History 2003: WW Disk Storage Systems Grew 12% Q/Q in 4Q02

HP and IBM statistically tied for ≠1 position, each with 25% revenue share

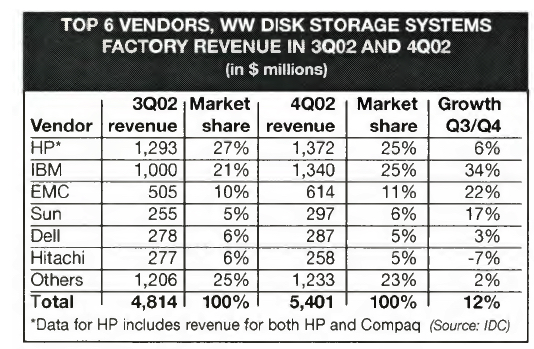

By Jean Jacques Maleval | November 2, 2023 at 2:00 pmWW disk storage systems factory revenue was $5.4 billion in 4Q02, up 12% compared with 3Q02, according to IDC.

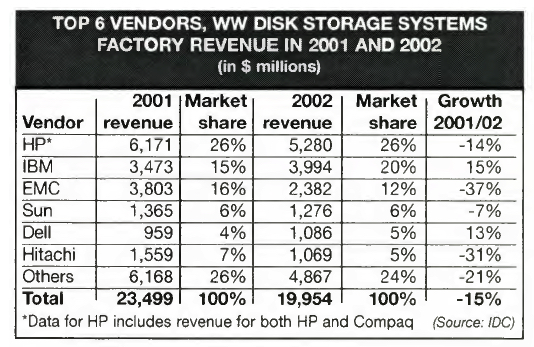

With the strong sequential growth, full year 2002 revenue was better than expected, declining only 15% compared to 2001 vs. a forecasted decline of 21%.

“The 4Q02 results were similar to what we have seen in the server market,” said John McArthur, group VP of storage research at IDC. “We expect to see a return to more normal seasonal changes as companies have already made their major adjustments to storage spending.”

In this highly consolidated market, competition continued to be fierce during the quarter, resulting in several statistical ties. In 4Q02, HP and IBM statistically tied for the ≠1 position, each with 25% revenue share. In addition, there was a 3-way statistical tie for ≠4 position between Sun, Dell and Hitachi, although Sun posted the strongest growth among the 3 with 17% sequential growth from 3Q02.

In the total external storage system market, revenue increased 12% sequentially in 4Q02. HP maintained its ≠1 position with 21% revenue market share. IBM and EMC, tied for ≠2, each with 17% revenue share.

There was a similar scenario in the total external RAID market, where HP and EMC tied for the ≠1 position, each with 19% of the revenue share.

“In 2003, vendors will continue to bring to market more compelling business and product strategies, including the introduction of new components and storage network technologies,” said Charlotte Rancourt, research director in IDC’s disk storage systems program. “As a consequence, we expect to see further fluctuation in vendor market share in 2003.”

The open SAN market outperformed the overall market, with 14% sequential growth from 3Q02.

The NAS market was weaker, but continues to be healthy, with 4% sequential growth. In the open SAN market, HP led with 28% revenue share followed by EMC with 26%. In the NAS market, NetApp maintained its leadership with 36% share followed by EMC with 33%. EMC continues to maintain its first position in the total network storage market (NAS combined with open SAN) with 28% revenue share. For the full year, HP (reported as the combined entity of Compaq and HP from 2002 going forward) edged out IBM for the ≠1 position with 21% revenue share for the total disk storage systems market. IBM and Dell posted the largest Y/Y growth among the top 5 vendors, with 15% and 13% respectively.

This article is an abstract of news published on issue 183 on April 2003 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter