DRAM Spot Prices Expected to Decline Post-Manufacturer Quoting Resumption

Due to sellers halting quotations, DDR3, DDR4, and DDR5 have all seen price increases.

This is a Press Release edited by StorageNewsletter.com on April 18, 2024 at 2:02 pmThis market report, published on April 17, 2024, was written by analysts from TrendForce Corp.

The analyst firm releases the latest trends in memory spot prices. Due to sellers halting quotations, DDR3, DDR4, and DDR5 have all seen price increases.

It is expected that prices will decline once quotations are fully resumed. On the other hand, with no strong signs of recovery in end-market demand for NAND flash, inquiry interest remains subdued. Details below:

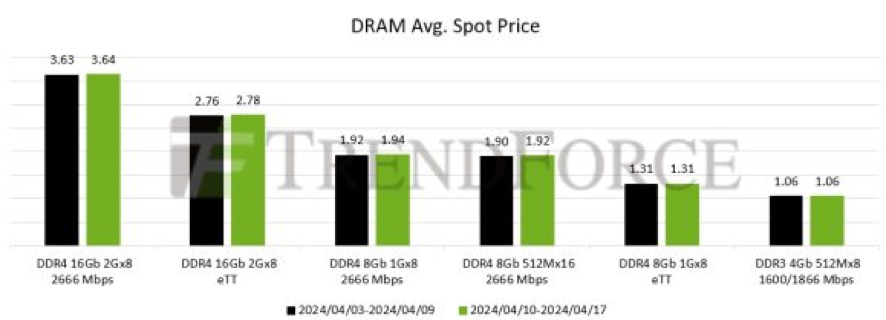

DRAM Spot Market:

In the spot market, sellers and module houses suspended quoting following Taiwan’s earthquake on April 3, leading to incremental price rises over several days. This upward trend applies to DDR3, DDR4, and DDR5 products. However, the spot market still lacks demand, and transactions have been limited in terms of quantity. Sellers will resume quoting very soon, and prices will shift down again as before. The average spot price of mainstream chips (i.e., DDR4 1Gx8 2666MT/s) rose by 0.93% from $1.927 last week to $1.945 this week.

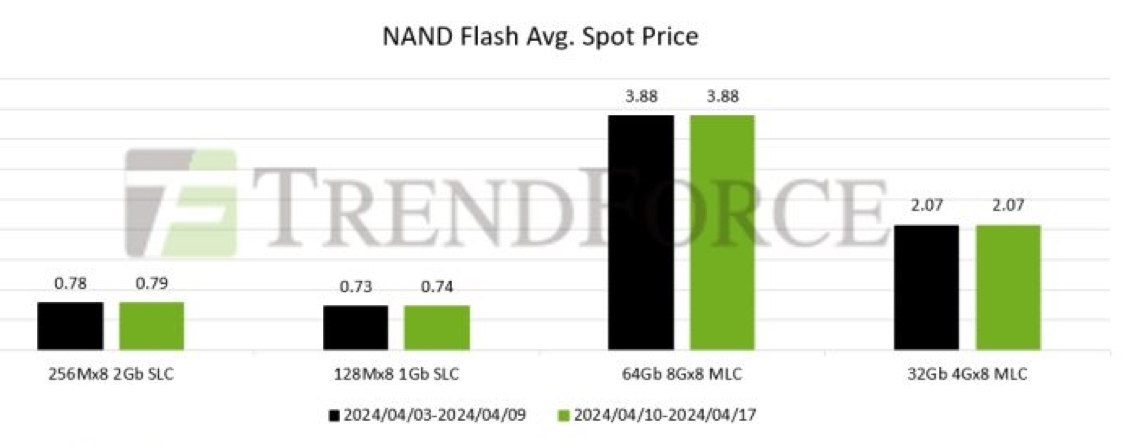

NAND Flash Spot Market:

Suppliers are carrying on with their increase of contract prices for the mainstream 512Gb wafers by more than $4, though inquiries have been sluggish as distributors are currently holding onto an excessive level of low-cost inventory, and that end market demand has also yet to resuscitate. A number of suppliers are truncating with prices that are slightly below that of contract prices for March, which are generating some sort of pricing pressure. Spot prices of 512Gb TLC wafers have risen by 0.03% this week, arriving at $3.765.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter