CXL Technology Unlocks Memory Performance

Market expected to grow to $15 billion by 2028, key players Astera Labs, Montage and Microchip

This is a Press Release edited by StorageNewsletter.com on October 11, 2023 at 2:02 pmThis report, published on October 10, 2023, was written by Yole Group.

CXL technology unlocks memory performance

CXL (Compute Express Link) solutions could transform today’s server memory challenges into a sizable $15 billion opportunity by 2028.

Outline

- The CXL solution is in its very early stages of deployment.

- Total CXL market revenue is expected to grow to more than $15 billion by 2028, DRAM will constitute most of the CXL market revenue, with more than $12 billion market revenue by 2028. However, this depends on an effective roadmap execution.

- Future business strategies are already profiling. Key players are Astera Labs, Montage, and Microchip.

- High-performance, cost-attractive CXL memory expander controllers and CXL switches will be key for the mass adoption of CXL in the datacenter space.

Datacenter workloads are becoming increasingly complex, requiring more and more computational power and memory to manipulate ever-growing amounts of data. Memory is a very expensive resource, averaging around 30% of the server value in 2022 and forecasted to reach over 40% by 2025. To tackle such issues, novel memory-processor interfaces have been proposed, with the aim of optimizing the use of resources and accelerating the execution of datacenter workloads. In this dynamic context, CXL has prevailed and is garnering broad support from the industry.

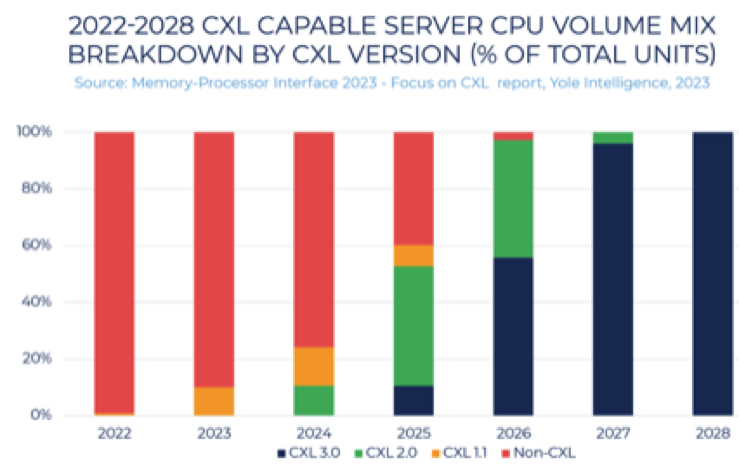

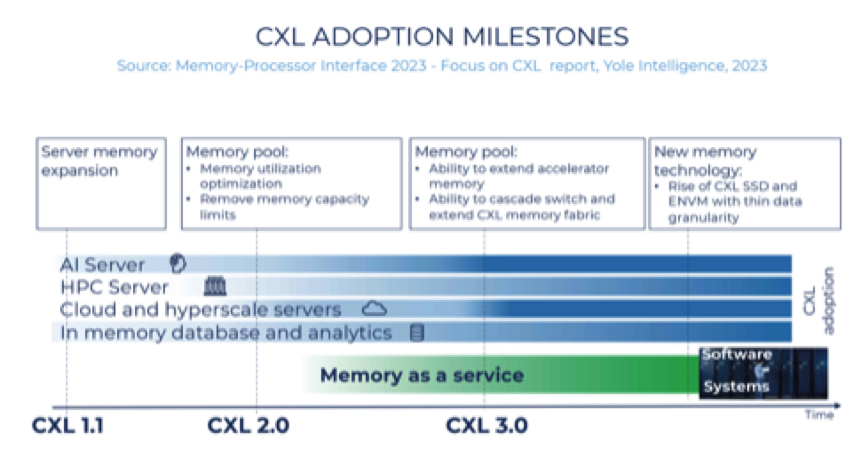

Servers are currently grappling with memory performance challenges, and CXL deployment offers short- and long-term solutions. AI cloud servers, starting from CXL 1.1, can benefit from memory expansion, while CXL 3.0 has the potential to grant accelerators such as GPUs, DPUs, FPGAs, and ASICs direct access to memory pools. Cloud service providers and hyperscalers are anticipated to express significant interest in memory pooling, initiated by CXL 2.0 and composable servers with CXL 3.0. Meanwhile, database servers will harness the capability to run larger in-memory databases for quicker analytics.

Notably, Astera Labs, Microchip, and Montage presently offer CXL expander controller chips, while CXL switches are being considered by numerous players including Enfabrica, Panmnesia, and Elastics.cloud, typically as embedded blocks within more complex chips. Conversely, the supplier Xconn intends to provide stand-alone CXL switch chips. CXL has the potential to revolutionize memory utilization, management, and access, ushering in a new era of disaggregation and composability akin to the storage paradigm shift of the 90s and potentially spawning an industry focused on CXL memory fabric software, systems, and services.

In this context, Yole Intelligence, a Yole Group company, has released its new memory report, Memory-Processor Interface 2023: Focus on CXL. In this report, its memory team provides a detailed technology and market analysis of the new CXL interface, focusing on memory devices and the related chipset.

The team delivers an in-depth analysis of the memory technology that is expected to leverage the CXL interface and its markets, and presents the CXL memory controllers and the CXL switches. In addition, they offer accurate, detailed market forecasts for CXL memory and CXL compatible ICs. Also in this report, memory experts describe the CXL ecosystem and players’ dynamics for memory technology.

CXL operates atop the PCIe physical layer, with current CXL 1.1 (PCIe 5.0) enabling direct memory expander attachment. CXL 2.0 (PCIe 5.0) will introduce CXL switches, expanding memory pooling capabilities.

Meanwhile, CXL 3.0, leveraging PCIe 6.0, will enable cascading switches and peer-to-peer connections, facilitating full server disaggregation and composability. The CXL standard encompasses three protocols (CXL.io, CXL.cache, and CXL.mem), enabling 3 distinct CXL device types. This report focuses on type-3 devices centered around memory expansion.

CXL, though media-agnostic, is expected to be primarily sought for memory expansion and pooling, predominantly utilizing DRAM memory expanders. These expanders can take the form of add-in cards equipped with DRAM DIMMs, or drives (EDSFF form factors) with embedded DRAM. Drives are poised to gradually supplant add-in cards due to their optimized form factors, compatibility with server chassis standards (critical for cooling), and ease of handling. Finding the right balance between cost and capacity will be pivotal in determining when CXL drives will outpace add-in cards.

When it comes to the price of CXL memory expander controllers, their complexity is expected to result in costs exceeding $60 in 2023 due to the emerging market and advanced manufacturing nodes. CXL switches, with their substantial lane configuration (x256 lanes) and reliance on aggressive technology nodes (such as 16nm FinFET for initial prototypes), are anticipated to be even more expensive. However, pricing for both CXL controllers and switches is projected to normalize as CXL gains widespread deployment.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter