History 2004: HGA Maker Magnecomp Gets 80% of KR Precision

That manufactures suspensions exclusively in Thailand, initially only for 3.5-inch technology, notably to Samsung

By Jean Jacques Maleval | July 10, 2024 at 3:10 pmDisk suspensions, which support magnetic heads in order to fly above the disk platters, and are used in the head gimbals assemblies (HGAs), are a critical component of the hard disk drive.

Almost as many suspensions are sold as disk heads that they support, and even nearly 20% more, according to the ratio calculated by Coughlin Associates, which follows this market closely.

Buyers are generally independent disk head makers such as SAE/TDK and Alps, or HDD assemblers directly, when they have their own HGA plant, HGA being acquired at an average unit price that currently ranges between $0.80 and $0.85.

Along with the motors, it’s one of the rare pieces of the device that is almost entirely in the hands of independent manufacturers (who don’t also manufacture HDDs), which isn’t true for disks and heads.

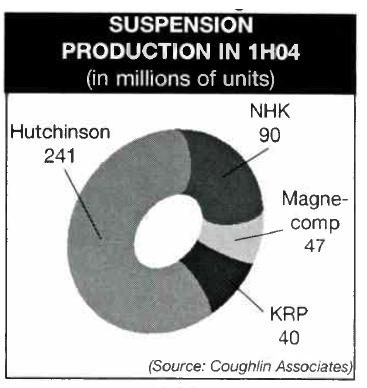

After Hutchinson, the undisputed leader for suspensions, with 538 million units shipped for the fiscal year ending in September 2004, things are beginning to stir.

Already, in April 2004, Magnecomp bought Fujitsu’s suspension manufacturing technology equipment. Now, 2 Hutchinson rivals have dangerously become only one, with Magnecomp’s acquisition of 80% of KR Precision.

Two situate both companies, the 5,500-person Magnecomp, founded in 1984, has shipped 151.4 million suspensions from plants in Thailand and China in 2003 (+78% over 2002), which corresponds to sales of $128 million. For 2004, it sold a record 46.5 million suspensions. It leads particularly in products for one-inch HDD, as the sole supplier for 3 out of 4 current manufacturers.

Meanwhile, the 1,300-person KRP founded in 1988, manufactures suspensions exclusively in Thailand, initially only for 3.5-inch technology, notably to Samsung, and more recently for 2.5-inch units. The firm placed some 81.7 million pieces in 2003 (+18%), while overall sales of the company attained $65 million (+22%) for a loss of $5 million.

For several years now, discussions have taken place between the 2 parties, without results. This time, however, they found a financial common ground, particularly since KPR was only operating at 30% of capacity, and was losing lots of money. For the June 2004 quarter, net revenues decreased 29.6% sequentially to $7 million with net loss deepening at $3 million, and units shipments dipping to 9.3 million units, a 24% decline compared to the preceding quarter. The company even anticipated a 10 to 15% drop in business for the September 2004 quarter, for which no figures have yet been released.

Singapore’s Magnecomp will take 80% control of the Thai-listed company by injecting into it $54 million in assets in return for 1.4 billion new KRP shares at Baht 2.60, the equivalent of $93 million.

Steven Campbell, the current CEO of Magnecomp, will hold the same position at KPR, once the transaction closes on January 31, 2005.

In the world of HDD suspensions, now with only 3 remaining players, Hutchinson, NHK and Magnecomp/KRP in order of market share, and the latter approaching quite closely to 2nd place, lawsuits for patent infringement are common occurrences. There have been filings between Hutchinson and Magnecomp. The most recent involve the 2 new partners. Last June, Magnecomp went after KRP, who countersued with charges of patent infringement, unfair trade practices, inducing breach of contract, interfering with business and employee relations, and theft of trade secrets. Two months later, Magnecomp re-launched the case by counter-filing for the infringement of 5 U.S. patents related to suspension assemblies.

This article is an abstract of news published on issue 203 on December 2004 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter