25% Y/Y Increase in Total DRAM Bit Output in 2025

Marking more substantial growth compared to 2024

This is a Press Release edited by StorageNewsletter.com on November 19, 2024 at 2:02 pmThis market report, published on November 6, 2024, was written by TrendForce Corp.

DRAM Suppliers Must Carefully Plan Capacity

To Maintain Profitability Amid Rising Bit Output in 2025

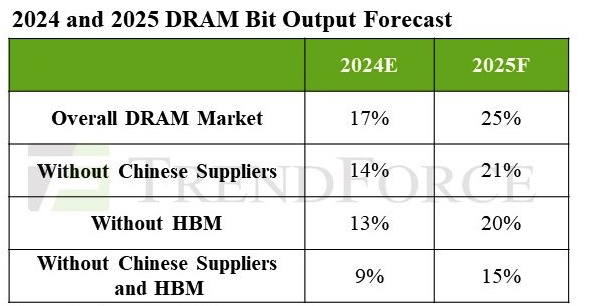

The DRAM industry experienced inventory reductions and price recovery in the 1st 3 quarters of 2024; however, pricing momentum is expected to weaken in the 4th quarter. TrendForce’s SVP of research, Avril Wu, noted that some DRAM suppliers, after achieving profitability this year, have begun planning new capacity expansions. This could lead to a 25% Y/Y increase in total DRAM bit output in 2025 – marking a more substantial growth compared to 2024.

The DRAM market structure is becoming increasingly complex. In addition to traditional categories such as PC, server, mobile, graphics, and consumer DRAM, HBM has been added to the product mix.

Geopolitically, China’s rapid capacity expansion in recent years is expected to impact the global supply landscape. Wu indicated that among the 3 major DRAM manufacturers, SK hynix will have the largest capacity expansion in 2025, driven significantly by its highly profitable HBM products.

Overall, TrendForce projects a 25% increase in DRAM bit output industry-wide in 2025, or 21% when excluding Chinese suppliers. Notably, most of the output from Chinese companies primarily serves domestic customers, with minimal supply directed to overseas markets.

HBM has emerged as a critical growth engine for the DRAM industry thanks to burgeoning AI demand.

Excluding HBM, conventional DRAM bit output is expected to increase by 20% in 2025. When further excluding HBM and supply from Chinese companies, the bit output from the three major DRAM manufacturers is forecast to grow by only 15% – a relatively low level compared to historical trends. Conventional DRAM includes products like DDR5, DDR4, LPDDR4/5, as well as graphics and consumer DRAM.

With an abundant supply of DRAM bits projected in 2025, any underperformance in demand could place downward pressure on prices.

From a geopolitical perspective, China’s DRAM supply achievement rate is expected to surpass other regions, focusing primarily on older-process LPDDR4x and DDR4, which will face higher pricing pressure compared to other DRAM types. Additionally, the HBM supply – particularly HBM3e – is anticipated to remain tight throughout next year.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter