WW SSD Shipments Down 10.7% Y/Y to 114 Million Units in 2022

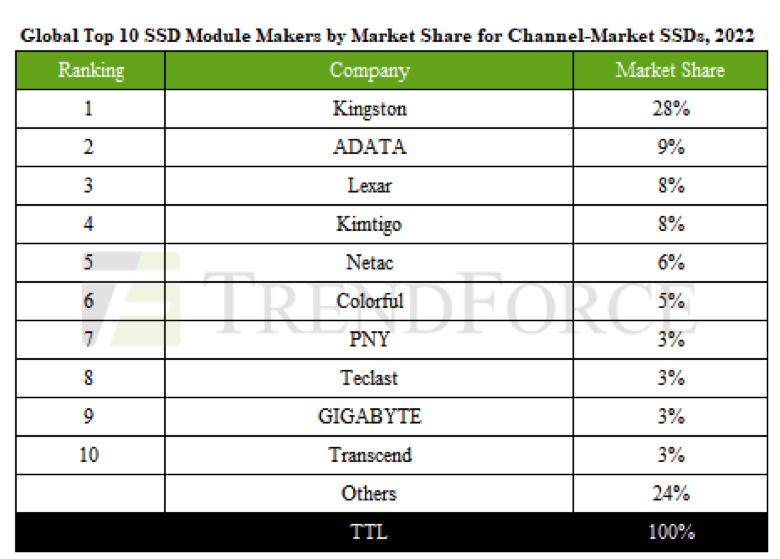

Kingston largely leader (28% market share), in front of Adata (9%), Lexar (8%) and Kimtingo (8%)

This is a Press Release edited by StorageNewsletter.com on November 20, 2023 at 2:03 pm This market report, published on November 7, 2023, was written by Bryan Ao, research staff member at TrendForce Corp.

This market report, published on November 7, 2023, was written by Bryan Ao, research staff member at TrendForce Corp.

Global SSD Shipments Down 10.7% Y/Y to 114 Million Units in 2022

The global SSD market has rectified its supply and demand dynamics in 2022, following a resolution in the shortage of master control ICs that had hampered the market in 2021. Despite the normalization of supply, global SSD shipments witnessed a decline, with only 114 million units shipped in 2022, a 10.7% decrease from the prior year.

The top 3 SSD shipment leaders of 2022 were Kingston, Adata, and Lexar, with Kingston and Adata maintaining solid advantages and experiencing growth in market share over 2021.

Lexar’s growth was attributed to an aggressive push for revenue in anticipation of going public.

Kimtigo, in 2022, made significant strides in expanding into industrial control and OEM markets, which in turn boosted its shipment volume and market share.

Netac maintained its competitive edge in the SSD market alongside securing several government orders in the enterprise SSD sector, keeping its market share and ranking consistent with the previous year.

Notable changes were seen further down the rankings.

Colorful, leveraging cost advantages from China’s homegrown master controls and NAND Flash, defied market trends with increased shipments, climbing to the 6th spot.

PNY re-entered the top 10, withstanding market downturns through extensive international channel development.

Teclast held its market share consistent with 2021, rising to the 8th position.

Gigabyte benefited from the gaming market, maintaining its 9th-place shipment market share and ranking, while lastly, Transcend held the 10th position, focusing on maintaining profitable niche products in the industrial control market rather than chasing higher shipment volumes.

In 2022, top 5 SSD channels held nearly 60% market share and will only continue to dominate

In 2022, despite market challenges, the top 5 SSD brands increased their combined market share from 53% to 59%.

With the global economy still struggling in 2023 – and despite constrained notebook and desktop shipments—module makers have been gradually reducing high-cost inventory pressures through continuous purchase smoothing, positioning themselves favorably for price-competitive shipping. Furthermore, the overall market sentiment saw a swift turnaround at the end of 3CQ23 due to aggressive production cuts by NAND Flash suppliers, with SSDs first reflecting cost increases, benefiting those module makers with lower-cost inventories. Large-scale SSD channels that possess substantial market volumes and financial resources have been able to successfully navigate market ups and downs and seize market opportunities. These large SSD firms will only continue to grow bigger in the years to come.

Domestic Chinese PCle master controller technology and SSD brands rapidly catching up

In terms of technology, Chinese homegrown PCIe master control entities, such as Maxio Technology, are rapidly catching up, with increasingly mature PCIe control technologies. They not only mass-ship mainstream PCIe 4.0 products compatible with various NAND flash suppliers but are also aggressively advancing into PCIe 5.0 product development and verification. The collaboration between China’s independent control ICs and module makers is expected to thrive. Facing a volatile market in recent years, Chinese homegrown SSD channels are also actively advancing supply chain configurations, aiming to step beyond China and into international waters, with Longsys leading the charge by acquiring shares in Licheng Suzhou and Smart Modular in Brazil to strengthen downstream module production capacity.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter