The company is the largest data center provider in the world with holdings across the U.S., Europe, India, and Japan. The company also recently made major investments in CoreWeave, a specialized provider of critical cloud infrastructure pioneering the AI revolution.

BofA Securities acted as the exclusive financial advisor to DDN in connection with the transaction.

Our Comments:

This is a big news for DDN and the market and at the same time, it's not a surprise in the context of fast growth due to AI pressure in all IT domains and even beyond IT.

DDN founders have refused external money for 2 decades at least wishing to control their destiny without any pressure, dilution effect and at their own pace. But things changed as the market changes fast as AI redefines many aspects of it. And DDN to maintain its leadership position in a very competitive segment has to join the investment pack finally. AI is about speed and same pattern for companies who play in it.

We saw the last round at VAST Data that boosted their valuation to $9.1 billion, WEKA reaching $1.6 billion with their $140 million last round and DDN at $5 billion is just a normal valuation in current time with the last 2 years of DDN business that shows a hyper growth trajectory. DDN belongs to the small group of Storage Unicorn companies as listed twice a year by Coldago Research.

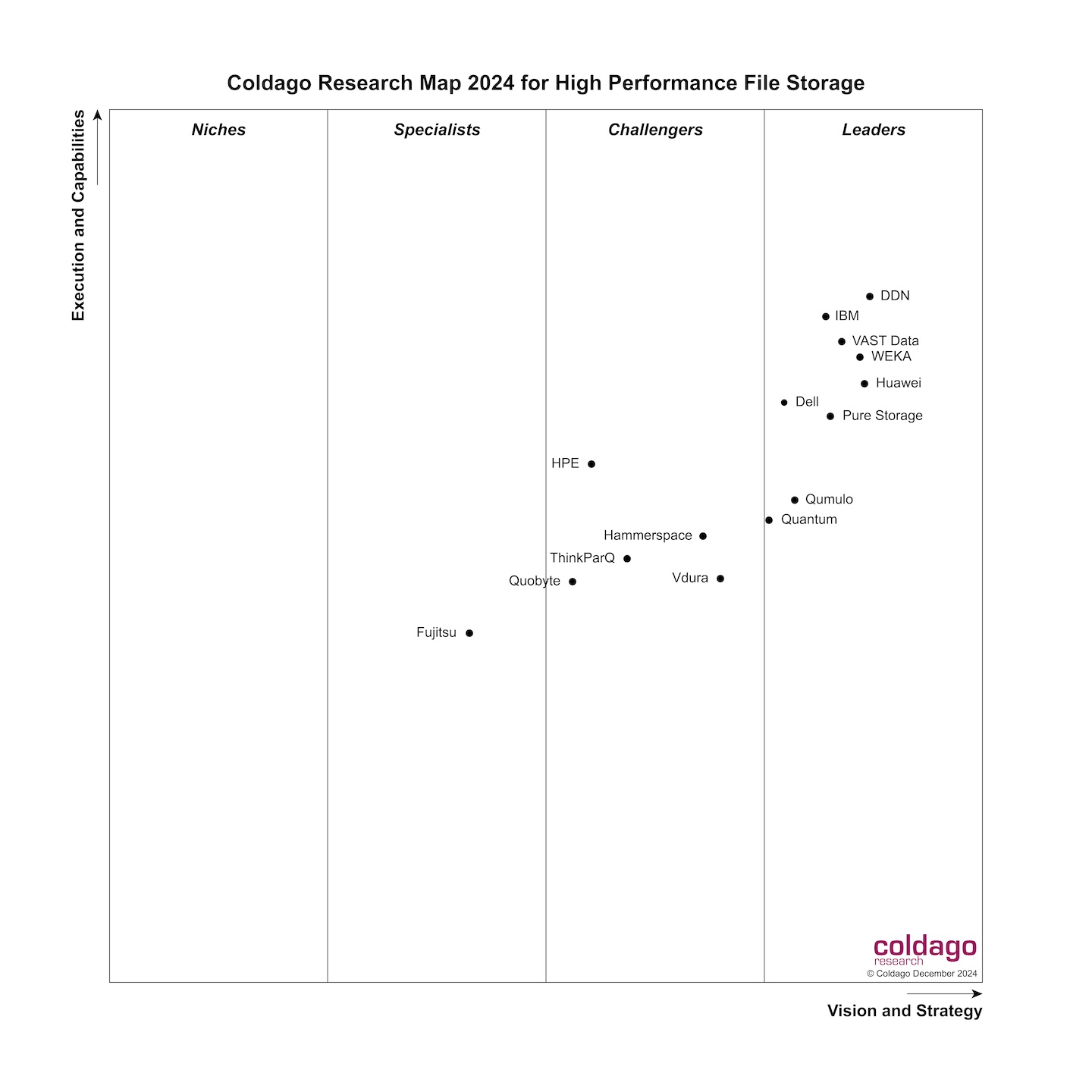

Long time considered as one of the leaders in HPC storage, DDN has very well integrated and included the AI pressure with new product iterations, for instance within ExaScaler, and even new product like Infinia. We anticipate some new developments and clear market penetration in the IT enterprise segment fueled by AI demand. As a confirmation, Coldago Research has elected again DDN as a leader in the Map 2024 for High Performance File Storage, consolidating its position in the Map.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter