Rubrik: Fiscal 1Q25 Financial Results

Rubrik: Fiscal 1Q25 Financial Results

Revenue of $187 million, up 38 % Y/Y, with huge $732 million loss, after $752 million IPO

This is a Press Release edited by StorageNewsletter.com on June 13, 2024 at 2:03 pm

| (in $ million) | 1Q24 | 1Q25 | Growth |

| Revenue |

135.7 | 187.3 | 38% |

| Net income (loss) | (89.3) | (732.1) |

Rubrik, Inc. announced financial results for the first quarter fiscal year 2025, ended April 30, 2024.

It is a leader in one of the fastest growing new segments in the cybersecurity market, data security, with a total addressable market of about $53 billion by 2027*. The explosion of data especially with AI is creating a massive market opportunity for the company.

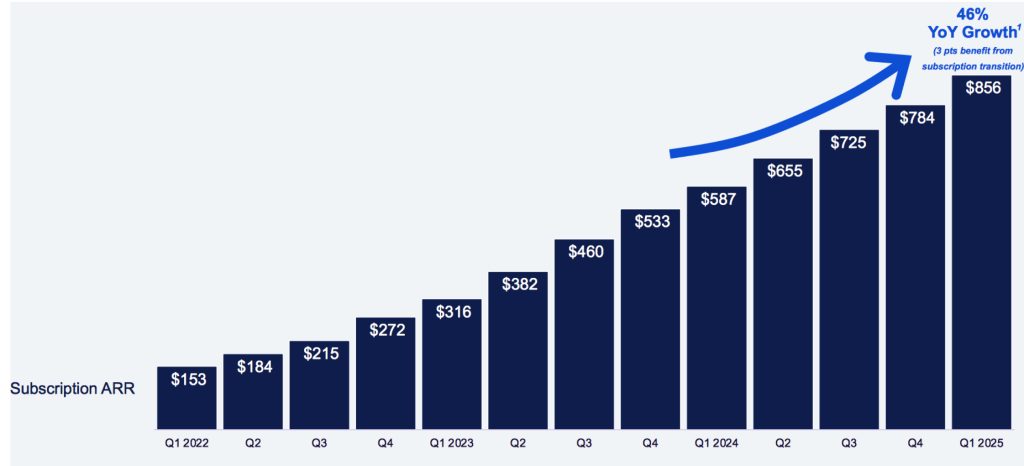

“The value we bring to our customers has resulted in subscription annual recurring revenue up 46% Y/Y in 1FQ25 to $856 million. While we are excited and proud of all the team has done to date, we are in the very early innings of data security and look forward to continuing to build an enduring company,” said Bipul Sinha, CEO, chairman, and co-founder.

Commenting on the financial results, Kiran Choudary, CFO, added: “We are pleased by the strong start to the year in 1FQ25 with strength in large transactions driving net new Subscription ARR of $72 million, up 32% Y/Y and Subscription ARR Contribution Margin up over 2,100 basis points year over year. We are confident in our ability to deliver strong growth in Subscription ARR and continued operating leverage towards our long-term financial model.”

1FQ25 Highlights

- Subscription Annual Recurring Revenue (ARR): Up 46% TY/Y, grew to $856.1 million as of April 30, 2024.

- Revenue: Subscription revenue was $172.2 million, a 59% increase, compared to $108.4 million in 1FQ24. Total revenue was $187.3 million, a 38% increase, compared to $135.7 million in 1FQ24.

- Gross Margin: GAAP gross margin was 48.8%, compared to 73.6% in 1FQ24. This includes $48.9 million in stock-based compensation expense, compared to $0.1 million in 1FQ24, due to the vesting of certain equity awards in conjunction with the IPO. Non-GAAP gross margin was 75.4%, compared to 73.6% in 1FQ24.

- Subscription ARR Contribution Margin: Subscription ARR Contribution Margin was (11)% compared to (32)% in 1FQ24, reflecting the improvement in operating leverage in the business. Subscription ARR Contribution Margin was (8)% when adjusting for $22.8 million in employer payroll taxes due to the vesting of certain equity awards in conjunction with the IPO.

- Net Loss per Share: GAAP net loss per share was $(11.48), compared to $(1.49) in 1FQ24. GAAP net loss includes $630.3 million in stock-based compensation expense, compared to $0.5 million in 1FQ24, due to the vesting of certain equity awards in conjunction with the IPO. Non-GAAP net loss per share was $(1.58), compared to $(1.48) in 1FQ24.

- Cash Flow from Operations: Was $(31.4) million, compared to $(17.5) million in 1FQ24. Free cash flow was $(37.1) million, compared to $(23.2) million in 1FQ24. Excluding the $20.6 million for employer payroll taxes due to the vesting of certain equity awards in conjunction with the IPO, free cash flow would have been $(16.5) million.

- Cash, Cash Equivalents, and Short-Term Investments: Were $606.3 million as of April 30, 2024.

Recent Business Highlights

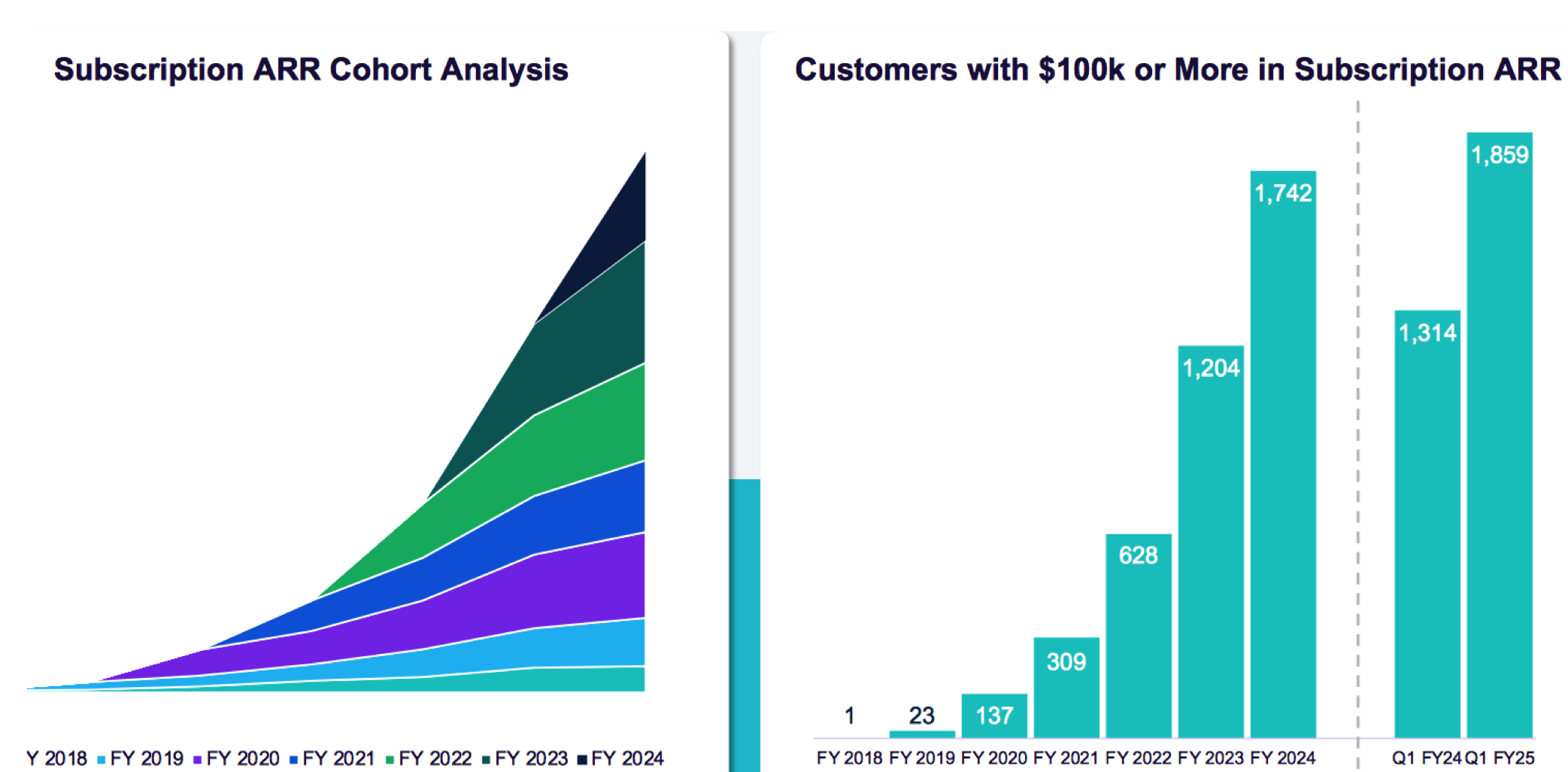

- As of April 30, 2024, the firm had 1,859 customers with Subscription ARR of $100,000 or more, up 41% Y/Y.

- Announced the pricing and closing of an IPO of 23,500,000 shares of Rubrik Class A common stock at a price to the public of $32.00 per share. Net proceeds to Rubrik from the offering were $710.3 million after deducting underwriting discounts and commissions. The shares began trading on the New York Stock Exchange on April 25, 2024, under the symbol RBRK. In May 2024, the underwriters exercised their option to purchase an additional 3,472,252 shares of Class A common stock at the initial public offering price of $32.00 per share. Net proceeds were approximately $104.9 million after deducting underwriters’ discounts and commissions.

- Announced the general availability of DSPM Everywhere, which is the first complete cyber resilience offering. DSPM Everywhere allows organizations to secure mission-critical data for comprehensive protection, recovery, and resilience against cyberattacks, whether in a cloud, SaaS, or on-premises environment.

- Announced a strategic partnership with CrowdStrike to accelerate data security transformation and stop breaches of critical information. By unifying rich, data-centric attack context from the Rubrik Security Cloud with the industry- leading AI-native CrowdStrike FalconÆ XDR platform, organizations can rapidly detect, investigate, and stop attacks targeting sensitive data.

- Announced a global strategic alliance and new services with Kyndryl, the world’s largest IT infrastructure services provider. As part of the strategic alliance, Rubrik collaborated with Kyndryl to co-develop and launch Kyndryl Incident Recovery with Rubrik. This fully managed as-a-service solution provides customers with data protection and cyber incident recovery, backup, and disaster recovery for cloud and on-premises workloads.

- Won 2 Global InfoSec awards for Pioneering Data Security Posture Management (DSPM) and Pioneering Cyber Resilience, in recognition of Rubrik’s leadership in advancing the field of data protection and cybersecurity in today’s rapidly evolving digital landscape.

2FQ25 Outlook:

- Revenue of $195 million to $197 million.

- Non-GAAP Subscription ARR contribution margin of approximately (13.5)% to (12.5)%.

- Non-GAAP EPS of $(0.50) to $(0.48).

- Weighted-average shares outstanding of approximately 179 million.

FY25 Outlook:

- Subscription ARR between $983 million and $997 million.

- Revenue of $810 million to $824 million.

- Non-GAAP Subscription ARR contribution margin of approximately (12.5)% to (11.5)%.

- Non-GAAP EPS of $(2.35) to $(2.25).

- Weighted-average shares outstanding of approximately 154 million.

- Free cash flow of $(115) million to $(95) million, including $23 million of one-time payroll taxes related to the public offering.

* Total addressable market number calculations of $53 billion by 2027 were performed by Rubrik, Inc. based on Gartner research. Calculations were based on Gartner research documents including:

- Gartner, Inc., Forecast: Information Security and Risk Management, Worldwide, 2021-2027, 4Q23 Update, December 2023; Gartner, Inc., Forecast Analysis: Cloud Security Posture Management, Worldwide, July 2023. Includes $6.6 billion and $9.8 billion in Application Security, $6.9 billion and $12.8 billion in Cloud Security, $1.7 billion and $2.7 billion in Data Privacy, $4.2 billion and $5.9 billion in Data Security, and $2.4 billion and $2.9 billion in Privileged Access Management by the end of calendar years 2024 and 2027, respectively.

- Gartner, Inc., Forecast Analysis: Cloud Security Posture Management, Worldwide, July 2023. Calculations performed by Rubrik, Inc. Includes $1.8 billion and $3.3 billion in Cloud Security Posture Management by the end of calendar years 2024 and 2027, respectively.

- Gartner, Inc., Forecast: Enterprise Infrastructure Software, Worldwide, 2021-2027, 4Q23 Update, December 2023. Calculations performed by Rubrik, Inc. Includes $11.1 billion and $13.3 billion in Backup and Recovery Software and $1.9 billion and $2.1 billion in Archive Software by the end of calendar years 2024 and 2027, respectively.

Comments

For 1FQ25, revenue was $187 million, up 38% Y/Y and 7% Q/Q, with huge $732 million loss after IPO when company raised $752 million last April.

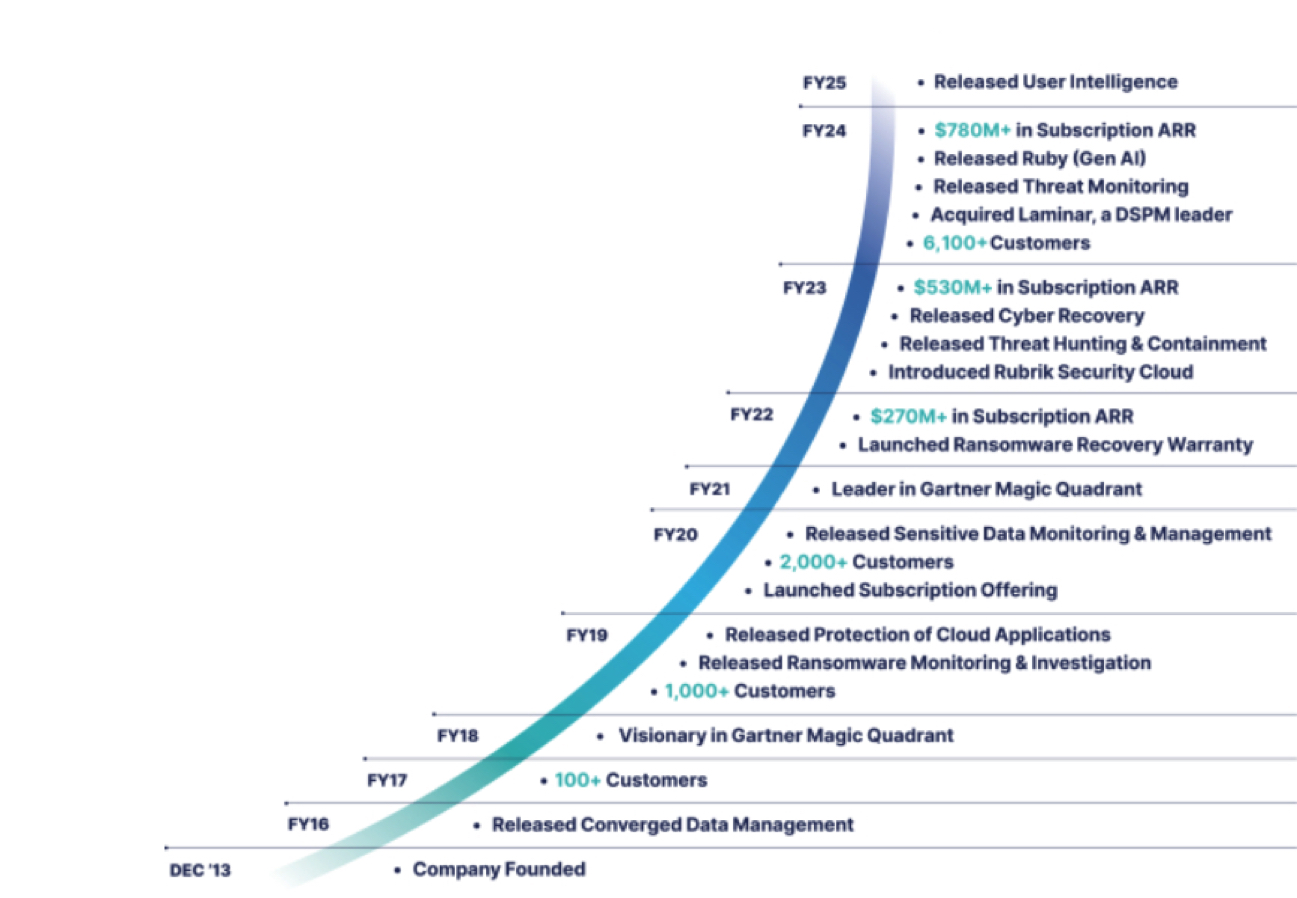

History

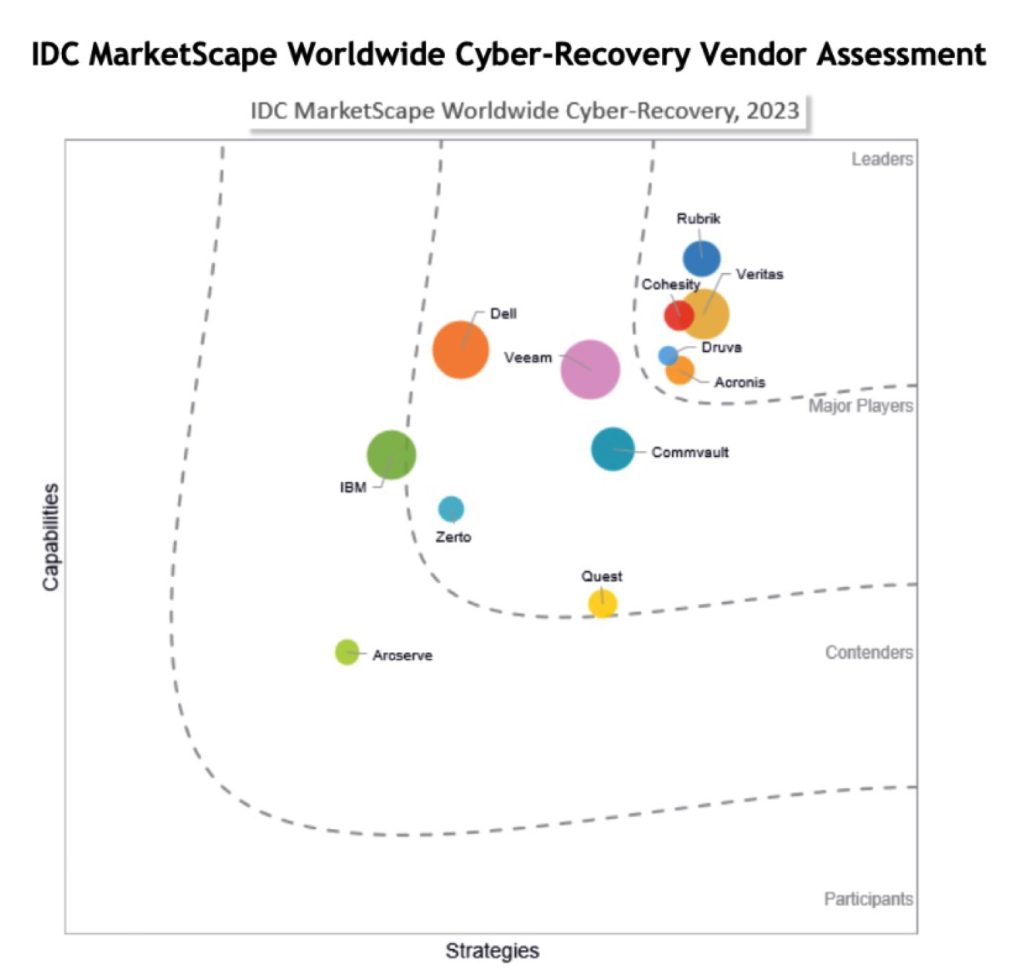

Leader in Cyber-Recovery

Subscription ARR Growth at Scale

Customer Growth and Expansion

FY ended January 31, in $ million

| Period | Revenue | Y/Y growth | Net loss |

| 1FQ23 | 132.2 | NA | (66.7) |

| 2FQ23 | 167.2 | NA | (62.1) |

| 3FQ23 | 164.7 | NA | (63.1) |

| 4FQ23 | 135.7 | NA | (86.0) |

| FY23 | 599.8 | NA | (277.7) |

| 1FQ24 | 135.7 | 3% | (89.3) |

| 2FQ24 | 151.5 | -9% | (81.1) |

| 3FQ24 | 165.6 | 1% | (86.3) |

| 4FQ24 | 175.0 | 29% | (97.5) |

| FY24 | 627.9 | 5% | (354.2) |

| 1FQ25 | 187.3 | 38% | (732.1) |

| 2FQ25 (estim.) | 195-197 | 29%-30% | NA |

| FY5 (estim.) | 810-824 | 29%-31% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter