Backblaze: Fiscal 4Q23 Financial Results

Backblaze: Fiscal 4Q23 Financial Results

Revenue up (23% Y/Y) as well as net loss (but increasing), as usual

This is a Press Release edited by StorageNewsletter.com on February 17, 2023 at 2:02 pm| (in $ million) | 4Q21 | 4Q22 | FY21 | FY22 |

| Revenue | 18.7 | 22.9 | 67.5 | 85.2 |

| Growth | 23% | 26% | ||

| Net income (loss) | (9.6) | (14.8) | (21.7) | (51.7) |

Backblaze, Inc. announced results for its fourth quarter and year ended December 31, 2022.

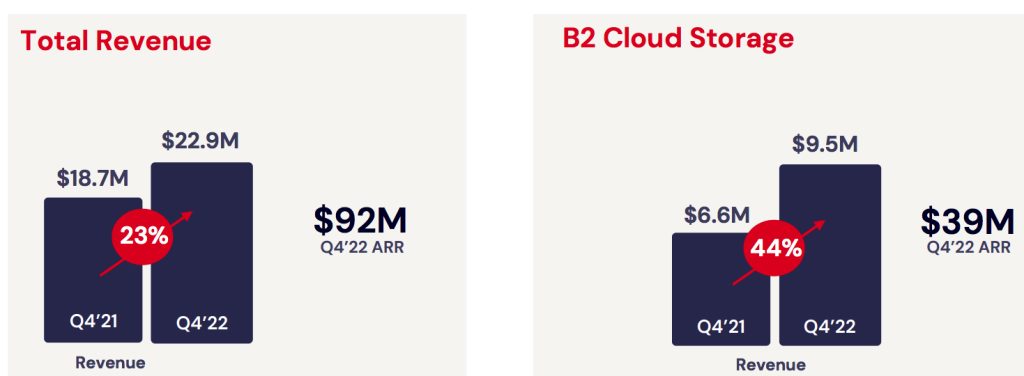

“We were pleased to finish 2022 with strong Q4 overall revenue growth of 23% driven by an increasing proportion of our B2 Cloud Storage service, which grew 44% in Q4,” said Gleb Budman, CEO. “We are excited as we begin 2023 as we see the opportunity to help more small and large businesses reduce the cost of their cloud infrastructure.“

“Given the uncertain macroeconomic environment, businesses have even more reason to seek cost savings with best-of-breed cloud services-and Backblaze provides them a solution with B2 Cloud Storage, which is one-fifth the price of traditional cloud storage providers such as Amazon S3. Further, Backblaze B2 is very easy to use, saving users up to 90% of the time it takes to manage traditional cloud services. Turning to our own financial picture, as we continue to grow revenue, we’re moderating expense growth and are targeting to approach adjusted EBITDA breakeven in Q4 of this year,” he continued

4FQ22 financial highlights:

- Revenue of $22.9 million, an increase of 23% Y/Y.

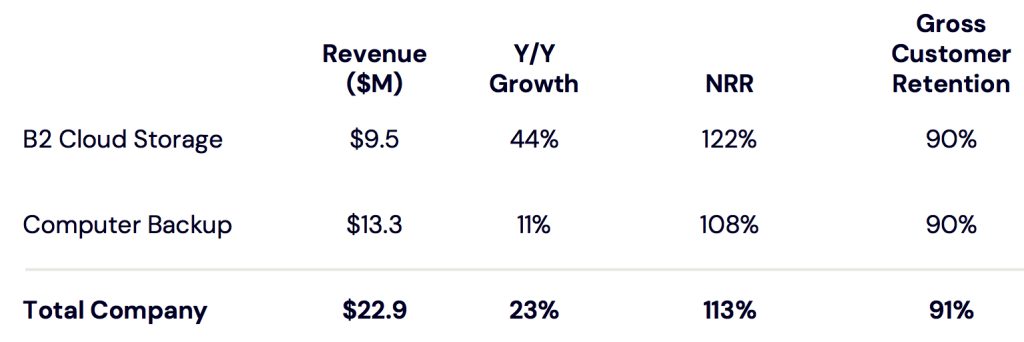

- B2 Cloud Storage revenue was $9.5 million, an increase of 44% Y/Y.

- Computer Backup revenue was $13.3 million, an increase of 11% Y/Y.

- Gross profit of $11.7 million or 51% of revenue, compared to $9.8 million or 53% of revenue in 4FQ21.

- Adjusted gross profit of $17.3 million or 75% of revenue, compared to $14.1 million or 75% of revenue in 4FQ21.

- Net loss was $14.8 million compared to a net loss of $9.6 million in 4FQ21.

- Net loss per share was $0.45 compared to a net loss per share of $0.38 in 4FQ21.

- Adjusted EBITDA was $(2.5) million or (11)% of revenue, compared to $(1.3) million or (7)% of revenue in 4FQ21.

- Non-GAAP net loss of $9.0 million compared to non-GAAP net loss of $6.5 million in 4FQ21.

- Non-GAAP net loss per share of $0.27 compared to a non-GAAP net loss per share of $0.26 in 4FQ21.

- Cash, short-term investments and restricted cash, non-current totaled $69.7 million as of December 31, 2022.

FY22 financial highlights:

- Revenue of $85.2 million, an increase of 26% Y/Y.

- B2 Cloud Storage revenue was $33.0 million, an increase of 46% Y/Y.

- Computer Backup revenue was $51.4 million, an increase of 17% Y/Y.

- Gross profit of $43.9 million or 52% of revenue, compared to $34.3 million or 51% of revenue in 2021.

- Adjusted gross profit of $64.6 million or 76% of revenue, compared to $50.5 million or 75% of revenue in 2021.

- Net loss was $51.7 million compared to $21.7 million in 2021.

- Net loss per share was $1.63 compared to $1.07 in 2021.

- Adjusted EBITDA was $(9.4) million or (11)% of revenue, compared to $3.2 million and 5% of revenue in 2021.

- Non-GAAP net loss of $32.8 million compared to non-GAAP net loss of $16.9 million in 2021.

- Non-GAAP net loss per share of $1.04 compared to a non-GAAP net loss per share of $0.83 in 2021.

4FQ22 operational highlights:

- Annual recurring revenue (ARR) was $92.0 million, an increase of 22% Y/Y.

- B2 Cloud Storage ARR was $38.6 million, an increase of 44% Y/Y.

- Computer Backup ARR was $53.4 million, an increase of 10% Y/Y.

- Net revenue retention (NRR) rate was 113% compared to 111% in 4FQ21.

- B2 Cloud Storage NRR was 122% compared to 132% in 4FQ21.

- Computer Backup NRR was 108% compared to 102% in 4FQ21.

- Gross customer retention rate was 91% compared to 91% in 4FQ21.

- B2 Cloud Storage gross customer retention rate was 90% compared to 89% in 4FQ21.

- Computer Backup gross customer retention rate was 90% compared to 91% in 4FQ21.

- Number of customers was 506,456 vs. 493,023 in 4FQ21.

- B2 Cloud Storage number of customers was 86,874 vs. 74,349 in 4FQ21.

- Computer Backup number of customers was 436,080 vs. 433,079 in 4FQ21.

- Total Annual Average Revenue Per Customer (ARPU) was $181 vs. $153 in 4FQ21.

- B2 Cloud Storage ARPU was $437 vs. $360 in 4FQ21.

- Computer Backup ARPU was $124 vs. $113 in 4FQ21.

For 1FQ23 the company expects:

- Revenue between $23.1 million to $23.5 million.

- Adjusted EBITDA margin between (15)% to (11)%.

- Basic shares outstanding of 33.5 to 35.5 million shares.

For FY23 it expects:

- Revenue between $81 million to $102 million.

- Adjusted EBITDA margin between (10)% to (6)%.

Comments

Backblaze records for 4FQ22 revenue of $22.9 million, up 23% Y/Y and 4% Q/Q or more than expected last quarter (20% to 22%).

For FY22, its is $85.2 million or +26% above what was predicted in 3FQ22 ($84.7-$85.1 million).

Founded 16 years ago, the company never was profitable, accumulating more than $90 million net loss since FY19.

Financial and operational 4FQ22 highlights

Number of customers

Paid customers increased to 506,000 up from 493,000 in 4Q21. The number of customers were B2 grew to 87,000 from 74,000 one year ago. The number of customers for computer backup totaled 436,000, up from 433,000 in 4Q21.

Average Revenue Per User (ARPU)

The annual average revenue per customer or ARPU for the entire company increased to $181 vs. $153 in 4FQ21. B2 Cloud storage ARPU grew to $437 vs. $360 one year ago, and computer backup ARPU was $124 up from $113 in 4Q21.

Backblaze B2 contributed sales of 9.5 million, reflecting 44% growth, "more than 2x the growth rate of 20% for Amazon AWS", stated the backup company. Computer backup revenue total 13.3 million, reflecting 11% growth. In 4FQ22, B2 cloud storage represented 41% of total revenue, continuing its upward trend.

Total net revenue retention or NRR was 113% an increase of 2 points Y/Y with B2 cloud storage at 122% and computer backup at 108%.

Gross customer retention was 91% overall consistent with the prior year with 90% for both B2 cloud storage and computer backups.

For next quarter projection is between $23.1 and $23.5 million in sales, up 18% to 21%.

For FY23, it's between $81 and 102 million, or -5% to 20%.

| (in $ million) | Revenue | Y/Y growth | Net income (loss) |

| FY19 | 40.748 | NA | (1.0) |

| 1FQ20 | 12.4 | NA | NA |

| 2FQ20 | 13,0 | 5% | (1,4) |

| 3FQ20 | 13.8 | 6% | (1.9) |

| 4FQ20 | 14.6 | 6% | (3,4) |

| FY20 | 53.8 | 32% | (6.6) |

| 1FQ21 | 15.3 | 23% | (3.7) |

| 2FQ21 | 16.2 | 24% | (2,4) |

| 3FQ21 | 17,3 | 25% | (6.5 to 7.5) |

| 4FQ21 | 18.7 | 28% |

(9.6) |

| FY21 |

67.5 | 25% | (21.6) |

| 1FQ22 | 19.5 | 27% | (12.5) |

| 2FQ22 | 20.7 | 28% | (11.6) |

| 3FQ22 | 22.1 | 27% | (12.8) |

| 4FQ22 | 22.9 | 23% | (14.8) |

| FY22 |

85.2 |

26% |

(51.7) |

| 1FQ23 (estim.) | 23.1-23.5 | 18%-21% |

NA |

| FY23 (estim.) |

81-102 |

-5%-20% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter