Micron: Fiscal 4Q24 Financial Results

Micron: Fiscal 4Q24 Financial Results

Revenue of $25.1 billion in FY24 vs. $15.5 billion for FY23

This is a Press Release edited by StorageNewsletter.com on September 30, 2024 at 3:01 pm

| (in $ million | 4Q23 | 4Q24 | 12 mo. 23 | 12 mo. 24 |

| Revenue | 4,010 | 7,750 | 15,540 | 25,111 |

| Growth | 93% | 62% | ||

| Net income (loss) | (1,430) | 887 | (5,833) | 778 |

Micron Technology, Inc. announced results for its fourth quarter and full year of fiscal 2024, which ended August 29, 2024.

4FQ24 highlights

- Revenue of $7.75 billion vs. $6.81 billion for 3FQ24 and $4.01 billion for 4FQ23

- GAAP net income of $887 million, or $0.79 per diluted share

- Non-GAAP net income of $1.34 billion, or $1.18 per diluted share

- Operating cash flow of $3.41 billion vs. $2.48 billion for 3FQ24 and $249 million for 4FQ23

FY24 highlights

- Revenue of $25.11 billion versus $15.54 billion for FY23

- GAAP net income of $778 million, or $0.70 per diluted share

- Non-GAAP net income of $1.47 billion, or $1.30 per diluted share

- Operating cash flow of $8.51 billion vs. $1.56 billion for FY23

“Micron delivered 93% Y/Y revenue growth in 4FQ24, as robust AI demand drove a strong ramp of our data center DRAM products and our industry-leading high bandwidth memory. Our NAND revenue record was led by data center SSD sales, which exceeded $1 billion in quarterly revenue for the 1st time,” said president and CEO Sanjay Mehrotra. “We are entering FY25 with the best competitive positioning in Micron’s history. We forecast record revenue in 1FQ25 and a substantial revenue record with significantly improved profitability in FY25.”

Investments in capital expenditures, net were $3.08 billion for 4FQ24 and $8.12 billion for FY24, which resulted in adjusted free cash flows of $323 million for 4FQ24 and $386 million for FY24. The company ended the year with cash, marketable investments, and restricted cash of $9.16 billion.

On September 25, 2024, the board of directors declared a quarterly dividend of $0.115 per share, payable in cash on October 23, 2024, to shareholders of record as of the close of business on October 7, 2024.

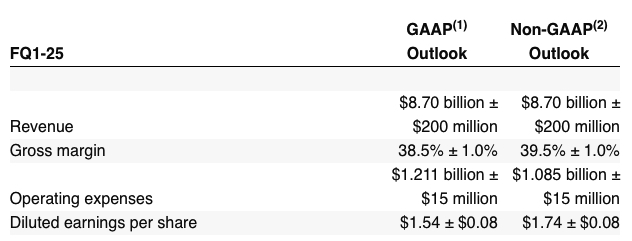

Business Outlook

Comments

Micron delivered a strong finish to FY24, with 4FQ24 revenue at the high end of guidance range and gross margins and earnings per share also above the high end of guidance ranges.

In 4FQ24, it achieved record-high revenues in NAND and in its storage business unit.

3FQ24 highlights

- Revenue of $6.81 billion vs. $5.82 billion for 3FQ24 and $3.75 billion for 3FQ23

- FY24 revenue grew over 60%, company gross margins expanded by over 30 percentage points and revenue records in data center and in automotive.

- Leadership 1-beta DRAM and G8 and G9 NAND process technology, and leadership products across firm's end markets.

- Robust data center demand is exceeding leading-edge node supply and is driving overall healthy supply-demand dynamics.

- As we move through calendar 2025, the company expects a broadening of demand drivers, complementing strong demand in the data center.

- It looks forward to delivering a substantial revenue record with significantly improved profitability in FY25, beginning with guidance for record quarterly revenue in 1FQ25.

Performance by technology

DRAM 4FQ24

- $5.3 billion, representing 69% of total revenue

- Revenue increased 14% Q/Q

- Bit shipments flattish Q/Q

- ASPs increased in the mid-teens percentage range Q/Q

DRAM FY24

- $17.6 billion, representing 70% of total revenue

- Revenue increased 60% Y/Y

NAND 4FQ24

- $2.4 billion, representing 31% of total revenue

- Revenue increased 15% Q/Q

- Bit shipments increased in the high-single digit percentage range Q/Q

- ASPs increased in the high-single digit percentage range Q/Q

NAND FY24

- $7.2 billion, representing 29% of total revenue

- Revenue increased 72% Y/Y

Technology and operations

- 1-beta DRAM and G8 and G9 NAND nodes are ramping in high volume and will become an increasing portion of mix through FY25. As a reminder, G8 NAND node refers to 232-layer NAND technology node.

- 1-gamma DRAM pilot production using extreme ultraviolet (EUV) lithography is progressing well, and the firm on track for volume production in calendar 2025.

- Delivered FY24 DRAM front-end cost reductions at the high end of the outlook provided at the beginning of the year, and NAND cost reductions were consistent with forecast.

- Expects FY25 DRAM front-end cost reductions excluding HBM to be in the mid-to-high single digits percentage range.

- Expects FY25 NAND cost reductions to be in the low-to-mid teens percentage range.

Data Center

- ndustry server unit shipments are expected to grow in the mid-to-high single digits in calendar 2024, driven by strong growth for AI servers as well as low-single digits growth for traditional servers.

- Mix of data center revenue reached a record level in FY24, and the vendor expects will grow significantly from here in FY25.

- Well positioned in the data center with portfolio of HBM, high-capacity D5 and LP5 solutions, and data center SSD products, the firm expects each of these three product categories to deliver multiple billions of dollars in revenue in FY25.

- Even as DRAM gross margins improved, 4FQ24 HBM gross margins were accretive to both company and DRAM gross margins, indicative of solid HBM yield ramp.

- Expects the HBM TAM to grow from approximately $4 billion in calendar 2023 to over $25 billion in calendar 2025.

- As a percent of overall industry DRAM bits, expects HBM to grow from 1.5% in calendar 2023 to around 6% in calendar 2025.

- HBM3E 12-high 36GB delivers 20% lower power consumption than competitors’ HBM3E 8-high 24GB solutions, while providing 50% higher DRAM capacity. Expects to ramp our HBM3E 12-high output in early calendar 2025 and increase the 12-high mix in shipments throughout 2025.

- Increasing adoption of our high-capacity mono-die based 128GB D5 DIMM products, the vendor is leveraging its innovative, industry-leading LP5 solutions to pioneer the adoption of low-power DRAM for servers in the data center.

- Data center SSD demand continues to be driven by strong growth in AI as well as a recovery in traditional compute and storage.

- Gained substantial share in data center SSDs.

- Achieved a quarterly revenue record with over a billion dollars in revenue in data center SSDs in 4FQ24, and FY24 data center SSD revenue more than tripled from a year ago.

Supply outlook

- Expects industry wafer capacity in both DRAM and NAND in 2024 to be below 2022 peak levels, and for NAND meaningfully so.

- This factor, combined with the increasing mix of HBM wafers, is reducing DRAM supply allocated to traditional products, and contributing to the healthy industry supply-demand environment that the company expects for DRAM in calendar 2025.

- Expects a healthy industry supply-demand environment for NAND in calendar 2025.

- NAND technology transitions generally provide more growth in annualized bits per wafer compared to the NAND bit demand CAGR expectation of high-teens.

- Consequently, the firm anticipates longer periods between industry technology transitions and moderating capital investment over time to align industry supply with demand.

NAND revenue only

| Period | Revenue in $ million |

Q/Q or Y/Y change for FY |

% of global revenue |

| FY19 | 5,335 | NA | 23% |

| FY20 | 6,131 | 14% | 29% |

| FY21 | 7,007 | 14% | 25% |

| 1FQ22 | 1,878 | -5% | 24% |

| 2FQ22 | 1,957 | 4% | 25% |

| 3FQ22 | 2,300 | 18% | 26% |

| 4FQ22 | 1,688 | -26% | 25% |

| FY22 | 7,811 | 11% | 25% |

| FY23 | 4,206 | -46% |

27% |

| 1FQ24 | 1,230 | 2% | 26% |

| 2FQ24 | 1,567 | 27% | 27% |

| 3FQ24 | 2,065 | 32% | 30% |

| 4FQ24 | 2,400 | 15% | 31% |

| FY24 | 7,200 | 72% | 29% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter