WW SSD Shipments Up 16.6% Q/Q to 75 Million in 2CQ23

Capacity growing by 12.4% to 64EB

This is a Press Release edited by StorageNewsletter.com on August 18, 2023 at 2:02 pmAnalysts from Trendfocus, Inc. published on August 7 a report, NAND/SSD Information Service CQ2 ’23 Quarterly Update – Executive Summary.

Positive Results in Certain Markets Lift SSD Units and Exabytes in 2CQ23

PC OEM purchases help client SSDs while data center continues to struggle

- Overall unit shipments increased 16.6% Q/Q to 74.889 million, with capacity also growing by 12.4% to 64.114EB.

- Client module units grew a significant 22.2% Q/Q to 60.57 million, with capacity shipped jumping 26.4% Q/Q to 40.326EB.

- Enterprise PCle continues to struggle due to ongoing suppressed data center demand, with units falling 24.3% Q/Q to 2.811 million and capacity shipments declining 12.4% to 11.959EB.

- SAS SSDs also dropped sharply Q/Q to 0.559 million units shipped and 2.293EB, down 31.8% and 19.9%, respectively.

- Enterprise SATA SSDs were a big bright spot for 2CQ23, increasing 55.5% Q/Q in units to 3.523 million, and 26.4% in capacity to 4.129EB, signaling improvement in channel demand during the quarter.

- Total NAND bit shipments jumped 30.7% from the previous quarter to 193.77EB, fueled by solid growth in both mobile and client SSDs.

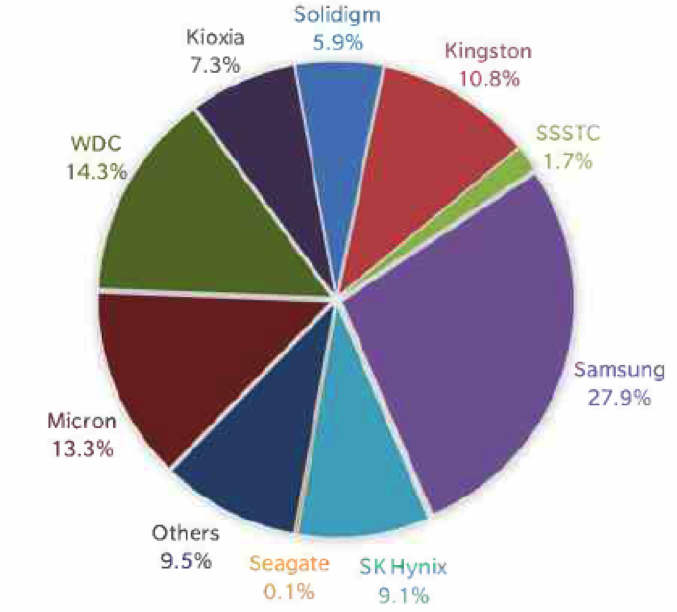

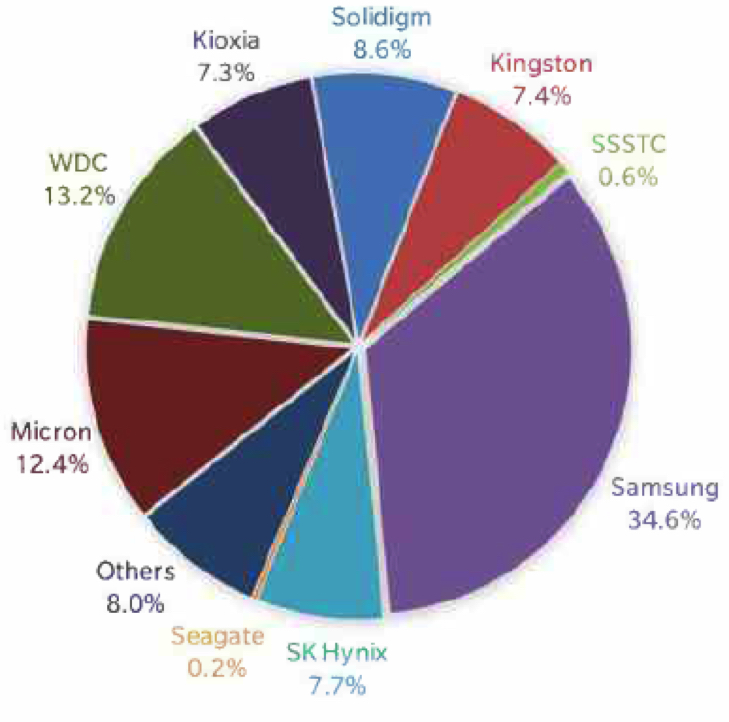

2CQ23 SSD Market Share, by Supplier, Units in Million, Exabytes

Total SSD Market: 74.899 Million Units

Total SSD Market: 64.114EB

Preliminary data – values may change.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter