NetApp: Fiscal 2FQ25 Financial Results

NetApp: Fiscal 2FQ25 Financial Results

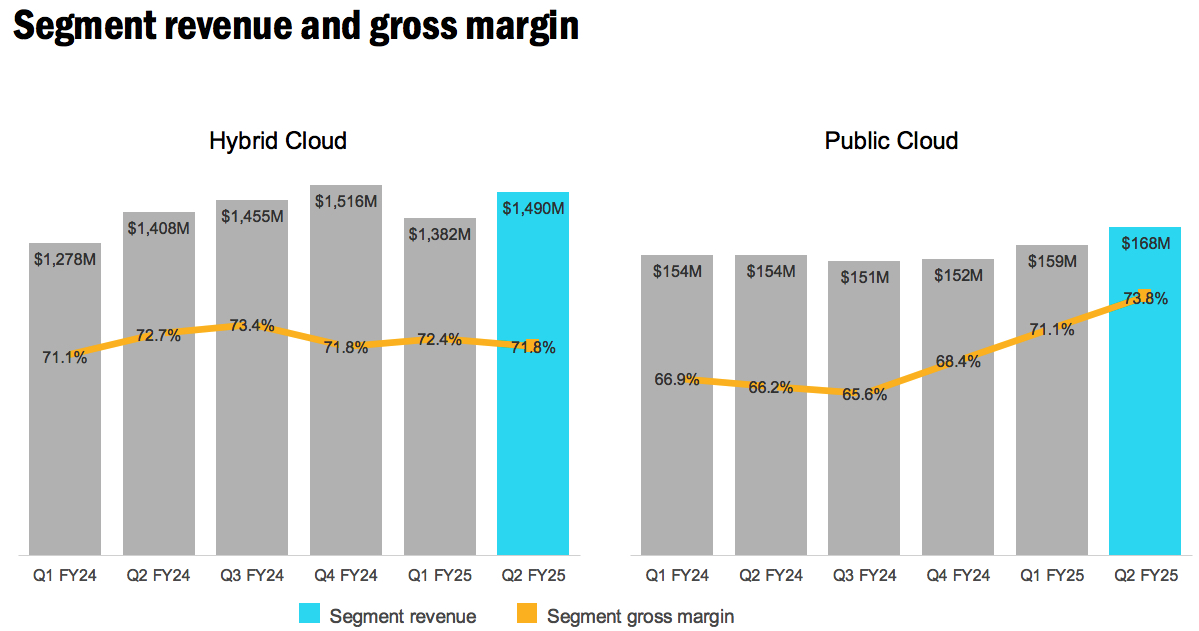

Robust growth, record AFA ARR run rate of $3.8 billion, Y/Y increase of 19%

This is a Press Release edited by StorageNewsletter.com on November 25, 2024 at 2:02 pm

| (in $ million) | 2Q24 | 2Q25 | 6 mo. 24 | 6 mo. 25 |

| Revenue | 1,562 | 1,658 | 2,994 | 3,199 |

| Growth | 6% | 7% | ||

| Net income (loss) | 233 | 299 | 382 | 547 |

- Record AFA annualized net revenue run rate of $3.8 billion, a Y/Y increase of 19% Y/Y

- First party and marketplace cloud storage services revenue grew approximately 43% Y/Y

- Second quarter GAAP operating margin of 21%; record 2nd quarter non-GAAP operating margin of 29%

- Second quarter GAAP net income per share of $1.42; record 2nd quarter non-GAAP net income per share of $1.87

- Returned $406 million to stockholders through share repurchases and cash dividends

NetApp, Inc. reported financial results for the second quarter of fiscal year 2025, which ended on October 25, 2024.

“Our strong Q2 performance was driven by another record-breaking quarter in all-flash storage and strong performance in first party and marketplace cloud storage services,” said George Kurian, CEO. “Broad-based customer preference for our intelligent data infrastructure platform and visionary approach for a data-driven future has enabled us to outgrow the market and take share from competitors. Our focus and momentum fuel my confidence in our ability to deliver outstanding results for customers and shareholders.”

2FQ25 Results

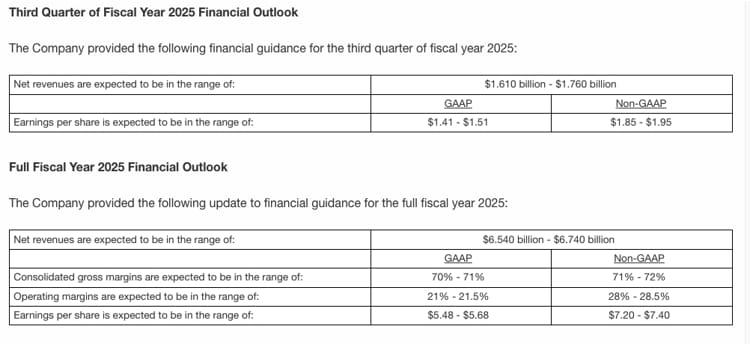

- Net revenue: $1.66 billion, compared to $1.56 billion in 2FQ24; a Y/Y increase of 6%.

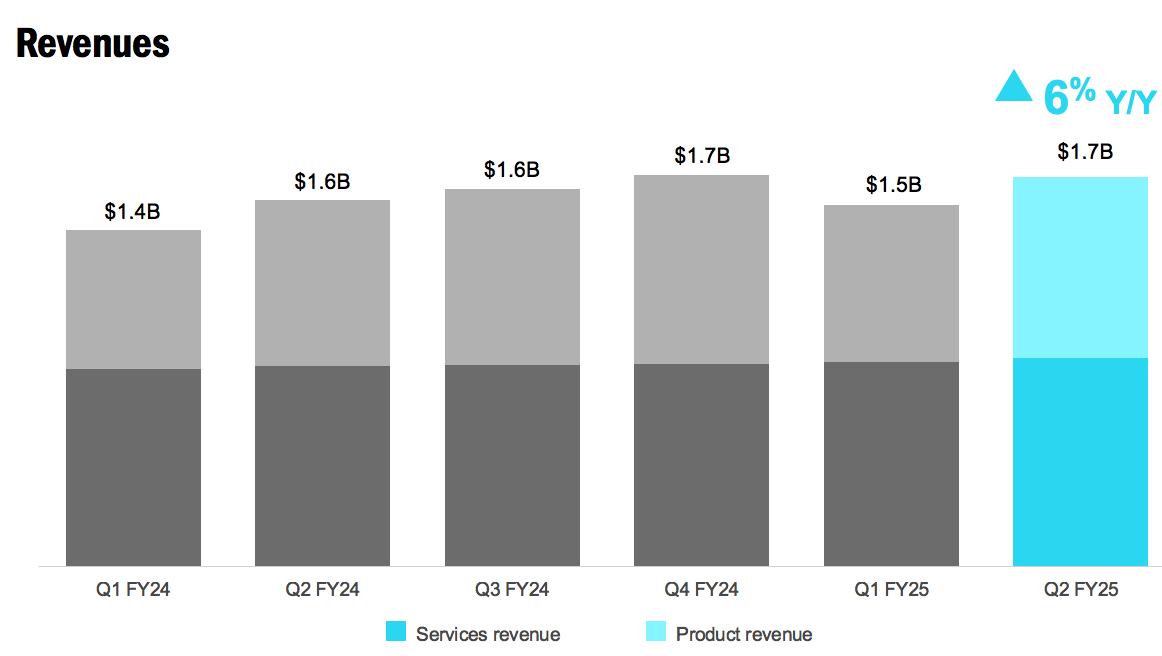

- Hybrid Cloud segment revenue: $1.49 billion, compared to $1.41 billion in 2FQ24.

- Public Cloud segment revenue: $168 million, compared to $154 million in 2FQ24.

- Billings: $1.59 billion, compared to $1.45 billion in 2FQ24; a Y/Y increase of 9%.

- All-flash array ARR: $3.8 billion, compared to $3.2 billion in 2FQ24; a Y/Y increase of 19%.

- Net income: GAAP net income of $299 million, compared to $233 million in 2FQ24; non-GAAP net income of $392 million, compared to $334 million in 2FQ24.

- Earnings per share: GAAP net income per share of $1.42, compared to $1.10 in 2FQ24; non-GAAP net income per share of $1.87, compared to $1.58 in 2FQ24.

- Cash, cash equivalents and investments: $2.22 billion at the end of 2FQ25.

- Cash provided by operations: $105 million, compared to $135 million in 2FQ24.

- Share repurchases and dividends: Returned $406 million to stockholders through share repurchases and cash dividends.

Dividend

Dividend

The next cash dividend of $0.52 per share is to be paid on January 22, 2025, to stockholders of record as of the close of business on January 3, 2025.

Comments

Revenue growth was driven by a 19% Y/Y increase in all-flash storage.

Company achieved record 2FQ25 operating margin and EPS, ahead of expectations.

2FQ25 revenue grew 6% Y/Y, the 4th consecutive quarter of mid-to-high single-digit Y/Y growth, with product revenue, cloud, and professional services all growing above this rate in the quarter.

2FQ25 highlights

- Delivered 2FQ25 Y/Y revenue and billings growth of 6% and 9%, respectively

- Set 2FQ25 records for operating margin at 29% and EPS at $1.87

- Grew all-flash ARR rate by 19% Y/Y to an all-time high of $3.8 billion

- Grew first party and marketplace cloud storage services revenue approximately 43% Y/Y

- Recognized as a leader in Gartner’s 2024 Magic Quadrant for Primary Storage Platforms for the 12th consecutive year

- Extended partnership with Google Cloud to provide the foundational data storage for Google Distributed Cloud

NetApp's financial results since FY16 in $ million

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| FY18 | 5,911 | 7% | 75 |

| FY19 | 6,146 | 4% | 1,169 |

| FY20 | 5,412 | -12% | 819 |

| FY21 | 5,744 | 6% | 730 |

| FY22 | 6,318 | 10% | 937 |

| FY23 | 6,362 | 1% | 1,230 |

| 1Q24 | 1,432 | -10% | 149 |

| 2Q24 | 1,562 | -6% | 230 |

| 3Q24 | 1,606 | 5% | 313 |

| 4Q24 | 1,668 | 6% | 291 |

| FY24 | 6,270 | -1% | 1,380 |

| 1Q25 | 1,541 | 8% | 248 |

| 2Q25 | 1,658 | 6% | 299 |

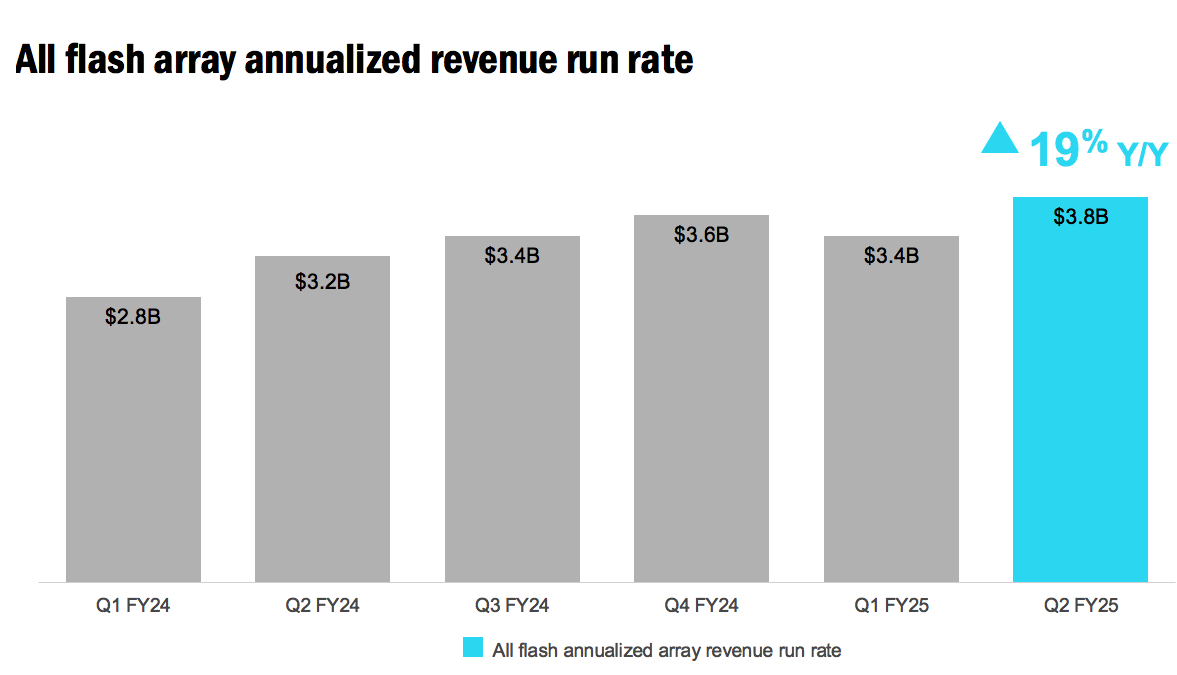

| 3Q25 (estim.) | 1,610-1,760 | 1% -10% | NA |

| FY25 (estim.) | 6,540-6,740 | 2% - 5% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter