History 2002: WW Disk Storage Systems Revenue Down 3% in 3CQ02

HP ≠1 in front of IBM and EMC

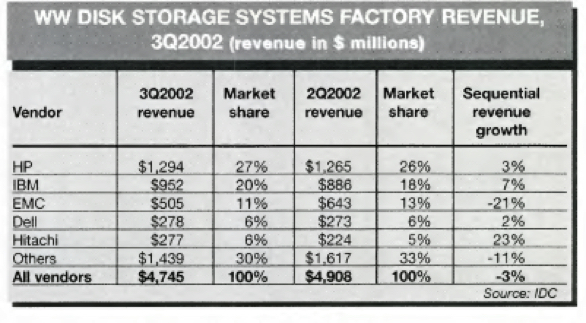

By Jean Jacques Maleval | September 20, 2023 at 2:01 pmWW disk storage systems factory revenue was $4.7 billion in 3CQ02, down 3% compared with 2CQ02, according to IDC.

Growth was no more than 1% sequentially from 1CQ02 and 2CQ02.

Overall, the new HP maintains its total storage revenue leadership with 27% share, followed by IBM with 20%. Hitachi and IBM had the strongest sequential quarterly revenue growth, with 23% and 7% respectively.

“The failure to gain revenue momentum in 3CQ02 is yet another indication that a rebound in the disk storage systems market is not imminent,” said Charlotte Rancourt, research director of IDC’s disk storage systems program. “The 3CQ02 is consistent with an emerging trend whereby growth in gigabyte per unit does not offset the unrelenting decline in dollar per gigabyte.“

The NAS and open SAN storage market declined more in revenue than the overall market, 10% and 6% sequentially.

Competition continues to be healthy, however, resulting in a number of market leadership changes.

NetApp took the lead in the NAS storage market with 38% revenue share, while EMC, the leader for the past several quarters, fell to the ≠2 position this quarter with 31%.

In the open SAN storage market, HP edged out EMC for the ≠1 position with 30% revenue share, while EMC followed with 27%. EMC continues to maintain its leadership in NAS combined with open SAN with 28%.

“Customers took advantage of the scalability of installed SAN and NAS solutions to increase capacity at lower cost,” said John McArthur, IDC group VP of storage research. “The declining revenue picture can sometimes be misleading. The trend towards networked storage continues, which means that suppliers have to look beyond revenue to see that capacity growth of networked storage exceeds the growth of DAS.”

The total external storage market (networked storage plus external DAS) declined 5% sequentially to $3.2 billion in 3CQ02 from 2CQ02. HP maintains it leadership with 22%, followed by EMC and IBM with 15.8% and 14.6%, respectively.

Within the highly watched total external RAID storage market, which was down 5% sequentially in revenue, HP took ≠1 position with 19.8% while EMC followed closely behind with 18.1 %.

This article is an abstract of news published on issue 179 on December 2002 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter