Comments on Western Digital Separating Into 2 Public Companies

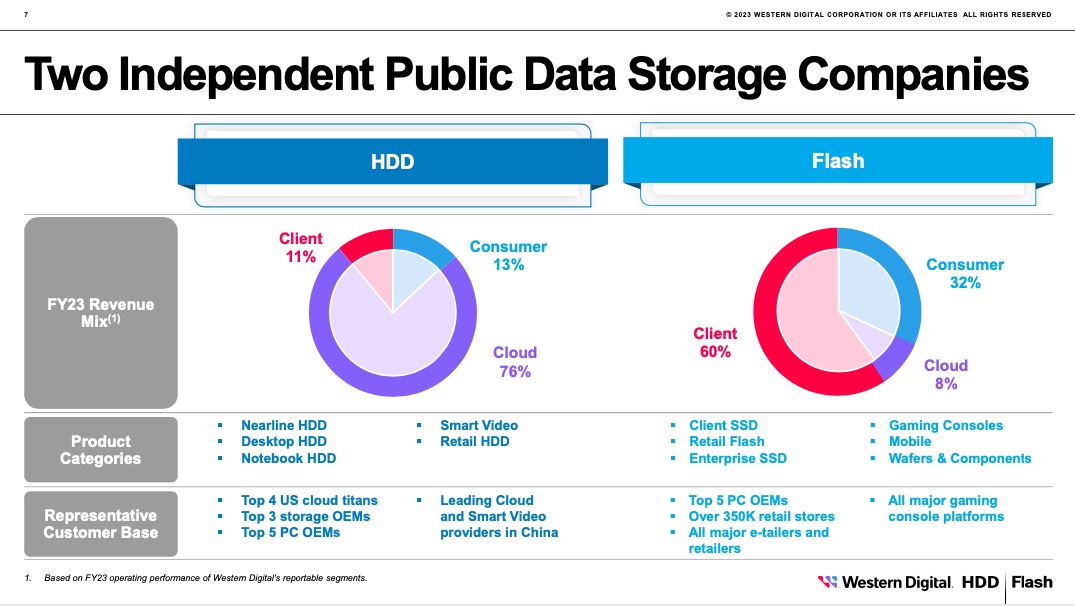

One for flash, one for HDD

By Philippe Nicolas | December 26, 2023 at 2:01 pmWestern Digital Corp. (WDC) is a long time player in storage with its HDD business. The management team understood some market shifts and chose to develop, partner and acquire some companies in software and flash/SSD domains to satisfy an ambitious time to market and valuation objective. There is also a clear visible erosion of the HDD business in favor of cloud and flash even if large capacity HDDs seem to find their spot.

Hitachi purchased at the end of 2002 for $2.05 billion the IBM HDD operations. Following this acquisition, it initiated the creation of HGST aka Hitachi Global Storage Technologies with full ownership at the end of 2005.

Among acquisitions, on the software side, HGST, a business entity acquired by WDC in 2012 for $4.8 billion, bought Amplidata object storage software in 2015 for $270 million. Some other software acquisitions were questionable like Arkeia, Schooner or UpThere.

Later in 2017, WDC swallowed Tegile to offer systems and platforms and extend its market footprint. It seems that the strategy changed as they sold these 2 for small amounts, Quantum picked Amplidata for just $2 million in 2020, a past OEM of the solution, and DDN got IntelliFlash for $28 million in 2019 to add it to its Tintri business line. At the same time the team recognized the growing SSD and flash pressure on its sales and decided to jump into that new category.

M&As

As we mentioned, a few mergers and acquisitions, a master word in the storage domain and especially in HDD and flash/SSD segments, we need to add other moves in that list.

WDC has made several acquisitions, probably 12 direct ones with Kazan Networks, STEC, Virident or Velobit and above all SanDisk effectively acquired in 2016 for $19 billion and as said HGST in 2012. These 2 bring to the company key advanced software and hardware technologies, among them Pliant, FlashSoft, M-Systems or Skyera. SanDisk was a pivot point for WDC to enter seriously into the flash market.

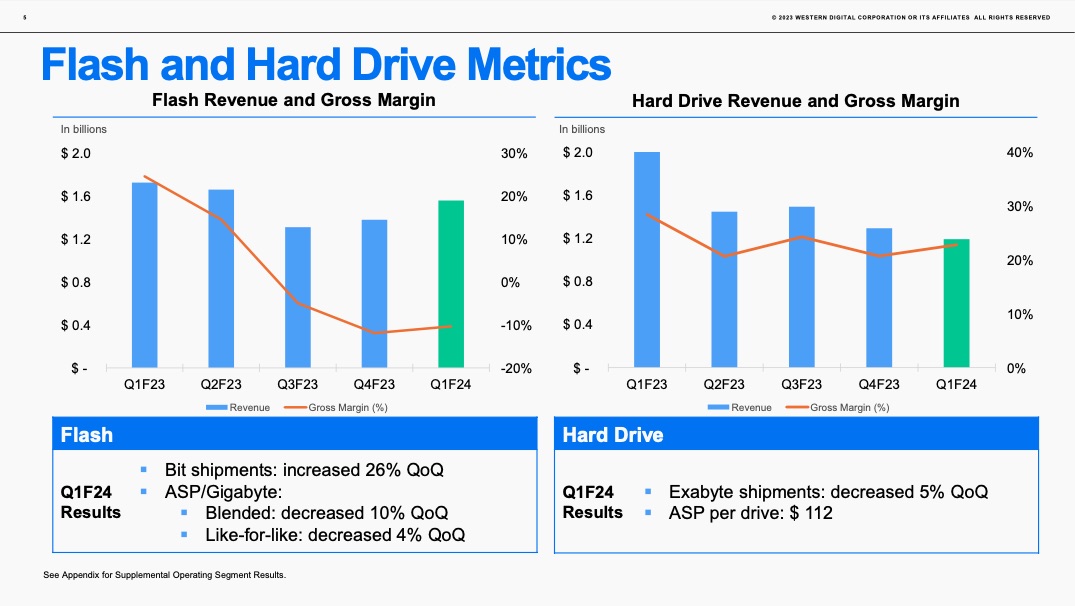

By 2015, the HDD industry was in decline and WDC had decided to make a big move to flash. The result was the acquisition of SanDisk effective in 2016.

As a result, today WDC is the only company operating both HDD and flash businesses and it seems to have an impact on their global revenue and valuation.

WDC products

Beyond internal and external disk, HDD or SSD, the firm has developed platforms and systems with the JBOF OpenFlex Data24 and the JBOD Data102 and cards with the RapidFlex for NVMe over Fabrics.

We have to mention that WDC is the only vendor offering head for LTO tape drives, this technology came from the HGST acquisition, and even before IBM.

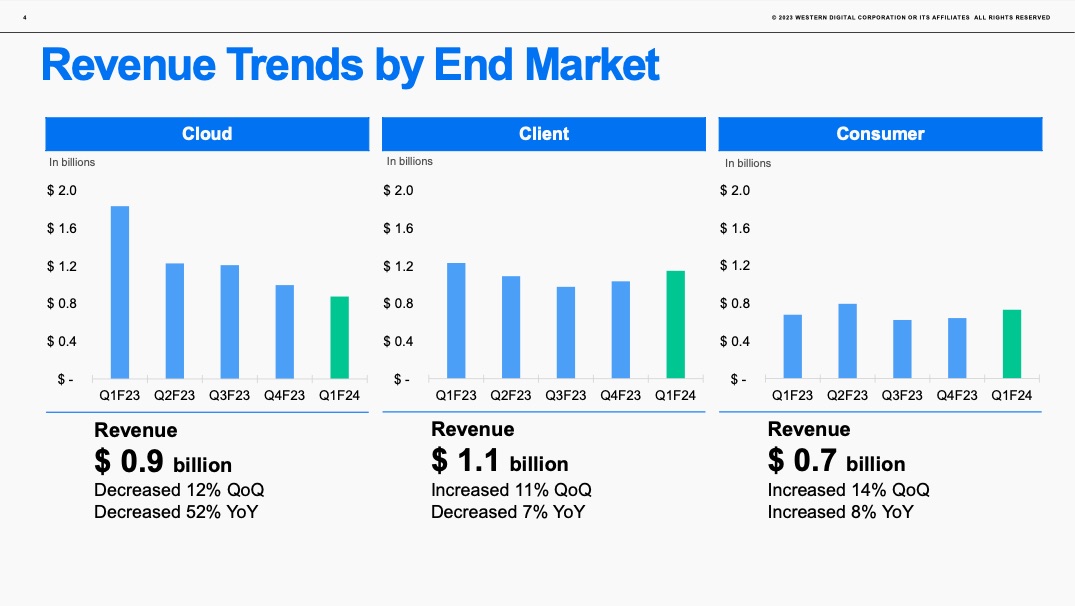

WDC revenue

WDC revenue continues to mark a negative curve representing $12.31 billion for FY23 with a big loss of $1.7 billion. The former fiscal year, the revenue was $18.79 billion with a net income of $1.5 billion and even before $16.92 billion with $821 million of net income. Today’s market cap is a bit above its last annual revenue for a value of $14.5 billion. We remember that the company has passed the $20 billion mark in revenue for FY17. Wow, what an erosion!

Background Kioxia-WDC

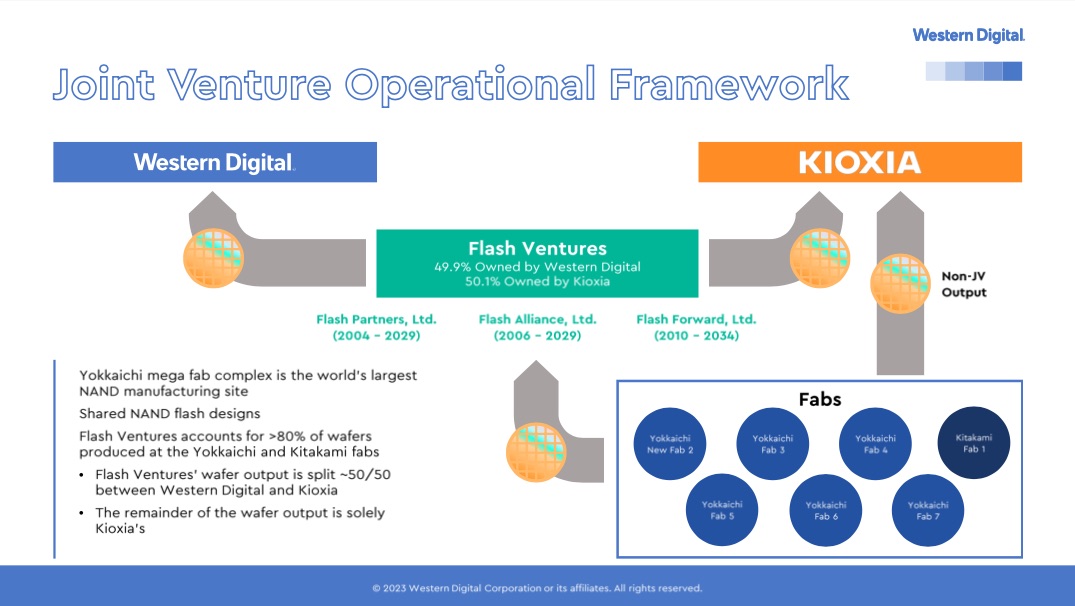

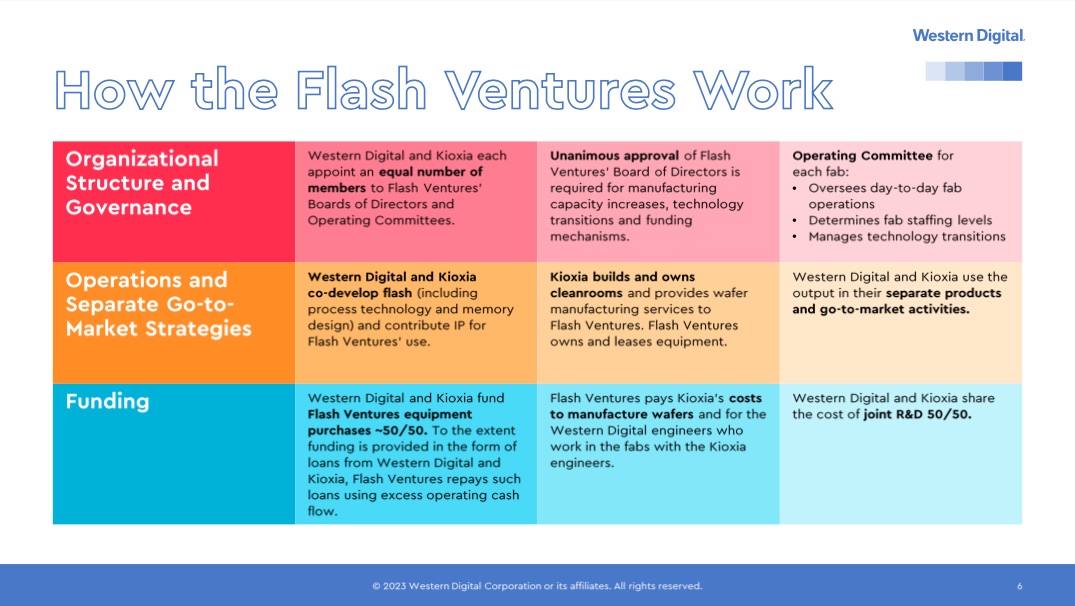

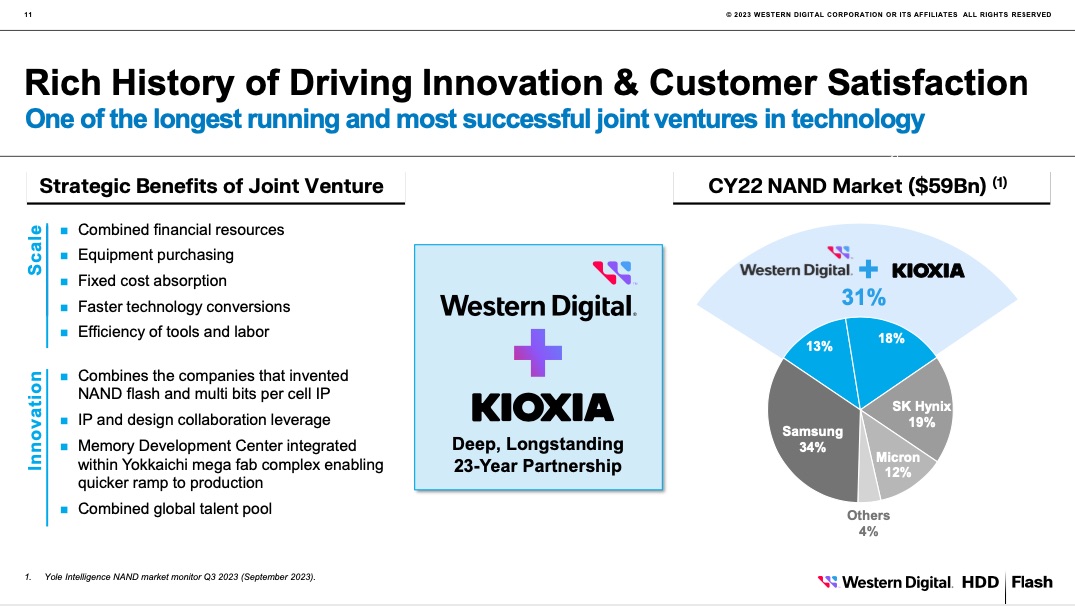

With Sandisk, WDC entered a strategic move to the flash world. At that time, Sandisk collaborated with Toshiba and, as of today, it represents 23 years of partnership with a commitment of 12 more years. With this flash venture, both companies add finance, IP, design effort in a shared fab in Yokkaichi in Japan. 49.9% of the association belongs to WDC and 50.1% to Kioxia today.

As a dual manufacturer in both SSD and HDD businesses, operations are challenging and create internal competition and lots of friction. Before we explain the company’s decision to split their business, let us come back to what Toshiba did a few years ago.

Toshiba and Intel paths

Toshiba, being in the same situation as WDC, decided to split their business in 2017 with the creation, first, of Toshiba Memory Corporation that became Toshiba Memory Holdings in 2019 then renamed Kioxia Holdings, an entity dedicated to flash and SSD. The HDD activity of Toshiba was kept in the original Toshiba part. And today, according to the Kioxia Holdings corporate page, Toshiba owns 40.64% of Kioxia, Bain Capital Private Equity 55.94% and Hoya Corporation 3.13%. The interesting aspect of it is that Seagate, the direct WDC competitor, joined the Bain Capital PE part to acquire 55% of Toshiba Memory Holdings in 2018 before the Kioxia renaming. Same remark with SK Hynix who ingested $3 billion in the $18 billion round led by Bain Capital in 2018 to acquire approximately half of Kioxia. With that, SK Hynix owns a right that could influence the deal and it was a clever move.

Intel decided to sell its SSD and NAND business to SK Hynix in October 2020. It was done in December 2021 and SK Hynix launched Solidigm. The deal is divided into 2 phases, $7 billion for the first phase and later in 2025 the remaining $2 billion to fully own the entity.

The split idea

Elliott Associates, L.P. and Elliott International, L.P., owning 6% of WDC with their $1 billion investment is one of the largest stakeholder, wrote a public letter to the board May 3, 2022.

For our listeners, Elliott started its flash investment in 2006 with Lexar, later acquired by Micron to finally be sold in 2017 to the Chinese Longsys company.

The letter argues the lack of performance operationally, financially and strategically and this situation impacts the valuation of the company. As the letter stated “It is important to emphasize that Western Digital’s underperformance long predates CEO David Goeckeler and his leadership team, nearly all of whom were hired in 2020 or later.“

Recognizing some difficulties, the management team made the important decision in September 2020 to separate the operations of HDD and flash into separate business units. WDC recruited Robert Soderbery to lead the flash entity as EVP and GM, spending some time at Cisco like Goeckeler.

Elliott believes in pure players and highly recommends a full separation of the flash business that can allow both HDD and flash to be more successful and unlock significant value. To support this, the investor is ready to offer $1 billion to accelerate the split.

They also extended their long standing flash joint ventures and they signed a contract in 2022 for a new NAND fab, named Fab7, again at Yokkaichi, Japan. The first phase of this site should produce 3D flash memory including 112 and 162 layers and future nodes. So synergy and convergence were in the pipe and existed for a long time.

In January 2023, Apollo Global Management, Inc. led the purchase of $900 million of convertible preferred stock of WDC, along with Elliott Investment Management L.P. and got one board seat.

As it appeared, WDC and Kioxia were in talks for quite a long time to couple the flash business activity of WDC with Kioxia to potentially represent a significant market share for NAND and SSDs.

The initial Kioxia-WDC deal failed due to financial challenges but also stakeholders’ negative positions like SK Hynix and even probably with some Seagate influence. These 2 companies would have been impacted by this deal.

The fact that SK Hynix holds an indirect stake at Kioxia is a major element in the current trajectory of the deal. It seems to operate like a poison pill and they anticipated this with a deal control token they took a long time ago.

As said, the WDC story is over and they didn’t have another choice to announce this split. The surprise came from the rapid news they issued with a ready to go plan B based on this famous long strategic exercise.

WDC will split the company into 2 entities Western Digital for its classic HDD business and the second entity, not named yet, around flash. This is very similar up to that point to what Toshiba did and explained before.

Flash market share

As a reminder, here are the market shares among the flash/NAND players. All market shares given here are subject to 1 or 2% difference depending on various analysts’ numbers but the order of magnitude is correct.

| Companies | Flash/NAND market share |

| Samsung | 34% |

| Kioxia | 19% |

| WDC | 14% |

| SK Hynix | 13% |

| Micron | 11% |

| Others | 9% |

Immediately it is translated as 75% of the market is covered by Asia and 25% from the USA. Clearly the USA has lost that battle, we should say war. Currently this market generates $59 billion with a projection to be $89 billion in 2025.

| Companies | Enterprise SSD market share |

| Sansung | 42% |

| Solidigm | 17% |

| Kioxia | 8% |

| SK Hynix | 6% |

| WDC | 5% |

| Others | 22% |

HDD market

This WDC story invites us to speak about the HDD market and the associated players. The segment is covered by 3 players: Seagate, Western Digital and Toshiba, two American companies and one Japanese.

| Companies | HDD market share 2022 |

| Seagate | 46% |

| WDC | 38% |

| Toshiba | 16% |

It confirms what we said for years that 80% of the HDD market is controlled by US companies. It is estimated that the HDD market will represent $25 billion in 2025.

For a few years, the HDD industry rebounded and went through a critical change: Demand for high-capacity HDDs (nearline) from hyperscale data centers and enterprise customers accelerated.

Market trend HDD vs. flash/SSD

WDC is working on high capacity HDDs, same for Seagate, currently it offers 26TB with the Ultrastar DC HC670 and we expect 40TB and even larger in the next few years. In terms of technology it means SMR, HAMR and dual actuator drives. The NVMe 2.0 spec introduced NVMe for HDD and it is supported by WDC promoting a convergence of interfaces.

But it is currently less than the capacity we can find for SSD on the market so HDDs lost the capacity battle. Soldigm announced last summer a 61.44TB SSD and others, like Pure Storage, delivers a proprietary flash card, their DFM, with 48TB, soon 75 and they expect a 300TB in 2 years.

With the adoption of SSDs for a vast variety of workloads, HDDs move to the secondary or nearline storage zone to essentially cover the data protection aspect with backup and archive needs.

Seagate

It’s difficult to avoid Seagate coverage when WDC is detailed as these companies are really intrinsically linked.

Seagate is legally an Irish company traded in Nasdaq under the STX ticker symbol. They focused essentially on HDD for their own production and partners for SSD and flash for instance with Phison for the last Nytro NVMe SSDs. The company has made tons of acquisitions, we wish to mention Conner Peripherals in 1995, Maxtor in 2005, Samsung HDD business in 2011, Xyratex for systems in 2013 and also tried some moves in the flash categories with LSI asset in 2014 or SandForce for SSD controllers also in 2014. The company has generated $7.4 billion in FY23 with a loss of more than $500 millions coming from $11.6 billion of revenue and benefits of $1.65 billion the year before. The market cap is around $14-15 billion, just the double of their last annual revenue.

Users

And for users, a key question remains open with various arguments in favor of HDDs and SSDs: why continue to use HDD when you can do the same things and even more with flash or SSD? Essentially users follow the economics with acquisition cost and TCO, capacity, performance and energy. For deep archives, tape still presents and delivers an attractive TCO so where can fit HDDs? We’ll probably see full flash data centers, flash plus tape and in both cases coupling them with cloud. But again where can fit HDDs?

Clearly HDD businesses became tough ones, WDC and Seagate will have tough times.

Future

What surprises us is the fact that WDC now follows a model we saw with Toshiba.

So at the end who will benefit from this new independent flash business? Will Micron, SK Hynix or Kioxia acquire this new entity to confirm its market share position?

First, Micron is not in a position to acquire that business.

Second, around 2025, SK Hynix will fully own Solidigm that should represent 23% of the enterprise SSD market based on today’s numbers and more than 15% for flash/NAND. Understanding the strong link between Kioxia and WDC, SK Hynix has made this Intel’s move.

Third, the only serious option still is Kioxia to also become the ≠2 with potentially 33% of market share for NAND and around 15% for enterprise SSD. But this deal will probably happen in a second phase when this split will be effective. Again, with the 23 years of deep and close collaboration between Kioxia and WDC, we don’t see how this merger could not occur.

And we don’t see others, like Broadcom, currently in the VMware integration aspects, or others joining the party.

And at the end, it would confirm once again that flash is owned and controlled by Asia with, in that case, 85% of the market.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter