Overall SSD Shipments Decreased 6% Q/Q to 82.8 Million in 1Q24

With capacity growing 2% to 87EB

This is a Press Release edited by StorageNewsletter.com on June 20, 2024 at 2:02 pmThis market report from Trendfocus, Inc. is an abstract of its NAND/SSD Information Service CQ1 ’24 Quarterly Update – Executive Summary, May 30, 2024.

CQ1 ’24 SSD Results Mixed, with Enterprise PCle the Bright Spot in both Units and Exabytes

Client SSDs slowed for the second quarter in a row

as PC OEMs continue to wait for increased end market demand

• Overall unit shipments decreased 6.2% Q/Q to 82.786 million, with capacity growing 2.0% to 86.988EB.

• Client module units fell by 10.5% while exabytes declined even more, by 12.1%, with shipments dropping to 64.874 units and 43.393EB, respectively.

• Enterprise PCle units climbed again, growing 31.6% Q/Q to 7.088 million, while capacity shipped also achieved substantial growth of 31.8% in the same time frame reaching 30.526EB, helped by several form factors and a variety of capacities.

• SAS SSD shipments contracted by 5.8% in units to 0.883 million but grew slightly, by 1.7%, in exabytes to 3.259.

• Enterprise SATA units increased by double-digits to 4.028 million; however, capacity shipped contracted by 6.3% as lower-capacity solutions benefitted from the uptick in demand.

• As expected, total NAND bit shipments decreased slightly, by 5.4%, dropping to 219.39EB shipped.

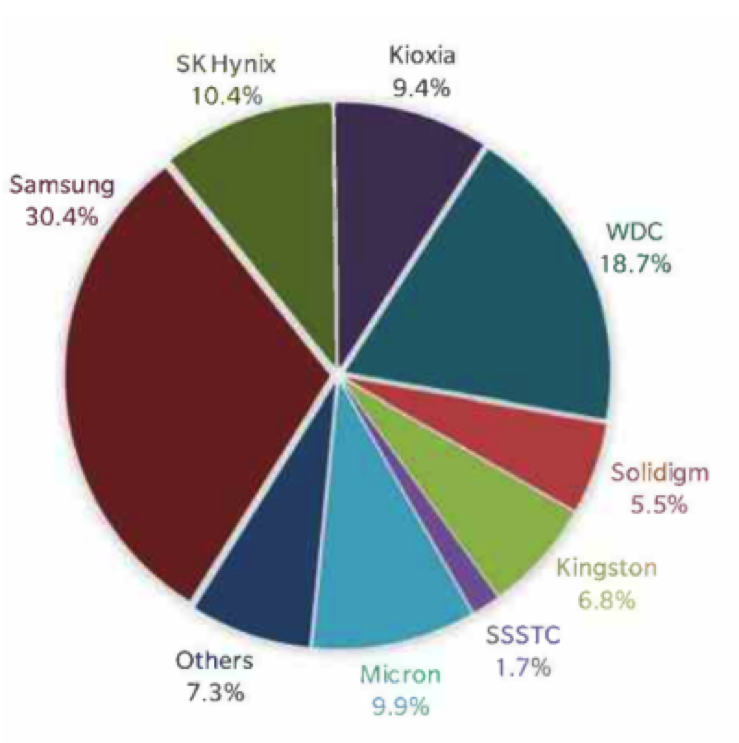

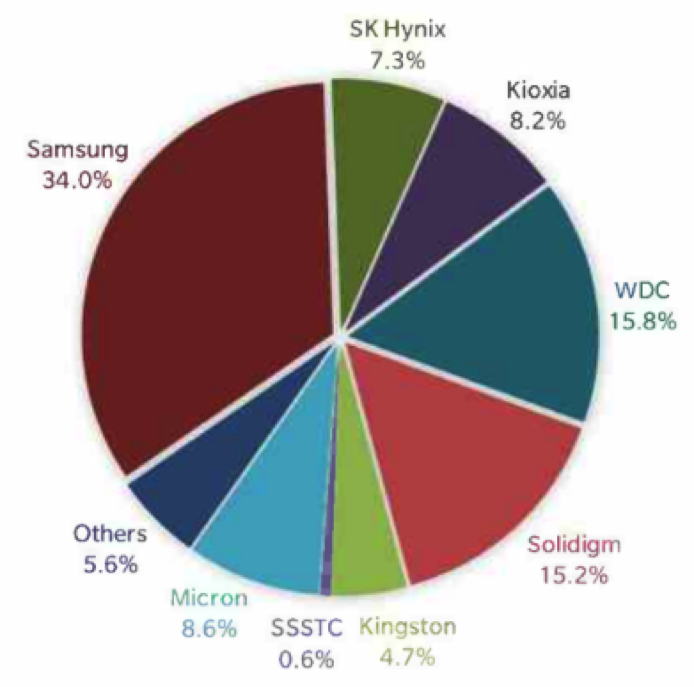

CQ1 ’24 SSD Market Share, by Supplier, Units (million), Exabytes

Total SSD Market: 82.786 Million Units

Total SSD Market: 86.988EB

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter