DataCore Powers its Universal Storage Portfolio with the Acquisition of Arcastream’s Parallel File System Business

Strategic Expansion Unlocks New High-Performance File Storage Capabilities for Managing Diverse and Demanding Workloads

This is a Press Release edited by StorageNewsletter.com on February 5, 2025 at 2:01 pmDataCore Software, a global leader in the data infrastructure and management space, announced that it has agreed to a joint letter of intent to acquire substantially all the assets of Arcastream, a Kalray company specializing in high-performance file storage solutions.

This strategic move expands DataCore’s offerings beyond existing block, object, and container storage to include advanced file storage capabilities. Building on Arcastream’s expertise in parallel file systems, DataCore now offers a universal storage portfolio, enabling unmatched flexibility across diverse storage types and hardware platforms-all under a streamlined, software-defined framework as envisioned in our DataCore.NEXT strategy.

DataCore’s Enhanced Universal Storage Suite:

- Reliable Block Storage: For over 25 years, SANsymphony has been a trusted solution for enterprise-grade storage virtualization, ensuring resilience and operational continuity for mission-critical structured data workloads. Extending this proven expertise, OpenEBS brings high-performance, persistent container-native storage to cloud-native environments, tailored for Kubernetes-based stateful applications.

- Scalable Object Storage: Swarm is an S3 private cloud storage designed for protection and active archiving of large unstructured datasets, capable of scaling to petabyte- and EB-level demands. Its advanced metadata management accelerates content search and retrieval operations.

- High-Performance File Storage: Arcastream features a parallel file system with a global namespace, delivering high throughput and efficiency for demanding workloads. It caters to the specialized needs of customers handling semi-structured and unstructured data, ensuring consistent performance at scale.

“DataCore is now uniquely positioned to address how organizations manage their most complex and performance-intensive workloads in areas like AI, HPC, healthcare, and media,” said Dave Zabrowski, CEO, DataCore Software. “Integrating robust file storage capabilities into our portfolio, this acquisition reinforces our role as a universal storage leader-offering block, file, and object storage to support workflows seamlessly across core, edge, and cloud environments.”

Strengthening Strategic Partnerships

Dell Technologies has been a trusted partner of Arcastream. Building on the strong existing partnership between Dell and DataCore, this merger strengthens collaboration, fostering compatibility between Dell’s hardware platforms and DataCore’s software offerings. We will continue to empower our joint customers with access to a wide range of storage solutions, combining the agility of software-defined technology with industry-leading hardware configurations.

“As a partner, this technology expansion greatly enhances our ability to meet our customers’ growing needs in an evolving IT landscape. With DataCore’s universal storage stack, we can now deliver end-to-end solutions for diverse infrastructure and application requirements, while optimizing costs and boosting productivity,” said Ian Caupene, CEO, Integra Systems.

Together, DataCore and Arcastream are poised to redefine data management with best-of-breed block, file, and object storage solutions. Contact us to craft a future-proof storage strategy that addresses a broad spectrum of IT use cases, driving your growth and long-term success.

Comments

It was supposed to be announced in January and finally postponed a few times to be unveiled February 5th. It represents the third significant event this year following the surprising and still strange Infinidat acquisition by Lenovo and the large investment of Blackstone in DDN.

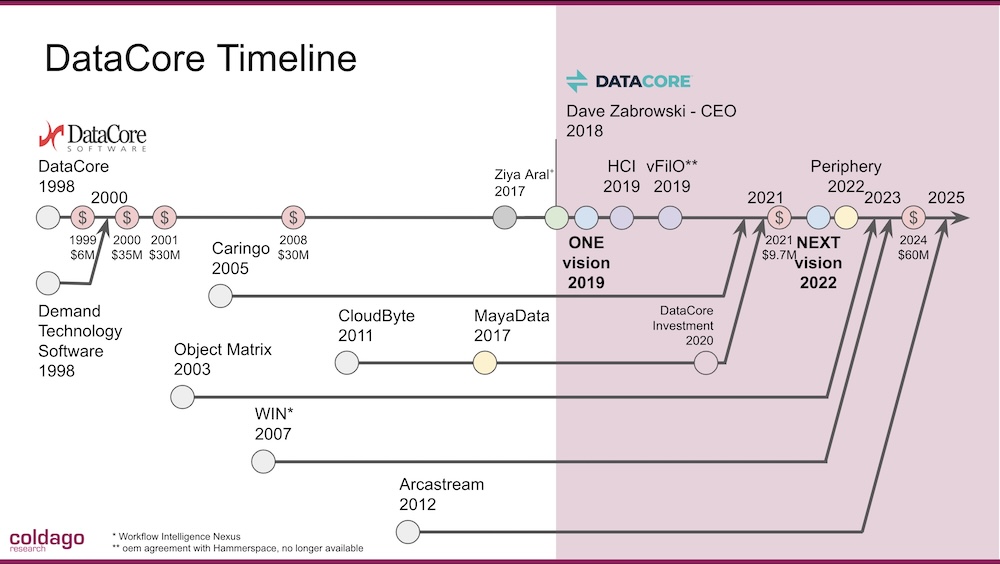

This DataCore move is a surprise and even if we mentioned for several years that DataCore needs a file storage solution, picking this one is just non understandable. We invite our readers to refer to the timeline below that illustrates the major events during the company lifetime. We saw that this diversification towards the file storage domain has been already tried with Hammerspace oem with vFilO but it went nowhere, too early probably. It was a strategy illustrated by the vision introduced in 2019 with block, file and object storage morphed later into core, edge ad cloud as they dropped file storage flavor in favor of Software-Defined Storage, S3 and cloud native storage.

Its current CEO, Dave Zabrowski, arrived in April 2018, has the mission to grow the valuation of the company and find a potential exit, this is clear. He previously sold Cloud Cruiser in 2017 to HPE after 7 years and was CEO of Neterion 7 years before its acquisition by Exar in 2010. And we're exactly in that year... Is it a sign?

DataCore has made 6 acquisitions and 5 under Zabrowski leadership.

The ambition is real and already demonstrated an attractive trajectory with several key moves, again the image below shows all these events.

But the key question is why Arcastream?

As we said above, it is a real surprise as ArcaXXX doesn't own a file system solution as they leverage and developed a real expertise on IBM GPFS, renamed Spectrum Scale and now promoted as Storage Scale. Where is the IP in the domain?

We mentioned ArcaXXX as Arcapix, Arcastream, Pixitmedia... embody a real fuzzy entity. But DataCore had to jump into the domain searching for bargains as this acquisition represents a very small amount, in a pure cash transaction. Remember the transaction given by Kalray when they purchaed ArcaXXX almost 3 years ago in March 2022.

A potential difficulty is the culture difference with a company historically strong in block and Windows environment who made some efforts towards Linux and container with MayaData. Now parallel file system is a different animal not for everyone and it appears often as a hammer for a thumbtack need.

On the business, there is some synergy with Dell as the Texas company needs a HPC oriented file storage solution and they promote IBM Storage Scale via Pixitmedia and its PixStor product. Dell also distributes ThinkParQ, a German parallel file system player. It appears that the IBM installed base is huge as the product is well respected so it exists a short term business opportunity, we'll see as within Kalray that activity didn't really explode. With the project Lightning, Dell plans to introduce its own parallel file system based on pNFS, like NetApp, Red Hat or Hammerspace, and will address its installed base thus reducing Storage Scale presence and its dependency.

In other words, DataCore doesn't enter the file storage market but more the service segment for file storage.

The second product in the basket, Ngenea, is an interesting HSM even if the technology relies on stubs and it can serve as a traffic generator for Swarm like Filefly. Unlike Storage Scale already listed in many analysts reports, Ngenea is just invisible.

We understand the needed strategy of acquiring a player to penetrate the file storage segment but some alternatives would have been possible with of course a real price difference. Among them, some interesting players, some more affordable than others, in the file storage domain with different profiles and offerings like Egnyte, JuiceFS, LucidLink, MooseFS, Peer Software, Quobyte, Resilio, StorONE, ThinkParQ, Tiger Technology or Tuxera... Sorry Rozo Systems has been acquired by Hammerspace in 2022, Compuverde by Pure Storage in 2019 or Elastifile by Google also in 2019. And we don't mention Sanbolic bought by Citrix in 2015 before Zabrowski's era.

The coming quarters will be interesting to see but if an exit would happen, it would be tough to measure the outcome of this move.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter