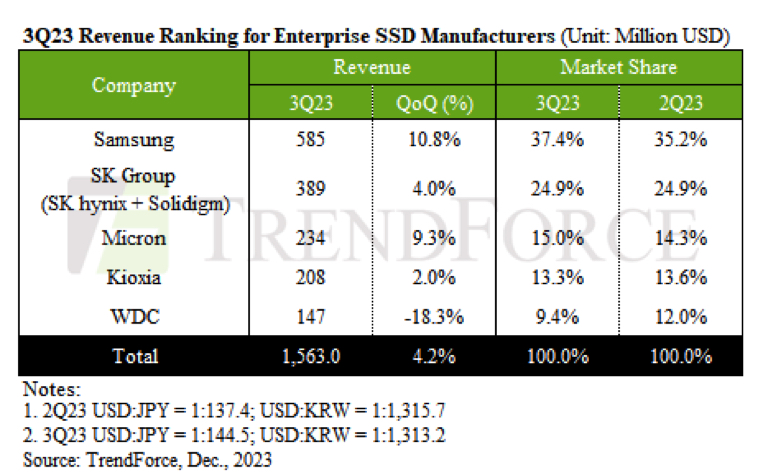

Enterprise SSD Revenue Grows by 4.2% Q/Q at $1.56 Billion in 3Q23, Over 20% Increase Expected in 4Q24

Samsung largely leader, as usual

This is a Press Release edited by StorageNewsletter.com on December 18, 2023 at 2:02 pm![]() This market report, edited on December 8, 2023, was written by Bryan Ao, research staff member at TrendForce Corp.

This market report, edited on December 8, 2023, was written by Bryan Ao, research staff member at TrendForce Corp.

Enterprise SSD Revenue Grows by 4.2% in 3Q23,

with Over 20% Increase Expected in 4Q23

With the ongoing reduction of inventories by CSPs, there has been an uptick in enterprise SSD purchases by server OEMs in 4Q23. Despite experiencing a Y/Y decrease in total NAND flash purchase bits, there are indications of a quarterly recovery.

This trend is particularly evident in Chinese e-commerce sectors, where businesses are replenishing inventories for year-end promotional events. Overall, while enterprise SSD contract prices continued their downward trajectory in 3Q23, a surge in global purchasing demand by 10% has elevated its revenue to $1.56 billion, marking a 4.2% Q/Q increase.

A rebound in quarterly contract prices is anticipated in 4Q23 as suppliers expand their production cuts. Concurrently, an influx of rush orders from server clients – coupled with tight supply and rising prices – suggests a potential Q/Q revenue increase of over 20% for enterprise SSDs.

Samsung’s enterprise SSD revenue grew to $590 million in 3Q23, a 10.8% increase from 2Q23. This growth marked a return to positive territory after 4 consecutive quarters of decline, primarily due to a decrease in generic server shipments.

SK Group (SK hynix and Solidigm) benefited from increased shipments to key clients, achieving $389 million in enterprise SSD revenue for 3Q23, a 4% quarterly increase. However, QLC enterprise SSD shipments did not show significant growth this quarter, while TLC PCIe products saw an uptick as client inventory adjustments concluded. It’s important to note that even though the US recently relaxed restrictions on South Korean manufacturers upgrading their equipment in China, the actual benefit to Solidigm’s Dalian factory is limited as the factory’s floating gate technology was already planned to cap at 192 layers. In the future, SK Group plans to focus more on CSP client validation, expecting intense competition in the North American CSP supply market.

Micron also benefited from an uptick in server OEM orders in 2H23, leading to a 9.3% increase in enterprise SSD revenue to $230 million in 3Q23. Meanwhile, shipments of PCIe 4.0 products are expected to increase in tandem with client validations. The report notes that Micron’s strategic focus on PCIe SSDs in recent years is now paying off, allowing the company to continue increasing its market share even amid subdued enterprise SSD demand. The firm is expected to leverage its cost advantage in higher-layer NAND flash and the availability of HBM products to expand collaboration with CSPs and increase enterprise SSD shipments.

Stable demand for PCIe 4.0 products and an increased need for SAS products due to server brand orders have helped push Kioxia’s enterprise SSD revenue to $210 million in 3Q23, a 2% Q/Q increase. The company is expected to further expand its market share as the PCIe penetration rate gradually climbs in 2024. However, as other enterprise SSD suppliers shift to technologies above 176 layers, its continued use of 112-layer technology presents challenges in increasing supply flexibility and optimizing profitability.

WDC’s enterprise SSD sales were primarily focused on North American CSP clients, who generally maintained conservative purchasing strategies, leading to a continued decline in overall purchases in 3Q23. In a market where both prices and quantities are dropping, revenue fell to $150 million in 3Q23, an 18.3% Q/Q decrease. As the company undergoes corporate restructuring, facing limitations in R&D resources, it is anticipated that the production timeline for PCIe 5.0 enterprise SSDs will be shortened. This constraint could result in revenue growth falling behind that of other suppliers in subsequent periods.

Overall, the slowdown in economic growth this year has led to a contraction in corporate spending, impacting the decline in enterprise SSD purchasing demand. With an expected gradual recovery in server shipments in 2024 and a decrease in circulating spot inventory in the market, enterprise SSD orders are poised to see Q/Q growth. The adoption rate of PCIe 5.0 products will increase alongside new platform rollouts. Samsung is anticipated to lead in revenue performance growth among suppliers as the 1st to mass-produce this interface.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter