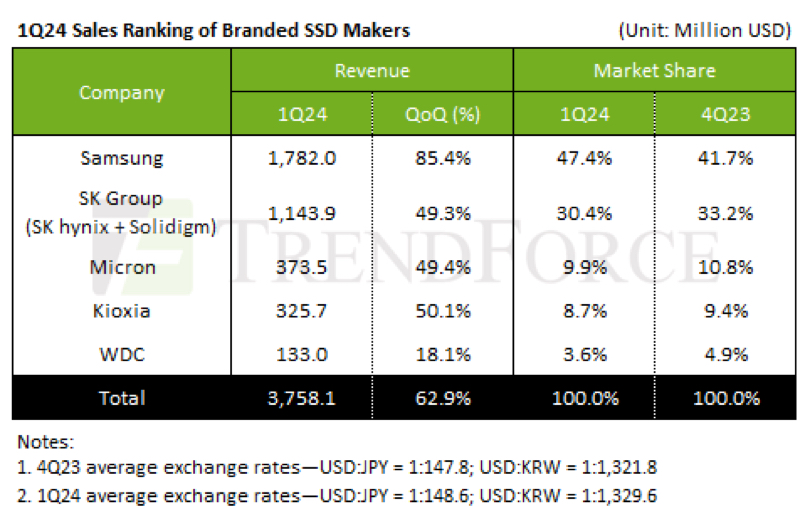

High-Capacity Storage Propels Enterprise SSD Revenue Up by as much as 63% Q/Q in 1Q24 to Reach $3.758 Billion

Because of growing demand

This is a Press Release edited by StorageNewsletter.com on June 3, 2024 at 2:02 pm![]() This market report, published on May 31, 2024, was written by Bryan Ao, analyst, TrendForce Corp.

This market report, published on May 31, 2024, was written by Bryan Ao, analyst, TrendForce Corp.

Growing Demand for High-Capacity Storage Propels Enterprise SSD Revenue Up by Over 60% in 1Q24

A reduction in supplier production has led to unmet demand for high-capacity orders since 4Q23. Combined with procurement strategies aimed at building low-cost inventory, this has driven orders and significantly boosted enterprise SSD revenue, which reached $3.758 billion in 1Q24 – a staggering 62.9% QoQ increase.

Demand for high-capacity, driven by AI servers, has surged. North American clients increasingly adopt high-capacity QLC SSDs to replace HDDs, leading to over 20% growth in 2Q24 enterprise SSD bit procurement. This has also driven up 2Q24 enterprise SSD contract prices by more than 20%, with revenue expected to grow by another 20%.

High-capacity QLC products have demonstrated superior demand momentum compared to other capacities, with Samsung and SK Group (SK hynix and Solidigm) holding a competitive edge. Samsung’s order growth has outpaced others thanks to its status as the primary supplier of enterprise SSDs to North American clients and the qualification of its QLC enterprise SSD products by customers, driving 1Q24 revenue to $1.782 billion – an 85.4% jump. Strong North American demand is projected to boost 2Q24 revenue by over 30%.

SK Group’s subsidiary Solidigm, which has long focused on QLC enterprise SSD products, has experienced a surge in orders, doubling due to increased adoption by AI customers. This led to 1Q24 enterprise SSD revenue of $1.144 billion, marking a 49.3% Q/Q increase. 2Q24 is also expected to benefit from high-capacity SSD orders, with projected revenue growth of over 30%.

Micron also saw significant gains, with 1Q24 enterprise SSD revenue reaching $374 million – a 49.4% Q/Q jump – driven by rising volume and prices.

Kioxia’s 1Q24 enterprise SSD revenue climbed to $326 million – a 50.1% Q/Q increase—bolstered by ongoing orders from North American clients. 2Q24 is expected to see an additional 20% revenue growth.

Western Digital, with a customer base mainly in North America, saw a modest 18.1% increase in revenue to $133 million because of its more limited product line. However, it is also aggressively pursuing shipments of high-capacity storage products, with plans to mass-produce 162-layer QLC SSDs. To accelerate the production of PCIe 5.0 SSDs, it is collaborating with 3rd-party controller manufacturers, breaking its tradition of in-house IC development. This strategic move underscores manufacturer’s efforts to expand its product range and support steady growth in enterprise SSD revenue.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter