Rubrik: Fiscal 3Q25 Financial Results

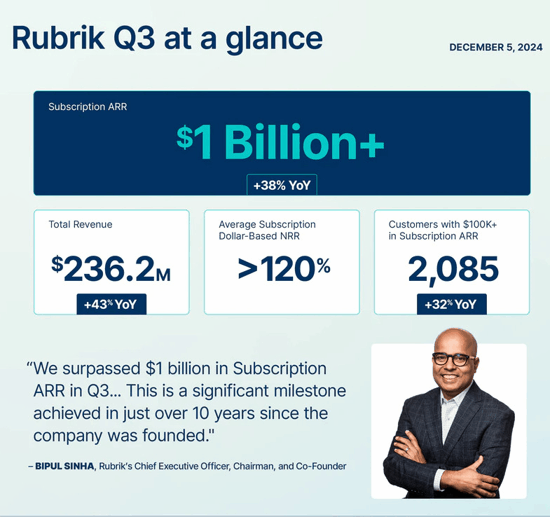

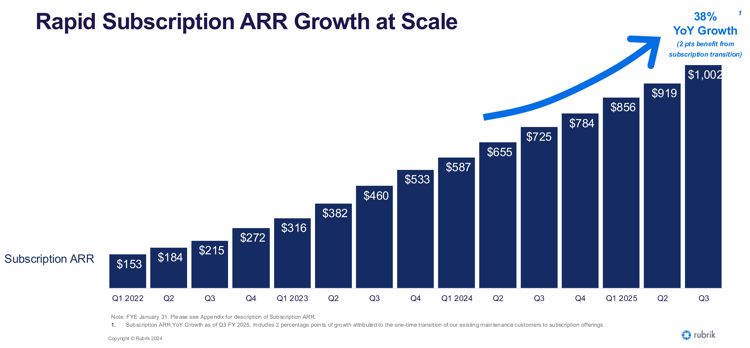

For 3rd Q revenue grew 43% YoY to $236.2 million, subscription ARR grew 38% YoY to $1,002.3 million

This is a Press Release edited by StorageNewsletter.com on December 9, 2024 at 2:02 pmRubrik, Inc. announced financial results for the 3rd quarter of fiscal year 2025, ended October 31, 2024.

“We’re incredibly proud to have surpassed $1 billion in Subscription ARR, growing 38% year-over-year. This is a significant milestone achieved in just over 10 years since the company was founded. Our strong growth at scale shows that we’re winning the cyber resilience market and we’re excited to continue to execute on this new vision to define the future of the cybersecurity industry,” said Bipul Sinha,CEO, chairman, and co-founder, Rubrik.

Commenting on the company’s financial results, Kiran Choudary, CFO, Rubrik, added, “We had another strong quarter, outperforming expectations across all metrics. In addition to strong growth, our Subscription ARR Contribution Margin was up over 1,100 basis points year-over-year, and we generated positive free cash flow. These results demonstrate our ability to drive growth at scale with improving efficiency.”

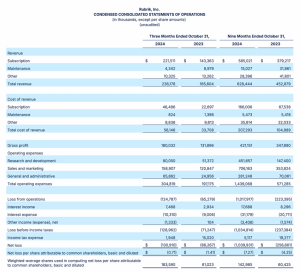

3rd quarter fiscal 2025 financial highlights:

-

Subscription Annual Recurring Revenue (ARR): Subscription ARR was up 38% YoY, growing to $1,002.3 million as of October 31, 2024.

-

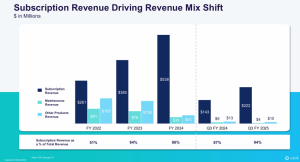

Revenue: Subscription revenue was $221.5 million, a 55% increase, compared to $143.4 million in the 3rd quarter of fiscal 2024. Total revenue was $236.2 million, a 43% increase, compared to $165.6 million in the 3rd quarter of fiscal 2024.

-

Gross Margin: GAAP gross margin was 76.2%, compared to 79.6% in the 3rd quarter of fiscal 2024. This includes $6.0 million in stock-based compensation expense, compared to $0.1 million in the year ago period, due to the vesting of certain equity awards after and as a result of the completion of our initial public offering. Non-GAAP gross margin was 79.2%, compared to 80.1% in the 3rd quarter of fiscal 2024.

-

Subscription ARR Contribution Margin: Subscription ARR Contribution Margin was (3)% compared to (14)% in the 3rd quarter of fiscal 2024, reflecting the improvement in operating leverage in the business.

-

Net Loss per Share: GAAP net loss per share was $(0.71), compared to $(1.41) in the 3rd quarter of fiscal 2024. GAAP net loss includes $92.5 million in stock-based compensation expense, compared to $0.7 million in the year ago period, due to the vesting of certain equity awards after and as a result of the completion of our initial public offering. Non-GAAP net loss per share was $(0.21), compared to $(1.39) in the 3rd quarter of fiscal 2024.

-

Cash Flow from Operations: Cash flow from operations was $23.1 million, compared to $6.9 million in the 3rd quarter of fiscal 2024. Free cash flow was $15.6 million, compared to $3.5 million in the 3rd quarter of fiscal 2024.

-

Cash, Cash Equivalents, and Short-Term Investments: Cash, cash equivalents and short-term investments were $632.0 million as of October 31, 2024.

Click to enlarge

Recent business highlights:

- As of October 31, 2024, Rubrik had 2,085 customers with Subscription ARR of $100,000 or more, up 32% YoY.

- Announced Rubrik Data Security Posture Management (DSPM) for Microsoft 365 Copilot to provide visibility and control of sensitive data, reduce the risk of exposure, and empower organizations to quickly and securely adopt Copilot.

- Announced support for Red Hat OpenShift Virtualization on Rubrik Security Cloud. General availability is expected in early 2025.

- Announced a partnership with Pure Storage to offer organizations a complete cyber resilience stack. This partnership combines the strengths of Pure Storage FlashArray, Rubrik Security Cloud, and Pure Storage FlashBlade to secure data and minimize downtime.

- Announced an integration with Okta’s Identity Threat Protection to help organizations identify user risks associated with sensitive data access and safeguard more effectively against identity attacks.

- Hosted Rubrik’s Healthcare Summit, the company’s 1st industry summit in its history. This event highlighted customer case studies, the continuity of patient care during cyber incidents and the introduction of the Rubrik Security Cloud Healthcare Dashboard for Epic.

- Named the 2024 Entrepreneurial Company of the Year by the Harvard Business School (HBS) Association of Northern California. Rubrik will join the ranks of past recipients, including Adobe, AWS, Cloudflare, Facebook, NVIDIA, and Salesforce.

4th Quarter and Fiscal Year 2025 Outlook:

Rubrik is providing the following guidance for the 4th quarter of fiscal year 2025 and the full fiscal year 2025:

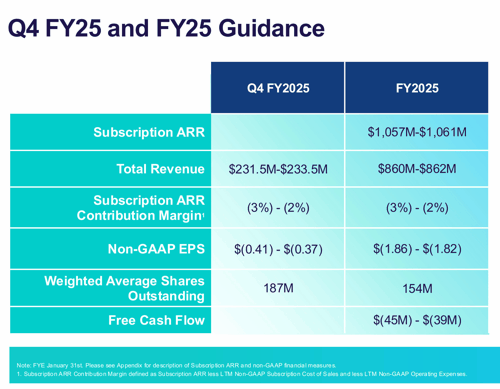

- 4th Quarter Fiscal 2025 Outlook:

- Revenue of $231.5 million to $233.5 million.

- Non-GAAP Subscription ARR contribution margin of approximately (3)% to (2)%.

- Non-GAAP EPS of $(0.41) to $(0.37).

- Weighted-average shares outstanding of approximately 187 million.

- Full Year 2025 Outlook:

- Subscription ARR between $1,057 million and $1,061 million.

- Revenue of $860 million to $862 million.

- Non-GAAP Subscription ARR contribution margin of approximately (3)% to (2)%.

- Non-GAAP EPS of $(1.86) to $(1.82).

- Weighted-average shares outstanding of approximately 154 million.

- Free cash flow of $(45) million to $(39) million, including $22.8 million in employer payroll taxes due to the vesting of certain equity awards in connection with our IPO.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter