Kioxia: Fiscal 2Q23 Financial Results

Kioxia: Fiscal 2Q23 Financial Results

Revenue and shipments decreased Q/Q.

By Jean Jacques Maleval | November 29, 2023 at 2:01 pm| (in ¥ billion) | 1Q23 | 2Q23 |

| Revenue | 251.1 | 241.4 |

| Growth | -10% | |

| Net income (loss) | (103.1) | (86.0) |

Kioxia Holdings Corporation, being hold at 40.64% by Toshiba Corporation, announced the financial results of its 2rd quarter of FY23 ending September 30, 2023.

Revenue decreased Q/Q as shipments decreased.

Operating profit (loss) improved due to ASP increase, benefiting from improved supply demand, a weaker yen, and shipment mix.

ASP on US dollar basis rose by low single digit percentage in 2FQ23.

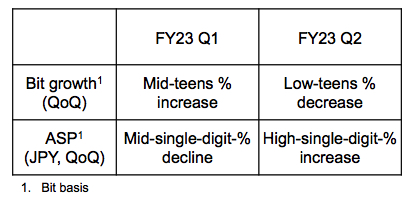

Recent sales trend

Industry/market trends and outlook

. The supply demand balance continues to improve and selling prices have bottomed out, as production adjustments by flash memory manufacturers impact overall supply and customer inventory normalizes.

. Demand for PCs and smartphones is expected to continue recovery drive by the normalization of customer inventories and the memory groth in PCs and smartphones backed by price elasticity. PCs and smartphones shipments are expected to increase in 2024.

. Demand for data center and enterprise SSDs is expected to recover after 1H24, due to weak enterprise IT spending caused by macroeconomic uncertainties and weak demand for general-purpose servers.

. Industry experts remain confident in the growth potential of the flash memory market and the underlying demand drivers in the long term horizon.

. Kioxia will continue production adjustments in line with market conditions and manage operating expenses, while reducing manufacturing costs, reviewing R&D and products development portfolios and accelerating development of focus products to ensure profitability regardless of market conditions.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter