HPE: Fiscal 4Q23 Financial Results

HPE: Fiscal 4Q23 Financial Results

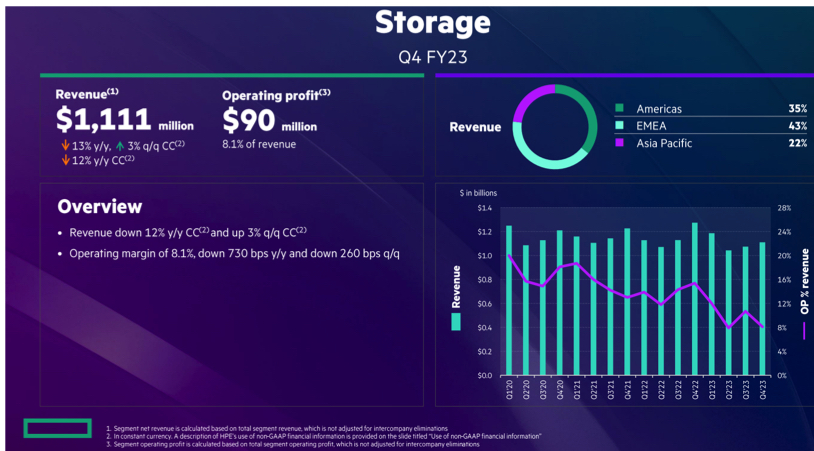

Storage revenue down 13% Y/Y for 1FQ23 and 4% for FY23

By Jean Jacques Maleval | November 29, 2023 at 2:01 pmFor storage only

| (in $ million) | 4Q22 | 4Q23 | FY22 | FY23 |

| Revenue | 1,274 | 1,111 | 4,613 | 4,415 |

| Growth | -13% | -4% | ||

| Earnings before taxes | 196 | 90 | 641 | 429 |

Hewlett Packard Enterprise Company announced financial results for the fourth quarter and full year ended October 31, 2023.

Global revenue reached $29.1 billion for FY23, up 2% and 5.5% in constant currency from the prior-year period, and $7.4 billion for 4FQ23, down 7% from the prior-year period and 6% in constant currency.

Click to enlarge

Storage revenue was $1.1 billion in 4FQ23, down 13% from the prior year period in actual dollars and 12% in constant currency, with 8.1% operating profit margin, compared to 15.4% from the prior-year period.

Storage revenue is down 13% Y/Y, but rose 3% Q/Q. Storage demand has now been flat to up for 3 straight quarters. HPE Electra revenue grew over 50% Y/Y and it will remain a robust growth contributor in FY24, supported by growth in file and object storage.

Electra is shifting company’s mix within storage to higher-margin software subscription revenue, which is a key driver of firm’s ARR growth. 4FQ23 storage operating margin of 8.1% was down 730 basis points Y/Y. Headwinds included the deferred revenue impact of the HP Electro subscription software, accelerated investment outpacing Y/Y revenue performance and a high mix of 3rd-party products this quarter.

Investments in product portfolio give the company confidence storage will make progress through FY24 toward its long-term operating profit margin target communicated at SAM 2023 of mid-teens.

“The overall storage market has been sluggish this year,” stated HPE. “And on our – even our uneven performance in this segment is in line with most of our peers. However, we are encouraged with 3 quarters of stable demand. We saw sequential improvement in storage revenue in 4FQ23.”

The company continues to invest in its sales execution capabilities. It recently deployed a large specialized store sales force, including a team devoted to growing our storage IP product mix. It expects its subscription-based offerings and differentiated IP problems like Electra will continue to be sources of strong growth to enhance the profitability of this business in the year ahead. It remain focused on advancing its position in hybrid cloud. It ended the year with 29,000 customers on GreenLake cloud platform.

Revenue for HPE storage since FY17

(in $ million)

| Fiscal quarter |

Revenue |

Q/Q growth |

Y/Y growth |

| FY17 | 3,280 | 3% |

|

| FY18 |

3,706 |

13% | |

| FY19 |

3,609 | -3% | |

| FY20 | 4,681 | -10% | |

| FY21 | 4,763 | 2% | |

| 1FQ22 | 1,156 | -8% | |

| 2FQ22 | 1,098 | -3% |

|

| 3FQ22 | 1,152 | 5% |

|

| 4FQ22 | 1,305 | 4% |

|

| FY22 | 4,711 | -1% | |

| 1FQ23 | 1,187 | 5% |

|

| 2FQ23 | 1,043 | -11% | |

| 3FQ23 | 1,074 | 3% |

|

| 4FQ23 | 1,111 | -13% |

|

| FY23 | 4,415 | -4% |

Effective at the beginning of 1FQ23, the company implemented certain organizational changes to align its segment financial reporting more closely with its current business structure. This resulted in the transfer of certain storage networking products, previously reported within the storage reportable segment, to the compute reportable segment. The firm reflected these changes to its segment information retrospectively to the earliest period presented, which primarily resulted in the transfer of net revenue and operating profit for each of the businesses as described above. These changes had no impact on the previously reported consolidated results.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter