Pure Storage: Fiscal 2FQ25 Financial Results

Pure Storage: Fiscal 2FQ25 Financial Results

Up 11% Y/Y and 10% Q/Q at $764 million, back to profit

This is a Press Release edited by StorageNewsletter.com on August 29, 2024 at 2:02 pm| (in $ million) | 2Q24 | 2Q25 | 6 mo. 24 | 6 mo. 25 |

| Revenue | 688.7 | 763.8 | 1,278 | 1,457 |

| Growth | 11% | 14% | ||

| Net income (loss) | (7.1) | 35.7 | (74.5) | 0.7 |

Pure Storage, Inc. announced financial results for its second quarter fiscal year 2025 ended August 4, 2024.

“In a world where energy demands are soaring, the power savings of Pure Storage alone make the move from hard disks to Pure technology a smart choice for both hyperscaler and enterprise data centers,” said chairman and CEO Charles Giancarlo. “Businesses can grow their data storage and reduce their energy footprint with Pure on a platform that eliminates existing data silos and simplifies customers’ data centers with guaranteed service-level agreements.“

2FQ25 Highlights

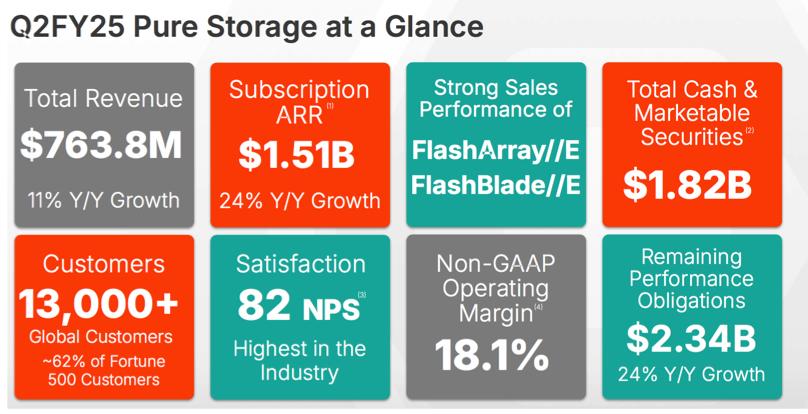

- Revenue $763.8 million, an increase of 11% Y/Y

- Subscription services revenue $361.2 million, up 25% Y/Y

- Subscription ARR $1.5 billion, up 24% Y/Y

- Remaining performance obligations (RPO) $2.3 billion, up 24% Y/Y

- GAAP gross margin 70.7%; non-GAAP gross margin 72.8%

- GAAP operating income $24.9 million; non-GAAP operating income $138.6 million

- GAAP operating margin 3.3%; non-GAAP operating margin 18.1%

- Operating cash flow $226.6 million; free cash flow $166.6 million

- Total cash, cash equivalents, and marketable securities $1.8 billion

“We delivered strong financial results through the first half of our fiscal year, highlighting the effectiveness of our strategic initiatives,” said Kevan Krysler, CFO. “Our highly differentiated data storage platform strategy is demonstrating success with our customers.”

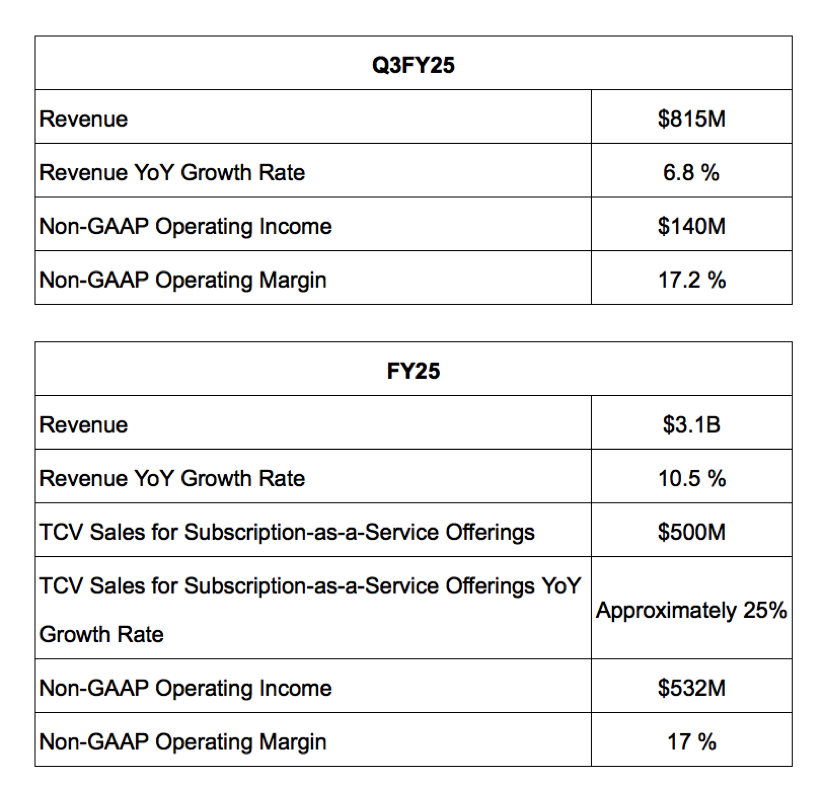

3FQ25 and FY25 Guidance

Comments

Pure delivered double digit revenue growth during 1FH25 and continues to see strong sales performance for both our FlashArray//E and Flashblade //E offerings. Revenue of $764 million in 2FQ25 grew 11% Y/Y, and both revenue and operating profit of $139 million exceeded guidance.

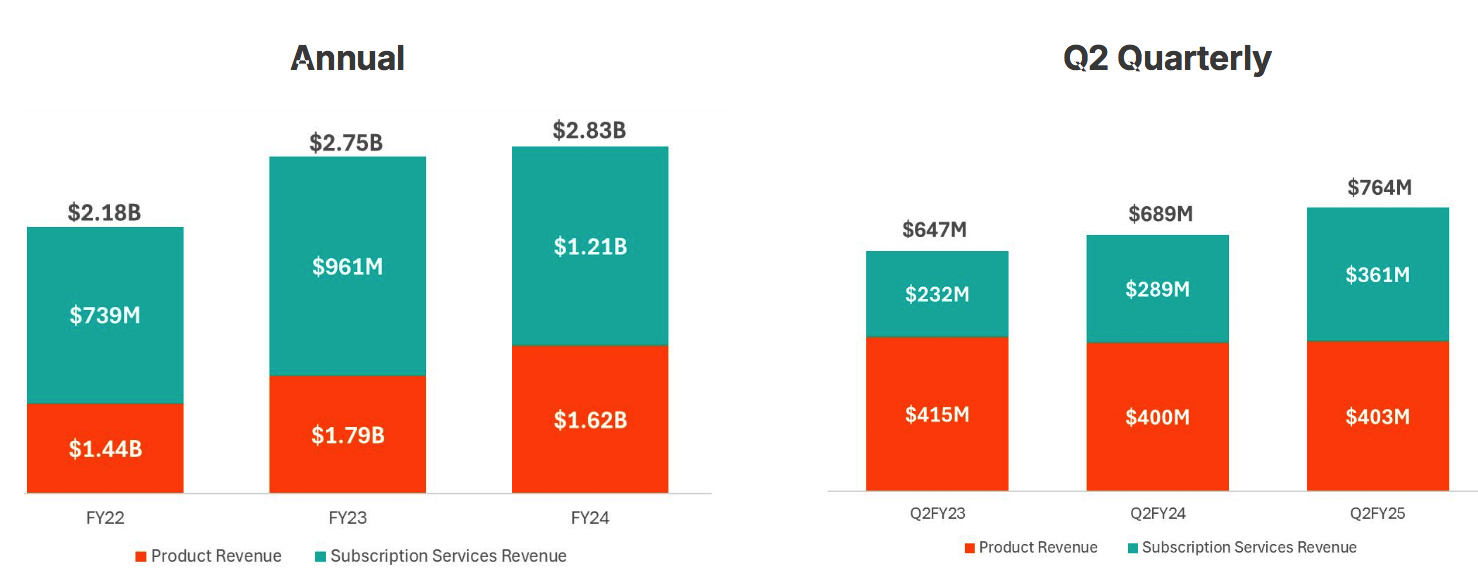

Revenue

ARR grew 24% to over $1.5 billion, which continues to be driven by Evergreen//One service offering, in particular, for higher velocity business.

Total RPO exiting 2FQ25, which includes both subscription services and product orders, grew 24% Y/Y to $2.3 billion dollars

US revenue for 2FQ25 was $538 million dollars and international revenue was $226 million dollars.

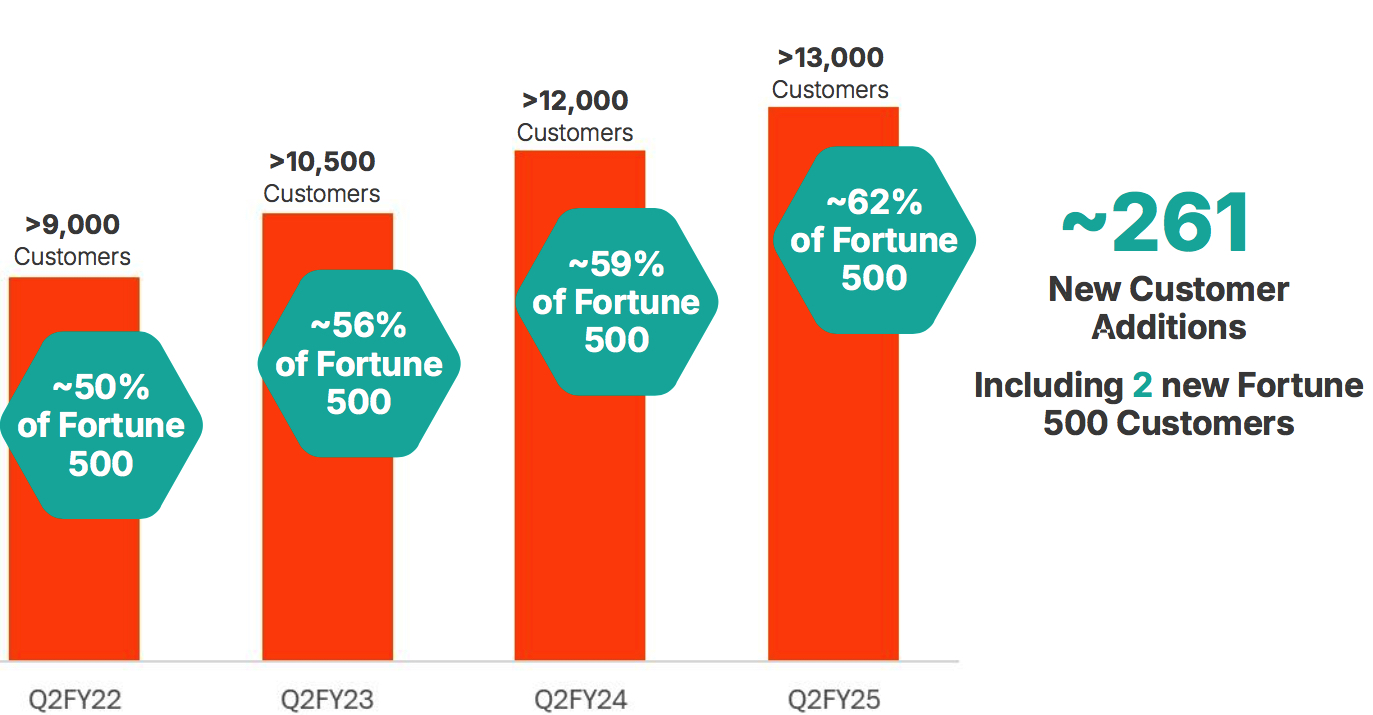

New customer acquisition grew by 261 during 2FQ25, and the firm now serves 62% of the Fortune 500.

Headcount increased sequentially by nearly 250, to approximately 5,700 employees at the end of the quarter.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Net income (loss) |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| FY20 |

1,643 | 21% | (201.0) |

| FY21 |

1,684 | 2% |

(282.1) |

| FY22 |

2,181 |

30% |

(143.3) |

| 1F23 | 620.4 | 50% |

(11.5) |

| 2F23 | 646.8 | 30% |

10.9 |

| 3F23 | 676.1 | 20% | (0.8) |

| 4F23 | 810.2 | 14% | 74.5 |

| FY23 |

2,753 |

26% |

73.1 |

| 1Q24 |

589.3 |

-5% |

(67.4) |

| 2Q24 | 688.7 |

6% |

(7.1) |

| 3Q24 | 762.8 | 13% | 70.4 |

| 4F24 | 789.8 | -3% | 65.4 |

| FY24 |

2,831 | 3% |

61.3 |

| 1F25 | 693.5 | 18% | (35.0) |

| 2F25 | 763.8 | 11% | 35.7 |

| 3F25 (estim.) | 815 | 7% | NA |

| FY25 (estim.) |

3,100 |

10% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter