Seagate: Fiscal 3Q23 Financial Results

Seagate: Fiscal 3Q23 Financial Results

Sales down 34% Y/Y and further decreasing next quarter, and much higher net loss

This is a Press Release edited by StorageNewsletter.com on April 21, 2023 at 2:02 pm| (in $ million) | 3Q22 | 3Q23 | 9 mo. 22 | 9 mo. 23 |

| Revenue | 2,802 | 1,860 | 9,033 | 5,782 |

| Growth | -34% | -36% | ||

| Net income (loss) | 346 | (433) | 1,373 | (437) |

• Revenue of $1.86 billion

• GAAP (loss) per share of $(2.09); non-GAAP (loss) per share of $(0.28)

• Cash flow from operations of $228 million and free cash flow of $174 million

• Declared cash dividend of $0.70 per share

Seagate Technology Holdings plc reported financial results for its fiscal third quarter ended March 31, 2023.

“We are seeing a more elongated customer inventory correction that led to weaker than expected nearline demand among a few large customers late in the quarter. Consequently, our March quarter revenue came in at the low-end of our guidance range, which along with underutilization charges and other factors had a severe impact on our reported margins and profitability,” said Dave Mosley, CEO. “Looking ahead, we now expect demand recovery to begin towards the end of the calendar year. In response to this dynamic environment, we are taking aggressive actions to lower our cost structure while still positioning Seagate to thrive over the long-term and sustain our technology leadership. To that end, we continue to execute on our product roadmap, including our strategically vital HAMR platform that we launched in April, as anticipated.”

GAAP operating expenses for 3FQ23 included a $300 million settlement penalty for alleged violations of U.S. Export Administration Regulations by the U.S. Department of Commerce’s Bureau of Industry and Security (BIS), that were subsequently resolved by a settlement agreement on April 18, 2023. Quarterly payments of $15 million will be made over the course of 5 years, starting in 1FQ24.

During 3FQ23, the company generated $228 million in cash flow from operations and $174 million in free cash flow, and paid cash dividends of $145 million. Cash and cash equivalents totaled $766 million. There were 207 million ordinary shares issued and outstanding as of the end of the quarter.

Quarterly Cash Dividend

The board of directors declared a quarterly cash dividend of $0.70 per share, which will be payable on July 5, 2023 to shareholders of record as of the close of business on June 21, 2023. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Restructuring Plan

On April 20, 2023, the company committed to a restructuring plan to reduce its cost structure in response to changes in macroeconomic and business conditions. The plan is intended to align the company’s operational needs with the near-term demand environment while continuing to support the long-term business strategy. The plan, which the company expects to be substantially completed by the end of 4FQ23, is expected to result in total pre-tax charges of approximately $150 million. The charges are expected to be primarily cash-based and consist of employee severance and other one-time termination benefits. The company expects to realize run-rate savings of approximately $200 million on an annualized basis starting in 4FQ24.

Business Outlook

The company is providing the following guidance for its 4FQ23:

• Revenue of $1.7 billion, ±$150 million

• Non-GAAP (loss) per share of $(0.20), ±$0.20

Guidance regarding non-GAAP diluted EPS excludes known pre-tax charges related to estimated share-based compensation expenses of $0.16 per share and restructuring costs of approximately $0.72 per share.

Comments

Historically the HDD market never was more in trouble than these last quarters. Consequently Seagate, ≠1 WW in this business, and a depending mostly (86%) upon this activity, suffered deeply during the quarter.

Lowest figure since years with $1,860 million at low end of guidance range, 3FQ23 revenue was down 34% Y/Y and 1% Q/Q, and 36% for the 9 months of FY23, with with Q/Q net loss from $33 million to $433 million. Shares slid more than 4% even as the storage company unveiled a new cost cutting initiative in light of weaker-than-expected 3FQ23 results and guidance.

Legacy

Within the Legacy market, revenue was $371 million, down 12% Q/Q

• Legacy revenue down 12% sequentially

• Client and consumer markets reflected typical seasonal demand trends

• Mission critical impacted by more cautious spending environment and weakening server demand

Mass capacity

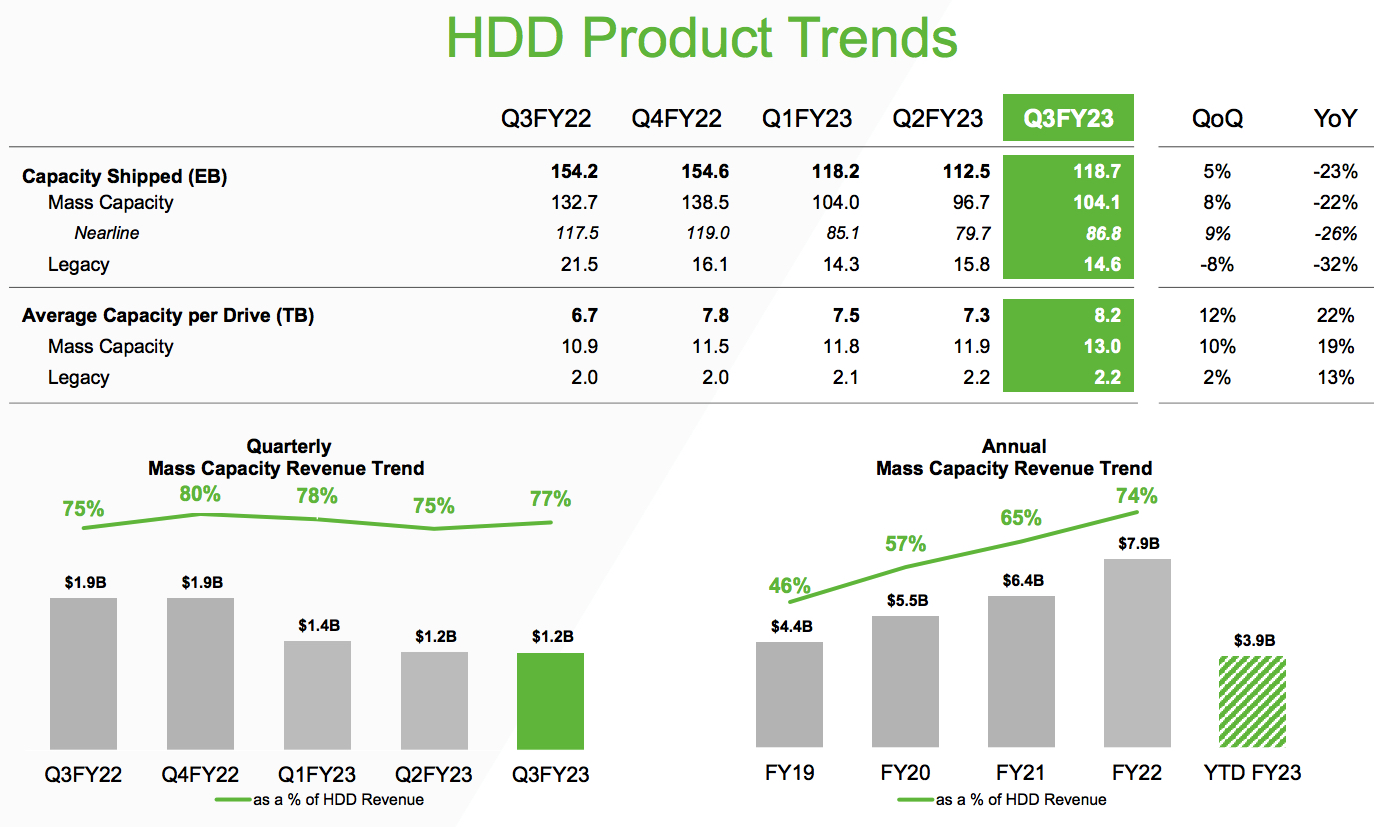

Mass capacity revenue remained essentially flat Q/Q at $1.2 billion. Shipments into the mass capacity market totaled 104EB compared with 97EB in the former quarter. Consistent with the prior quarter, roughly 83% were derived from nearline products shipped into cloud and enterprise OEM customers. Macroeconomic uncertainties drove more cautious cloud and enterprise spending, prolonging inventory consumption, impacting nearline demand.

• Nearline shipments of 87EB, up 9% sequentially, driven by continued growth in 20TB+ products now representing two-thirds of nearline exabytes shipped in Q3FY23

• VIA continued to be impacted by global economic slowdown, expecting gradual

recovery in the 2CH23.

• As a percentage of nearline exabytes shipments, 20TB+ capacity drives has grown from high single digits to approximately 2/3 of our nearline exabytes Y/Y.

• HAMR 30+TB qualification units shipped to a cloud partner in April, with volume ramp starting early CY24. Firm plans to ship Corvault with 30+TB HAMR

drives for revenue during the June quarter.

Non-HDD

Revenue of systems, SSDs and other reached $256 million in 3FQ23, up 14% Q/Q and 8% Y/Y to be compared to $1,604 million for HDDs, -4% Q/Q and -37% Y/Y.

The company is providing the following guidance for its 4FQ23: revenue of $1.7 billion, plus or minus $150 million or between -30% and -41%. It translates into

between -35% and -37% for FY23, lowest figures since at least FY18.

Salary of CEO reduced by 100%

On April 16, 2023, the board of directors approved temporary salary reductions for the company's named executive officers. Effective beginning May 1, 2023, for a period of 6 months, the base salary of each of William D. Mosley, CEO, and Gianluca Romano, EVP and CFO, will be reduced by 100% and the base salary of Ban Seng Teh, EVP and CMO, will be reduced by 50%.

On April 20, 2023, the company announced that Jeffrey D. Nygaard, EVP of operations and technology, will leave effective May 1, 2023.

HDDs from 1FQ16 to 3FQ23

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3Q20 | $86 | 120.2 | 4,100 |

| 4Q20 |

$89 | 117.0 | 4,500 |

| 1Q21 |

$82 | 114.0 | 4,400 |

| 2Q21 |

$81 | 129.2 | 4,300 |

| 3Q21 | $91 | 139.6 | 5,100 |

| 4Q21 | $97 | 152.3 | 5,400 |

| 1Q22 |

$103 | 159.1 | 5,700 |

| 2Q22 |

$106 | 163.2 | 6,100 |

| 3Q22 |

NA | 154.2 | 6,700 |

| 4Q22 |

NA | 154.6 | 7,800 |

| 1Q23 |

$104 | 118.2 | 7,500 |

| 2Q23 |

$108 | 112.5 | 7,300 |

| 3Q23 |

$111 |

118.7 |

8,200 |

FY ending in June

* in $million

| Period | Revenue* | Y/Y growth | Net income* |

| FY18 | 11,184 | 4% | 772 |

| FY19 | 10,390 | -7% | 2,012 |

| FY20 | 10,509 | 1% | 1,004 |

| FY21 | 10,681 | 2% | 1,314 |

| 1FQ22 | 3,115 | 35% | 526 |

| 2FQ22 | 3,116 | 19% | 501 |

| 3FQ22 | 2,802 | 3% | 346 |

| 4FQ22 | 2,628 | -13% | 276 |

| FY22 | 11,661 | 9% | 1,649 |

| 1FQ23 |

2,035 |

-35% |

29 |

| 2FQ23 | 1,887 | -49% | (33) |

| 3FQ23 | 1,860 | -34% | (433) |

| 4FQ23 (estim.) | 1,550-1,850 | -41% - -30% | NA |

| FY23 (estim.) | 7,332-7,632 | -37% - -35% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter