China NAND and DRAM Business: No Signs of Slowing Down

Country purchases more than 30% of products manufactured by global IDMs.

This is a Press Release edited by StorageNewsletter.com on May 17, 2023 at 2:02 pm![]() This article, published on May 10, 2023, was written by Simone Bertolazzi, Ph.D., principal analyst, memory, Yole Intelligence, a Yole Group company.

This article, published on May 10, 2023, was written by Simone Bertolazzi, Ph.D., principal analyst, memory, Yole Intelligence, a Yole Group company.

Semiconductor memory:

China’s ambition shows no signs of slowing down

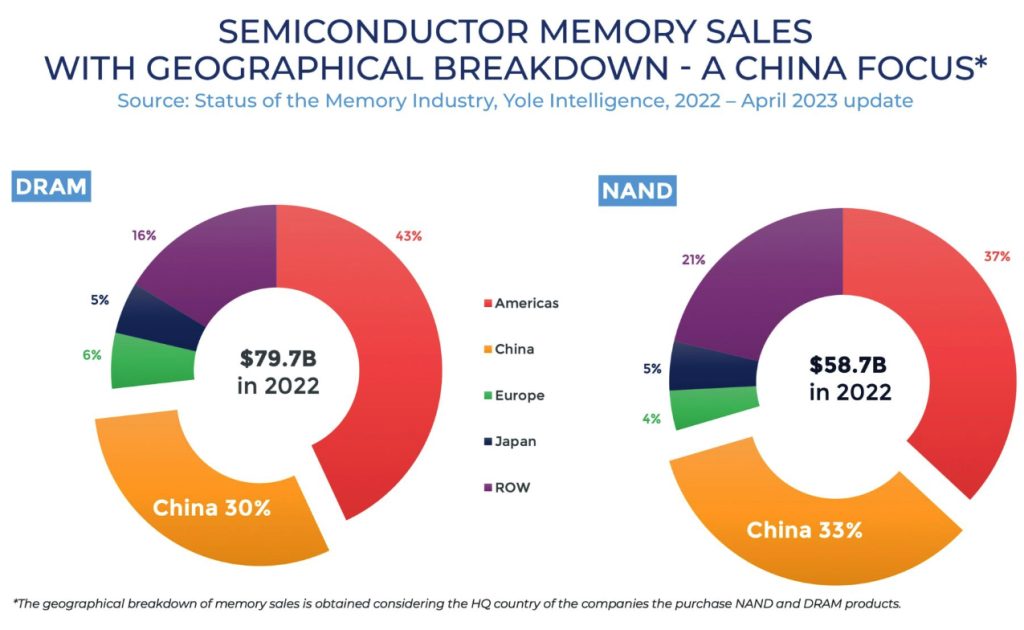

The semiconductor memory industry has long been a strategic priority for China’s economic development. Chinese companies purchase more than 30% of the NAND and DRAM products manufactured by global IDMs, while China’s self-sufficiency in memory is currently estimated to be below 15%.

The large gap between memory consumption and production in China is fueling the country’s burning desire to produce an ever-increasing amount of NAND and DRAM wafers locally.

The restrictions set in October 2022 by the US government have resulted in strong headwinds vs. China’s memory ambition, jeopardizing the fab-capacity expansion and the roadmap execution of Yangtze Memory Technologies Co. (YMTC) and ChangXin Memory Technologies (CXMT), the 2 leading Chinese memory IDMs.

The restrictions prohibit US companies – including equipment suppliers – from exporting certain technologies to Chinese companies. The technologies in question include those related to equipment used for manufacturing NAND and DRAM devices vital for YMTC and CXMT to progress and become competitive in the very challenging memory business.

YMTC leading NAND maker in China

It is currently shipping 64- and 128-layer NAND domestically, with 232-layer in early production with its Xtacking 3.0 architecture. However, in December 2022, it was added to the so-called “Entity List,” which means that US businesses cannot sell products or services to YMTC unless an export license is granted. Therefore, NAND progress could stall, with YMTC’s wafer ramp-up capped at 115~120K wafers per month and its technology roadmap on hold due to a lack of support from key equipment vendors.

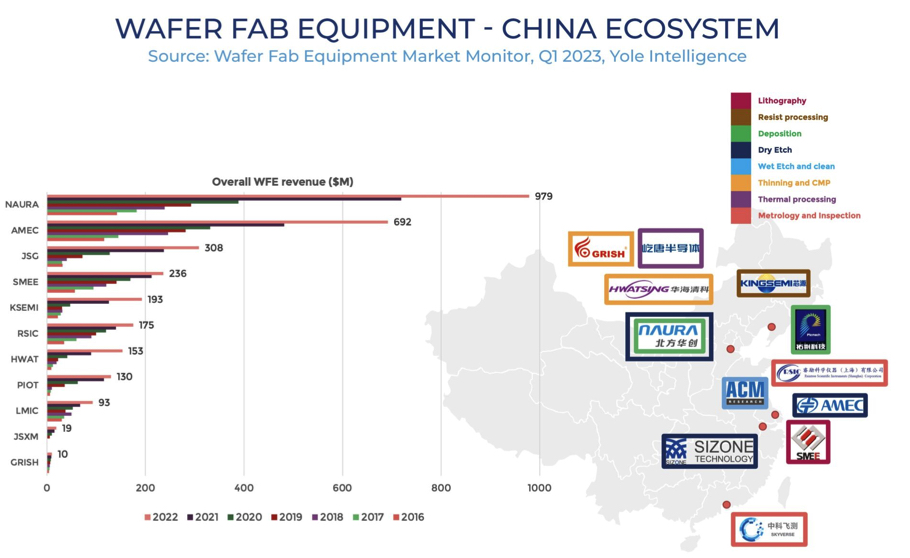

YMTC has been looking to countries such as Japan, Taiwan, and South Korea, major suppliers of semiconductor equipment and materials. Moreover, the company has considerably intensified its efforts to work with Chinese equipment suppliers through a not-so-visible project code-named “Wudangshan” and recent funding – of the order of $7 billion – from its state-backed investors. Recently, it could place crucial orders with local equipment companies, among which is Naura Technology – a supplier of etching and deposition tools that could help mitigate the lack of support from US companies such as Lam Research and Applied Materials.

CXMT, workhorse DRAM company in China

CXMT was founded in 2017 and rapidly became the workhorse DRAM company in China. Despite not being added to the “Entity List,” the company faces significant challenges in the execution of its roadmap. Initial production (Gen 1, ~27nm memory density equivalent) is now available (DDR4 & LPDDR4), while Gen 3 (1xnm equivalent) is currently ramping.

However, WFE support for this node will likely be challenging due to the export restrictions, and CXMT’s roadmaps are likely to be significantly slowed down. Like YMTC, CXMT is also reacting rapidly to gather the resources necessary to face the headwinds.

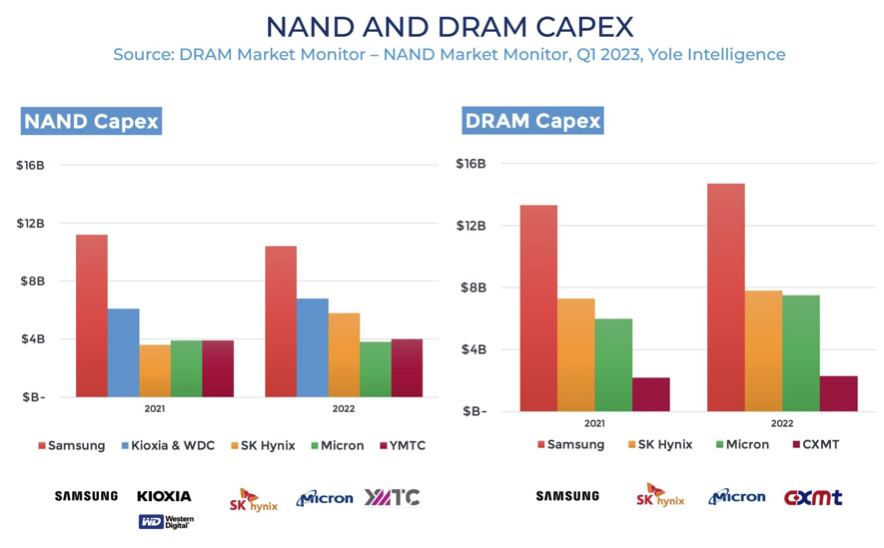

A Bloomberg article published on April 20, 2023, introduced the rumor that the company is seeking an IPO at a valuation of more than $14 billion. For a 6-year-old company, this is an astonishing figure, but this should be put in the context of the global memory industry, where R&D spending and capital expenditures by global suppliers can easily surpass the single-digit billion-dollar amount over a 2-year period.

Although all these financial efforts will help mitigate the impact of the US trade restrictions, China’s memory industry will continue facing significant challenges. The industry requires not only a massive amount of investment, but also considerable expertise and technology developments to catch up with its competitors in the US, Japan, and Korea. Furthermore, the US government could potentially tighten its trade restrictions further, making it even more difficult for Chinese companies to access the technologies they need.

In conclusion, the US trade restrictions pose a significant challenge to China’s memory industry, which relies heavily on imported technologies. However, China has not shown any signs of backing down from its semiconductor memory ambition. On the contrary, with strong financial support from the government, Chinese memory companies can support local equipment vendors and speed up the development of leading-edge tools for NAND and DRAM manufacturing. Although the future of China’s memory industry remains uncertain, what is clear is that memory will continue to be a strategic priority for the Chinese semiconductor ecosystem, and the country will do everything possible to keep their workhorse memory companies – YMTC and CXMT – alive and running.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter