AFA Market to Grow at CAGR of 25% Between 2022 and 2027

Forecasted to increase by $31 billion

This is a Press Release edited by StorageNewsletter.com on September 26, 2023 at 2:02 pmThe All-Flash Array (AFA) market size is estimated by Technavio in its report ($2.500, 168 pages) to grow at a CAGR of 24.57% between 2022 and 2027. The market size is forecast to increase by $31,027.13 million.

The growth of the market depends on several factors, including the growing enterprise storage market, increasing adoption of SSDs in laptops and gaming and high-end PCs, and increasing demand for AFAs in enterprise applications. An AFA is a storage infrastructure that contains only flash memory drives instead of spinning HDDs. All-flash storage is also referred to as a Solid-State Array (SSA). AFAs and SSAs offer speed, performance, and agility for different business applications.

This AFA market report covers market segmentation by type ((SSD and custom flash modules (CFM)), end-user (enterprises, HDCS, and CSPs), and geography (North America, APAC, Europe, South America, and Middle East and Africa). It also includes an analysis of drivers, trends, and challenges. Furthermore, the report includes historic market data from 2017 to 2021.

AFA Market Overview

Driver

One of the key factors driving the AFA market growth is the increasing adoption of SSDs in laptops and gaming and high-end PCs. There is increasing adoption of SSDs by laptop manufacturers due to their several benefits such as faster booting, faster processing speed, low power consumption, and small size, as well as the growing demand for thin and compact laptops. Additionally, the growing demand for optimized and power-efficient laptops is also contributing to the market growth.

For example, in August 2021, Micron Technology, Inc. launched Crucial P5 Plus PCIe SSDs as an expansion of its NVMe SSD portfolio to offer high-performance internal Gen4 storage options to end-users. Therefore, the several advantages offered by the SSDs such as fast boot-ups, faster processing speed, low power consumption, and small size will positively impact the AFA market growth. Hence, such factors are expected to drive market growth during the forecast period.

Trends

A key factor shaping the AFA market growth is the increasing demand for high-performance storage solutions. There is an increasing demand for high-performance storage systems to handle big data and analytics applications which is positively impacting AFA market growth. The main advantage of enterprise flash storage when compared to conventional storage systems in terms of performance is that it enables rapid data access, retrieval, and analysis.

Furthermore, there is an increasing adoption of flash storage across several enterprises as it is ideal for managing significant amounts of data in real-time due to its high IO/s) and low latency. In addition, the efficiency of big data processing is increased fueled by the capacity of the flash storage system to manage multiple workloads at the same time and offer stable performance. Hence, such factors are expected to drive market growth during the forecast period.

Restrain

Issues related to the reliability of AFAs are one of the key challenges hindering the AFA market growth. The main drawback associated with flash storage is that it has limited write cycles. Additionally, high electric fields are applied to the tunnel oxide during each P/E cycle which increases stress. Tunnel oxide can be referred to as a thin oxide that leads to other effects, including erratic bits and over-program must also generate the most effective algorithm to develop a successful and reliable technology.

Furthermore, the main factor which determines the reliability of flash storage is the number of P/E cycles it can withstand before failure and the capacity of the memory to store the requisite information when external power is not applied. Additionally, as flash storage is susceptible to power failure, it leads to corrupt data or results in their failure. Hence, such factors can hinder the market growth during the forecast period.

AFA market segmentation by type

The SSD segment is estimated to witness significant growth during the forecast period. An SSD can be referred to as a SSD or an electronic disk that is used for storage and is manufactured using semiconductors. The main similarity of SSDs with HDDs is that it uses the same I/O interface design and store data in solid-state memory. These SSDs are mainly manufactured from silicon microchips and store data electronically.

The SSD segment was the largest segment and was valued at $3,752.83 million in 2017.

The main advantage of SSDs when compared to HDDs is that they use spinning disks to read and write data and have no moving parts, which makes them faster, more reliable, and less prone to failure. Additionally, this segment generates minimal heat when compared to HDDs and is also more energy-efficient. Some of the main form factors in which SSDs are available include 2.5-inch, M.2, and U.2. These are widely used in laptops, desktops, servers, and other electronic devices. Some of the main benefits of SSDs include proper and faster functioning, durability, portability, and easy installation. Hence, such factors are expected to fuel the growth of this segment which in turn will drive the market growth during the forecast period.

AFA market segmentation by end-user

The increasing adoption of AFA across enterprise segments due to their high performance increases market growth. Some of the main factors for the increasing adoption of AFAs across several organizations, non-profit organizations, and governmental organizations include high-performance autonomous operation, predictive analytics, real-time analytics, and application-level management and operation of enterprises. There is an increasing preference for AFAs with the highest performance, lowest cost, and customized features across enterprises which contributes to the growth of this segment. Hence, such factors will fuel the growth of this segment which in turn will drive the market growth during the forecast period.

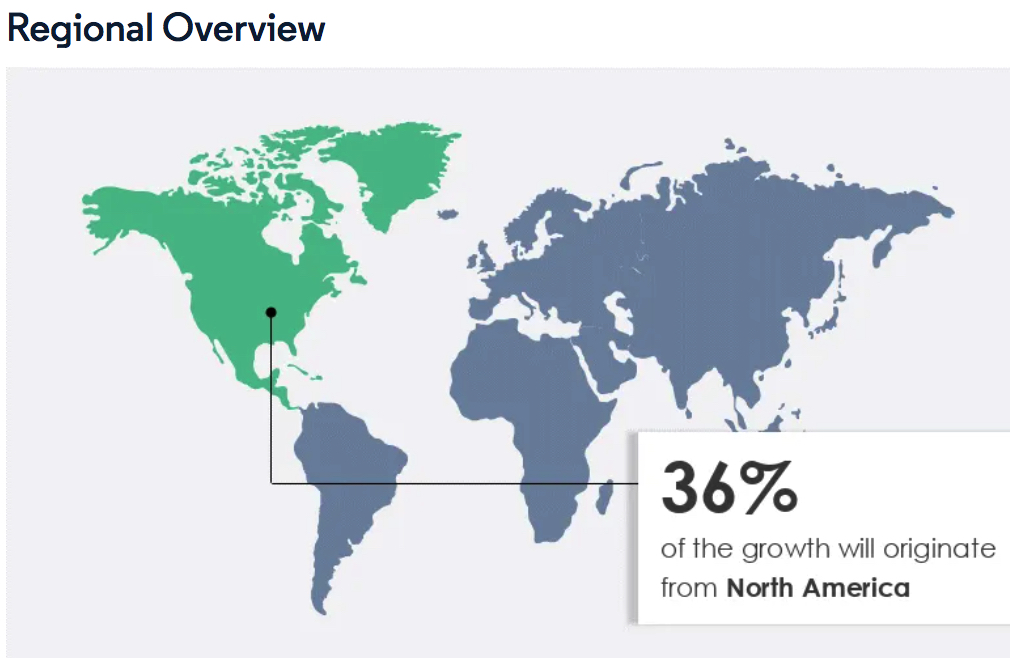

Regional overview

North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. As North America is an early adopter of new and advanced technology, the AFA market in the region is mostly mature. One of the main countries which is significantly contributing to the growth of the AFA market in North America is the US due to the presence of several data centers in the country.

Additionally, there is a higher adoption of containerized data centers in North America which is positively impacting the AFA market growth in the region. Furthermore, there is an increasing preference for energy-efficient IT infrastructure across organizations in North America which is expected to drive market growth in the region during the forecast period.

In 2020, during the Covid pandemic, the growth of the AFA market witnessed a significant slowdown due to the halt in economic activities such as manufacturing, construction, and trading, resulting in a decline in the demand for new PCs and laptops in workplaces. In North America, however, in 2021, the initiation of large-scale vaccination drives lifted the lockdown and travel restrictions, which led to the restoration of operations in several industries. Such factors are expected to drive the market during the forecast period.

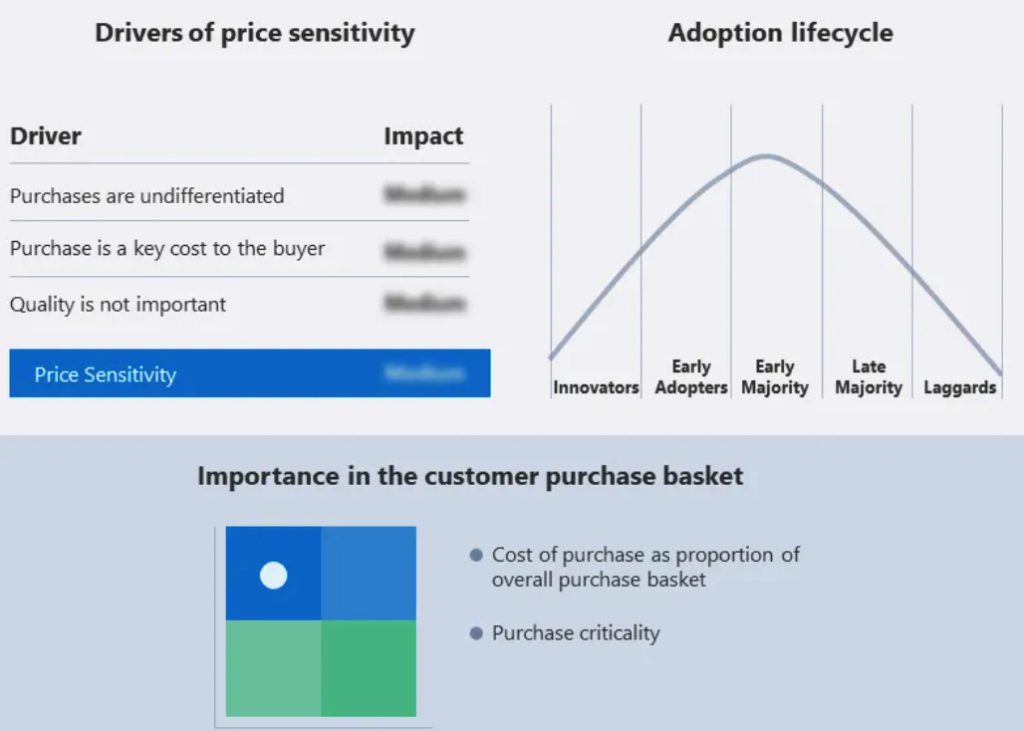

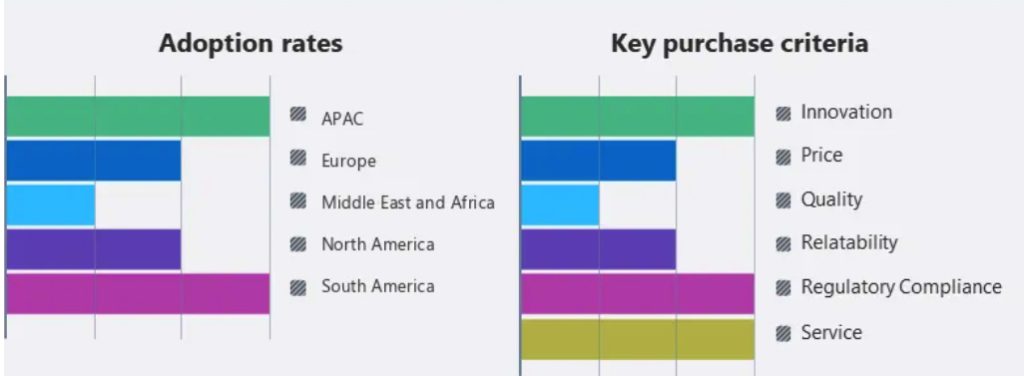

AFA market customer landscape

The AFA market industry report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Who are the major AFA companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Dell Technologies Inc.: The company offers AFAs such as Dell PowerMax NVMe, Dell PowerStore, and Dell EMC Unity XT.

- Furukawa Electric Co. Ltd: The company offers AFA under the brand Fujitsu Ltd.

- Hewlett Packard Enterprise Co: The company offers AFA array such as Nimble Storage AFA, Primera, and 3PAR StoreServ.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

CMS Distribution

DataDirect Networks Inc.

Hitachi Ltd.

Huawei Technologies Co. Ltd.

International Business Machines Corp.

ionir, inc.

Lenovo Group Ltd.

MacroSAN Technology Co. Ltd.

Micron Technology, Inc.

NetApp Inc.

Nutanix Inc.

Oracle Corp.

Pure Storage, Inc.

Quantum Corp.

Veritas Technologies LLC

VIOLIN Systems LLC

Western Digital Corp.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter