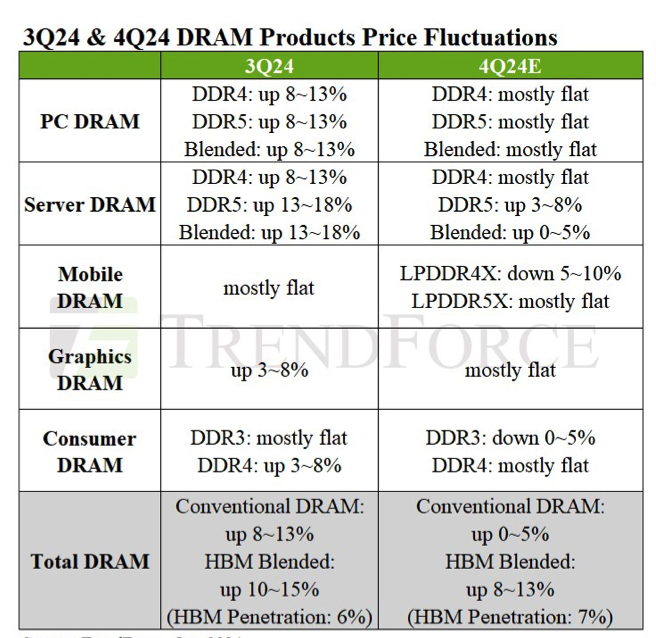

Average Price of Overall DRAM Projected to Rise 8–13% in 4Q24, Marked Deceleration Compared to 3Q24

Benefiting from rising share of HBM

This is a Press Release edited by StorageNewsletter.com on October 11, 2024 at 2:02 pmThis market report was published on October 9, 2024 by TrendForce Corp.

Weaker consumer demand has persisted through 3Q24, leaving AI servers as the primary driver of memory demand. This dynamic, combined with HBM production displacing conventional DRAM capacity, has led suppliers to maintain a firm stance on contract price hikes.

Smartphone brands continue to remain cautious despite some server OEMs continuing to show purchasing momentum. Consequently, TrendForce forecasts that 4Q24 memory prices will see a significant slowdown in growth, with conventional DRAM expected to increase by only 0–5%. However, benefiting from the rising share of HBM, the average price of overall DRAM is projected to rise 8–13% – a marked deceleration compared to the previous quarter.

PC DRAM prices expected to stabilize

PC OEMs have experienced a lackluster 3Q24 despite the traditional peak sales season owing to Intel’s Lunar Lake series not yet being released and ongoing consumer hesitation. Inventory clearance efforts have intensified due to heightened DRAM procurement costs, a trend expected to persist into Q4 that will reduce bit volume purchases.

In mid-to-late 3Q24, the spot market saw an influx of low-priced DDR4 and DDR5 components from dismantled modules, prompting module makers to ramp up their purchases of these cheaper alternatives to lower costs. Looking ahead to 4Q24, as the capacity impact of HBM production continues to expand, suppliers may still push for PC DRAM price hikes. However, this effort will likely be undermined by PC OEMs’ cautious inventory strategies and weak spot market trends. Consequently, TrendForce anticipates that PC DRAM prices will remain flat compared to the previous quarter.

Server DRAM prices expected to increase by 0-5% Q/Q

US-based CSPs reduced server DRAM procurement due to high inventory levels in 3Q24. Meanwhile, the Chinese market has shown signs of recovery but still remains insufficient in driving overall demand. Overall server DRAM bit shipments will improve in 4Q24, as DDR5 momentum improves and the low base in 3Q24 sets the stage, with average contract prices rising by 0–5% Q/Q.

LPDDR4X mobile DRAM prices expected to decline by 5-10%; LPDDR5X prices to remain stable

Smartphone brands focused on reducing existing mobile DRAM inventory in 3Q24 and resisted supplier price adjustments through delayed procurement strategies. This caused demand for mobile DRAM to drop by over 30% sequentially. This passive procurement approach will persist into 4Q24 as brands aim for more favorable quarterly contract prices.

Oversupply is becoming apparent because of the rapid capacity expansion of Chinese supplier CXMT in LPDDR4X, leading to an anticipated 4Q24 contract price decline of 5–10%. Conversely, LPDDR5X inventory levels remain relatively healthy, and supply has not increased significantly, so 4Q24 prices are expected to stay stable.

Graphics DRAM prices projected to remain flat

4Q24 demand for graphics demand remains lackluster, with only a slight uptick in orders from VGA card manufacturers. Suppliers have eased their push for price hikes, while buyers continue to stockpile inventory, leading to stable prices through 4Q24. Although there are no immediate signs of a price drop, suppliers are closely monitoring inventory levels of buyers. Furthermore, as similar capacity is increasingly being allocated to HBM production, suppliers are adopting a conservative approach to GDDR production planning.

Consumer DRAM: DDR3 prices may drop 0-5%; DDR4 to remain stable

Overall demand in the consumer DRAM market remains weak, and as year-end approaches, buyers are adopting an increasingly cautious restocking strategy. Although there has been some minor uptick in orders from networking clients for Wi-Fi 7, it has been insufficient to drive significant demand growth.

For DDR3, Taiwanese manufacturers have continued to expand capacity while the three major suppliers have been gradually reducing production each quarter. Coupled with a sharp decline in demand, this has led to oversupply in the market. 3Q24 prices remained largely flat compared to 2Q24, but in 4Q24, some suppliers may resort to price cuts to meet shipment targets, potentially causing contract prices to decline by 0–5%.

Meanwhile, DDR4 continues to be the mainstream consumer DRAM product, but with ongoing production increases from Chinese manufacturers, the possibility of a price drop cannot be ruled out.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter