What Could Be Future of DataCore?

Few options but clearly one seems to be preferred one.

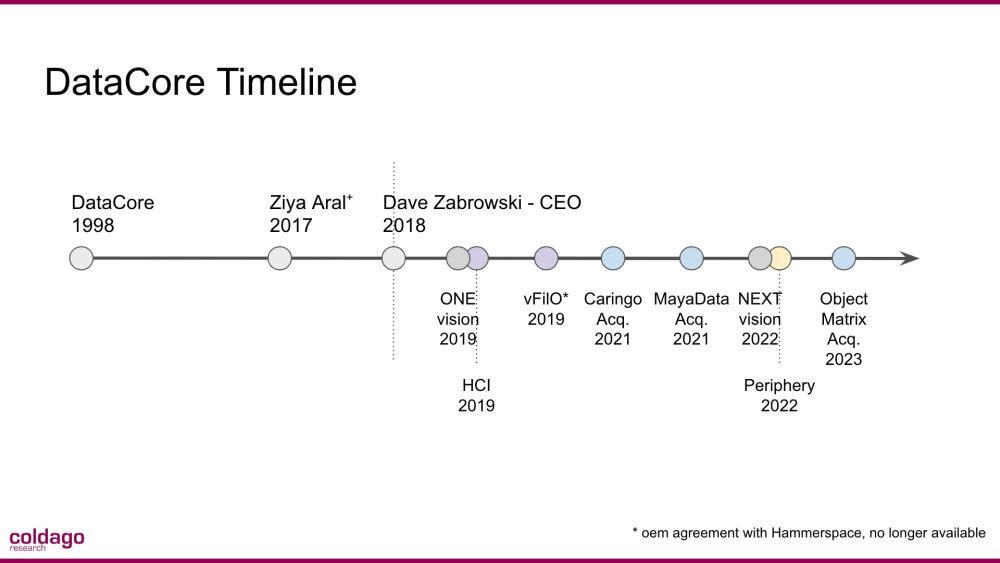

By Philippe Nicolas | July 5, 2023 at 2:02 pmWe know the story of DataCore Software Corp. but it helps to refresh our memory with a few key milestones for the company that explain the trajectory and also introduce some options for the future.

Founded in 1998 in Fort Lauderdale, FL, by former Encore Computer, Amdahl and Blockbuster Entertainment people, the original idea was to offer a storage software to build virtual storage array for enterprises with high performance and high resiliency running Microsoft Windows Server on Intel-based architecture. We mean here a block storage i.e a storage array exposing a block interface to applications servers.

Among these founders, we can mention George Teixeira, a long time CEO of the company, and of course Ziya Aral, one of the brain behind the product, who suddenly disappeared in 2017.

In fact, it seemed that some IP and patent protections prevented the company to make the software available on Unix-based platforms. Not easy but clearly there was a spot following the appearance of SAN a few years before with FC gaining traction. But guess what, Windows was definitely a good choice that allowed the firm to grow and penetrate the market becoming the de-facto standard for SMB+ storage virtualization.

The company has had some acquisition offerings but Teixeira and his team refused them and the company stayed independent since that. This era marked really the first phase for the software firm playing with one product, SANsymphony, in a fast evolving market with SAN/FC, iSCSI, HDD, then flash, persistent memory and NVMe and new fast networks and CPUs. And clearly, the company is a pioneer in storage virtualization for open systems having probably today the largest installed base on the planet.

But observers have wondered what could be the next phase for DataCore. An event mentioned above, Aral death, have shaken the company leadership team, triggered some talks and strategic thinking and finally accelerated decisions. We have to mention that the company jumped into the SDS wave and actively promoted this approach being a natural extension of the past storage virtualization model, but still with a block storage offering, the company ignoring at that time file and object storage market segment.

In 2018, a few new executives joined the company especially Dave Zabrowski as CEO with Teixeira moving as chairman, highly promoted by Insight Partners, a historical investor. It was a pivot point for the company and things changed radically in several domains. First the company extended its storage coverage with a file storage solution. As a tactical choice, the team announced vFilO in November 2019, a file storage virtualization solution based on an OEM agreement with Hammerspace, thus the storage virtualization and SDS story got expanded. We revealed this OEM agreement a few days later. The product is no longer listed on the web site.

In 2019 also, the company announced a HCI solution that finally went nowhere. And even if the market presents some opportunities, people believe so, the market is controlled by 2-3 players with some real difficulties to penetrate. But we get the idea of the expansion race and the desire to build a global portfolio, clearly illustrated by the DataCore ONE then NEXT vision and strategy to address cloud, datacenter and edge needs.

Zabrowski’s mission has been and continues to be to build a reference infrastructure player in multiple storage domains beyond the historical SMB+ and Windows-based segments and to finally make an exit. No doubt about this, he did some in his past career and Insight, and other investors, management included, also wishes to find a landing zone for DataCore.

In January 2021, the firm acquired Caringo, a pioneer and reference in object storage, founded in 2005 following the FilePool acquisition made by EMC in 2001 that became EMC Centera. The company developed and offered a strong software solution, Swarm, well respected on the market. Zabrowski’s goal continued to be fulfilled with now object in addition to block and file storage claiming to play as a global storage software provider.

In November 2021, a bargain opportunity appeared perfectly aligned with the ambition of the company. The team swallowed MayaData, a key player in the growing Kubernetes ecosystem. It is today offered as Bolt and fueled the DataCore global product strategy. It also clearly contributes to the Unicorn status of the company aggregating SANsymphony strong business, Swarm and now Bolt.

In September 2022, a strategic announcement was made in M&E domain with Perifery line and key partnerships. We understood that beyond the product quest, the company wished also to multiply its vertical industry coverage.

And more recently, in January 2023, DataCore acquired Object Matrix, a Welsh company, developing an object storage software product well deployed in the M&E segment. And again the story is written, DataCore in 2023 is very different from what it was when Zabrowski joined.

Globally the company has raised around $117 million with a last round in 2021 led by Insight Partners and Jeff Horing in particular.

Covering multiple storage domains, DataCore faces new competitions with newcomers, established ones or other small ones. Among them, we can list StorPool, StorONE, Lightbits Labs, SimplyBlock or Volumez on the block side. For object storage, consolidation continues and this segment has morphed into a S3 world. Users don’t really care about a “pure” object storage as they just wish and need a S3 interface on top on any storage and this is what we see on the market. It explains the difficulties from some companies claiming to replace SAN and NAS 10 years ago and be now just a secondary storage target for backup software. Kubernetes is promising but didn’t take off on the storage side, still controlled by storage gorillas, with some difficulty to see strong new players. This segment is tough with small data volumes, long sales cycle, subscription mode and, as said, usual suspects presence. Guess what, several of these new or young players disappeared or got acquired like Ondat, Robin.io, MayaData or Portworx or have difficulties like Diamanti.

The cloud strategy still is an open question for the management team and, except Kubernetes, we don’t see real offering in that domain. We understand a program exists for SDS but it is at least not very visible and we wonder about its adoption.

Five years following the arrival of Zabrowski, it is probably a good time to think about an exit, honestly it was his original mission, that horizon always existed in his mind and Insight’s one. DataCore has a strong block storage business in SMB+ with a significant installed base fueled by a serious network of loyal partners. Their users love them and used them for decades. We believe that Insight Partners shares similar view having in its company portfolio some real gems that can serve as a foundation to build a software giant. Among them, we see Acronis, Kaseya or Veeam. Just imagine DataCore coupled with one of these. This could be an option. The second one could be a “classic” exit with a sale to a portfolio company or an external one. In that case who? HPE? IBM? Dell? A cloud giant? Microsoft ? An other infrastructure software company? The acquirer should be ready to pay probably between $1 and 1.2 billion today. The third option could be an IPO but we don’t believe in this path. We’ll see but 5 years represents a moment, a real moment…

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter