HBM3e 12-Hi Faces Yield Learning Curve and Customer Validation Challenges

2025 HBM supply outlook remains uncertain.

This is a Press Release edited by StorageNewsletter.com on October 14, 2024 at 2:02 pm This market report was written on September 30, 2024 by Avril Wu, SVP of research, TrendForce Corp.

This market report was written on September 30, 2024 by Avril Wu, SVP of research, TrendForce Corp.

Concerns over a potential HBM oversupply in 2025 have been growing in the market, Wu reports that it remains uncertain whether manufacturers will be able to ramp up HBM3e production as planned next year. Additionally, the steep learning curve for achieving stable yields in HBM3e 12-Hi production makes it difficult to determine if a capacity surplus will occur.

TrendForce’s latest findings indicate that Samsung, SK hynix, and Micron have all submitted their first HBM3e 12-Hi samples in 1H24 and 3Q24, respectively, and are currently undergoing validation. The 2 vendors are making faster progress and are expected to complete validation by the end of this year.

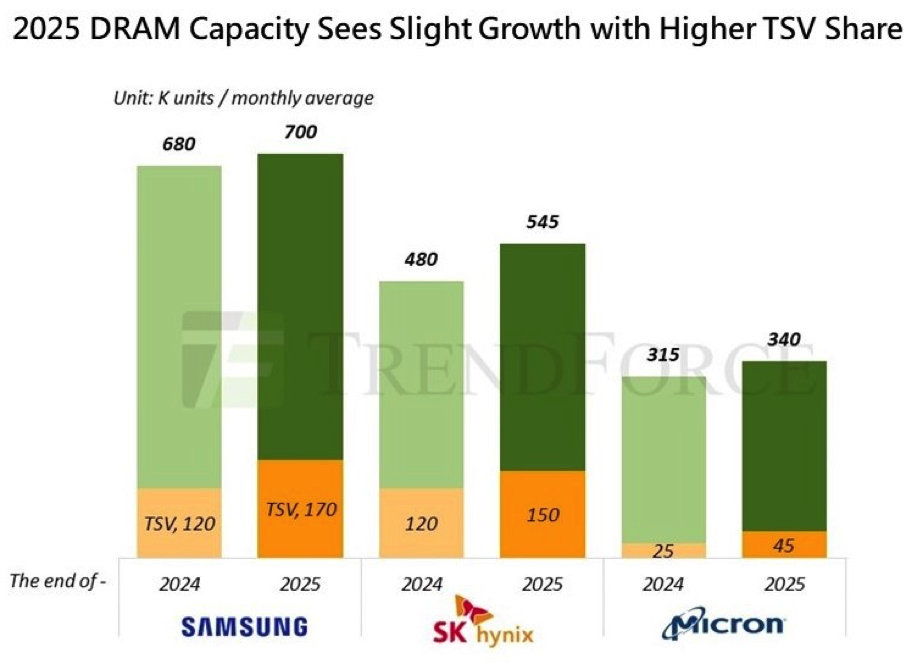

The market is concerned that aggressive capacity expansion in TSV processes by some DRAM suppliers could lead to oversupply and price declines in 2025. Current plans to expand capacity reveal that Samsung is set to increase its TSV production from 120,000 wafers per month at the end of 2024 to 170,000 wafers by the end of 2025 – a 40% increase. SK hynix, in turn, is planning a 25% capacity increase over the same period. However, whether these expansions will be fully realized depends on the successful validation of their products.

Wu notes that achieving stable yields for HBM3 and HBM3e 8-Hi products required at least 2 quarters of learning in previous generations. Based on this precedent, the learning curve for HBM3e 12-Hi is unlikely to shorten significantly, especially with the rapid market shift toward the 12-Hi version.

Furthermore, key products such as Nvidia’s B200 and GB200, as well as AMD’s MI325 and MI350, will adopt HBM3e 12-Hi. The high cost of these systems will also demand strict stability, complicating mass production and adding another layer of uncertainty.

TrendForce projects that as AI platforms increasingly adopt next-gen HBM products, more than 80% of the total HBM bit demand in 2025 will be for HBM3e, with over half of this coming from 12-Hi models. The 12-Hi version – followed by 8-Hi models – is expected to become the mainstream product ordered by major AI competitors in the second half of next year. Therefore, if an oversupply does occur, it is more likely to affect older-generation products such as HBM2e and HBM3. The impact on individual DRAM suppliers will depend on their product mix.

TrendForce maintains its outlook for the DRAM industry, forecasting that HBM will account for 10% of total DRAM bit output in 2025, doubling its share in 2024. HBM’s contribution to total DRAM market revenue is expected to exceed 30% given its high ASP.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter