Server DRAM and HBM Boost 3Q24 DRAM Industry Revenue by 13.6% Q/Q

Reaching $26 billion

This is a Press Release edited by StorageNewsletter.com on November 28, 2024 at 3:51 pmThis market report, published on November 26, 2024, was written by TrendForce Corp.

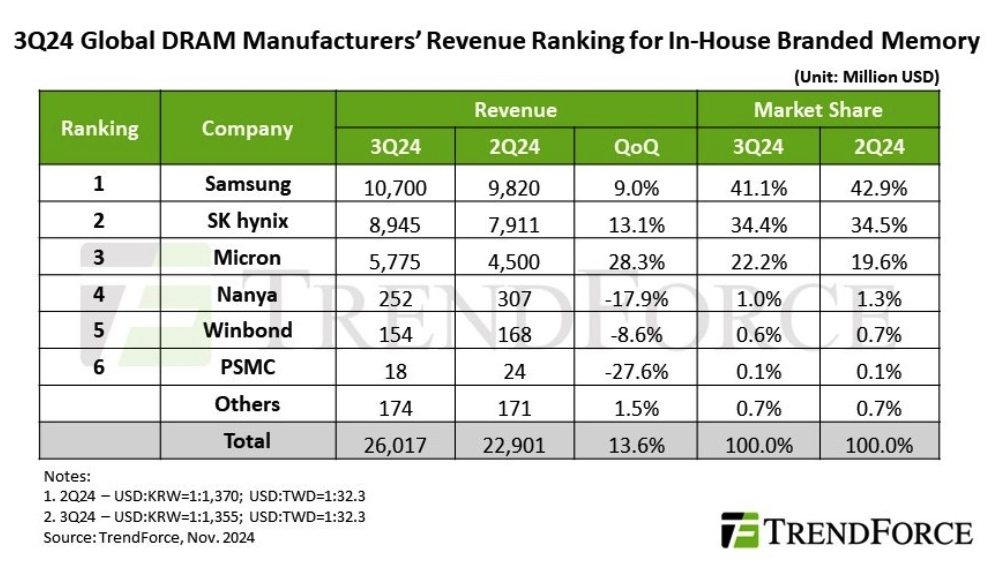

Latest investigations reveal that the global DRAM industry revenue reached $26.02 billion in 3Q24, marking a 13.6% Q/Q increase.

The rise was driven by growing demand for DDR5 and HBM in data centers, despite a decline in LPDDR4 and DDR4 shipments due to inventory reduction by Chinese smartphone brands and capacity expansion by Chinese DRAM suppliers. ASPs continued their upward trend from the previous quarter, with contract prices rising by 8% to 13%, further supported by HBM’s displacement of conventional DRAM production.

Looking ahead to 4Q24, TrendForce projects a Q/Q increase in overall DRAM bit shipments. However, the capacity constraints caused by HBM production are expected to have a weaker-than-anticipated impact on pricing. Additionally, capacity expansions by Chinese suppliers may prompt PC OEMs and smartphone brands to aggressively deplete inventory to secure lower-priced DRAM products. As a result, contract prices for conventional DRAM and blended prices for conventional DRAM and HBM are expected to decline.

Server and PC DRAM contract price increases lifted revenues for the top 3 DRAM manufacturers. Samsung retained the top spot with revenue of $10.7 billion, up 9% Q/Q. By strategic inventory clearing of LPDDR4 and DDR4, bit shipments remained flat compared to the previous quarter.

SK hynix reported $8.95 billion in revenue – a 13.1% Q/Q increase – maintaining its 2nd-place position. Although its HBM3e shipments ramped up, a 1%–3% Q/Q decline in bit shipments from weaker LPDDR4 and DDR4 sales offset these gains.

Micron saw its revenue surge by 28.3% Q/Q to $5.78 billion, driven by strong growth in server DRAM and HBM3e shipments, which led to a 13% Q/Q increase in bit shipments.

Taiwanese DRAM suppliers saw their revenues decline in 3Q24, falling significantly behind the top three manufacturers. Nanya Technology faced a more than 20% Q/Q drop in bit shipments due to weaker consumer DRAM demand and intensified competition in the DDR4 market from Chinese suppliers. Its operating profit margin further deteriorated from -23.4% to -30.8%, reflecting losses from a power outage incident.

Winbond experienced an 8.6% Q/Q decline in revenue, falling to $154 million, as consumer DRAM demand softened and bit shipments decreased.

PSMC reported a 27.6% Q/Q decline in revenue from its in-house consumer DRAM production. However, including foundry revenue, its total DRAM revenue rose 18% Q/Q, driven by ongoing inventory replenishment from its foundry clients.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter