Power Management Integrated Circuit with Server DDR5 RDIMMs

Convergence of DDR5 server DRAM price decline

This is a Press Release edited by StorageNewsletter.com on May 15, 2023 at 2:02 pm

This report, published on April 24, 2023, was written by Mark Liu and Caron Ju, analysts at TrendForce Corp.

PMIC Issue with Server DDR5 RDIMMs Reported,

Convergence of DDR5 Server DRAM Price Decline

Mass production of new server platforms – such as Intel Sapphire Rapids and AMD Genoa – is imminent. However, recent market reports have indicated a PMIC (Power Management Integrated Circuit) compatibility issue for server DDR5 RDIMMs; DRAM suppliers and PMIC vendors are working to address the problem.

This will have two effects:

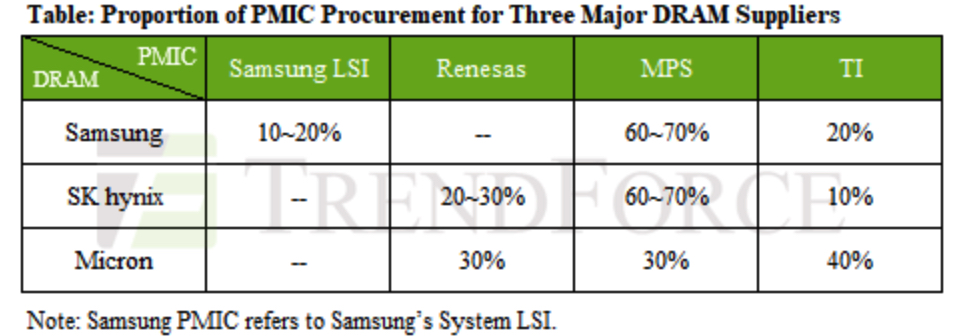

- First, DRAM suppliers will temporarily procure more PMICs from Monolithic Power Systems (MPS), which supplies PMICs without any issues.

- Second, supply will inevitably be affected in the short term as current DDR5 server DRAM production still uses older processes, which will lead to a convergence in the price decline of DDR5 server DRAM in 2Q23 – from the previously estimated 15~20% to 13~18%.

As previously mentioned, PMIC issues and the production process relying on older processes are all having a short-term impact on the supply of DDR5 server DRAM. SK hynix has gradually ramped up production and sales of 1α-nm, which, unlike 1y-nm, has yet to be fully verified by consumers. Current production processes are still being dominated by Samsung and SK hynix’s 1y-nm and Micron’s 1z-nm; 1α and 1β-nm production is projected to increase in 2H23.

DDR5 server DRAM 32 GB prices are expected to decrease to $80-90 during April and May, owing to lower fulfillment rates of DDR5 server DRAM in the short term. However, this price estimate is slightly higher than the previous 2Q average estimate of $75. In contrast, DDR4 prices are projected to fall by 18-23% in 2Q23, whereas DDR5 prices are expected to drop by 13-18%. This indicates a larger quarterly price decline for DDR4 than DDR5, as the price gap between the two widens.

AI indirectly helps drive up demand, 128GB high-capacity modules see prices stop falling in April

The explosive popularity of ChatBOT has driven up demand for AI server shipments, leading to talks about HBM and boosting purchasing power for 128GB server DDR5 RDIMM to accommodate ChatGPT 4.0 computing architecture. This has led to an increase in demand for high-capacity RDIMMs in early 2Q23, primarily from US CSPs. 128GB RDIMMs require Through-Silicon VIA (TSV) packaging, as the DDR5 mono die is mostly 16Gb. However, main suppliers cannot increase their TSV production capacity in the short term, leading to further price increases for SK hynix’s high-capacity DDR5 modules this month. This is in contrast to the current downward trend in the prices of DDR4 and other DDR5 products.

Overall, compared to DDR4, DDR5 modules require PMIC components, which introduces the possibility of compatibility risks. In the meanwhile, clients have also been delaying the mass production of new server platform models. Even though DRAM suppliers have already been sending out samples to CPU vendors and buyers since early 2022, practical issues have only just begun to emerge as new server production ramps up. The resulting changes in the price difference between DDR4 and DDR5 will be reflected in 2Q and 3Q of this year. As the production of new products begins to ramp up, the price gap will converge.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter