History 2001: Singapore World’s HDD Factory

Special report from Jean-Jacques Maleval in country

By Jean Jacques Maleval | March 2, 2023 at 2:00 pmIBM and Seagate manufacture all their enterprise HDDs in Singapore, and both lead in this market. Maxtor assembles all of its devices in the country, while MKE produces a healthy proportion of its output there. All told, these are the 4 leaders in the industry.

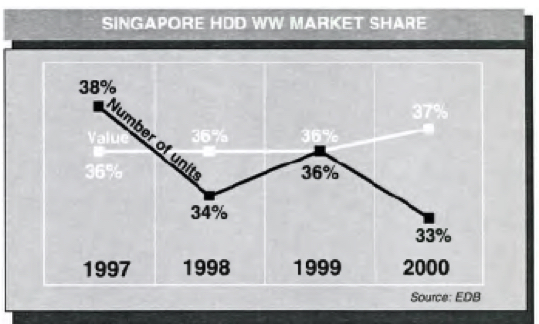

According to Singapore’s Economic Development Board senior officer King Wang Poon, the country was home to the manufacture of about 33% of all HDDs produced in the world for 2000 (37% in value). This translates to some 35 million devices.

“Singapore has been the single most important regional hub for HDD assembly in the world since the mid-80s,” wrote Poh-Kam Wong.*

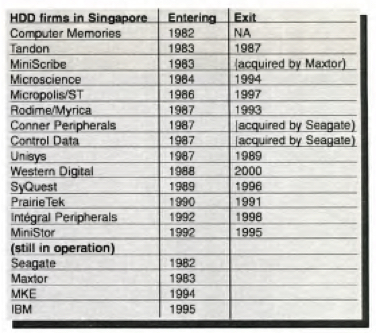

This is still the case, despite Western Digital’s departure from the island republic last year, the closure of Integral Peripherals in 1998, of ST/Micropolis in 1997, of SyQuest in 1996, of Rodime/Myrica in 1993, of PrairieTek in 1991, and before that CDC, Conner Peripherals, Microscience and Tandon.

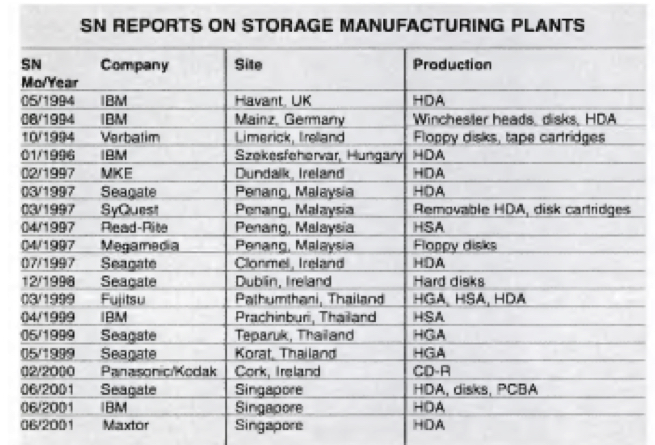

Nearly 50% of all HDDs came from Singapore between 1986 and 1996, but this percentage dropped steadily until 1998, as manufacturers left in pursuit of less costly labor in Malaysia, Thailand, the Philippines and China. It seems, however, that there is new interest in Singapore once again, the proof of which can be seen by the presence of the 3 market leaders (Maxtor/Quantum, Seagate and IBM), all US firms (we’ve included MKE, which is now a subcontractor for Maxtor). Western Digital is the one American exception.

The other major missing players are all Asian (Hitachi, Fujitsu, Samsung and Toshiba)

Note, however, that in Singapore, only 3.5-inch HDDs, enterprise units for IBM and Seagate, desktop devices for Maxtor and MKE, and until now not a single mobile drive, are manufactured.

This reversal in the trend seems to be the result of certain progress towards automation except at Maxtor which results in the decrease of the workforce’s share in the final production cost.

Tom Mitchell and Seagate first on the scene

When did the first storage makers arrive on this island slightly more than 3.5x the size of Washington, DC?

Tandon and Micro Peripherals landed in 1981 in order to manufacture floppy disk drives.

But the real pioneer was Tom Mitchell, who decided in 1982, or only 3 years after the birth of Seagate, to transfer all production of 5.25-inch HDDs from Santa Cruz, CA, to Singapore.

He was highly unsatisfied by the “high cost, marginal quality and poor availability of labor” in California. He also had the good fortune to fall upon a remarkable local engineer, S.C. Tien, to help him in his efforts.

Why choose Singapore now? Seagate’s success inspired many imitators (see inset below). In fact, Seagate’s model was only one factor among many. The country has always had an active government subsidy policy, and is particularly generous in terms of tax incentives. It country also boasts the best infrastructure to be found in Southeast Asia, with world-class transportation and communications. The city is extraordinarily clean with harsh enforcement of anti-littering laws and a ban on chewing gum you might think you were in Switzerland. The country’s political system, particularly calm, and a stable economy are no doubt reassuring to industrial investors, not to mention legislation restricting trade union activity and an effective corruption- free business environment.

Furthermore, the population is highly influenced by American style, with a heavy percentage of fluent English speakers and highly educated engineers. Singapore has taken considerable pains with its education system, in order to advance beyond being merely a factory haven for which it supplies operators.

A good example of the country’s policy was the founding in 1992 of the Magnetics Technology Center, later the Data Storage Institute (DSI), which employs 170 people and trains high-level engineers in disk drive technology. DSI has even filed some of its own patents relating to storage technology.

The GM of one Singaporean HDD plant made the following telling remark: “I have a lab here, but if there’s a problem I can’t resolve, I ask the DSI where to find skilled engineers.“

Another advantage: the presence of component manufactures locally (Hoya, Mitsubishi Chemical and Seagate for disk media, Nidec for motors, not to mention some outstanding PCB makers) or in nearby Malaysia and Thailand.

There is only one bridge, in the north of the island, connecting the country with surrounding Malaysia and its lower-cost workforce, which explains why certain manufacturers such as IBM and Seagate have built a fleet of buses to transport young workers, mostly women, across the bridge each morning, returning them home again each night.

Singapore does not only have advantages. The city holds little touristic or cultural interest. Real estate prices are high, which is why many factories are built upwards, on several levels, rather than outwards on a single floor as in neighboring countries. Compared to the latter, the cost of labor on the island is significantly higher, and this gap is widening. According to our sources there, the average cost of an operator is roughly $1,000 per month.

IBM for high-end drives

For its first HDD facility in Southeast Asia (there is now a 2nd one in Thailand), IBM has invested a total of $300 million since 1994. The 2,000-employee factory in Kaku Bakit includes 4 buildings for a total of 500,000 square feet, including 60,000 square feet of cleanroom space.

Its GM is S.C. Leong, a veteran of Conner Peripherals, who explained to us that his plant essentially manufactured 10,000 and 15,000rpm enterprise drives, based on 3-inch disk media and designed in Japan.

Automation cannot be implemented, too extensively here, however, since the units must be customized according to the client (Compaq, Dell, EMC, HP).

This is also where Big Blue manufactures its LTO drives and Mylex RAID controllers.

IBM’s other HDA plants include one in Hungary (2.5- and 3.5-inch HDDs) and 2 in Thailand (1.0/2.5/3.5″). [NEC no longer makes IBM HDDs. -Ed.]

Maxtor and its MPUs

All of Maxtor’s HDDs (excluding Quantum units), in other words currently some 2.5 million per month, are assembled in a single factory in Ang Mo Kio. The building boasts 400,000 square feet on 2 floors, with between 6,500 and 7,000 employees, nearly half of whom are Malaysian, according to Larry Tan, VP of human resources.

The assembly method, designed onsite, is highly original, since there is almost no robotics.

“Automation would be too expensive,” we were told.

All components are unpacked in a large receiving area, and subsequently distributed to what Maxtor calls MPUs, or Modular Process Units. There are 18 in all. These are workspaces roughly 50 feet in length in which a half dozen people are in charge of the manual assembly of the drives, including servo-writers. It takes 5mn to construct a single HDD, 4 of which may be put together simultaneously in the same unit. Once they emerge from the MPUs, the drives are tested and packaged.

Obviously, this process allows the company to easily adapt to a new drive design.

MKE: no entry

“We do not open our Singapore plant to the public. We are very sorry to be unable to accept you. Your consideration is highly appreciated.” Such was the official response of the Japanese headquarters to our request to visit the factory of Matsushita Kotobuki Electronics Industries Singapore Pte. Ltd. (MKS).

Undaunted, we decided to pay an unannounced call, not an easy feat since the Corporation Road is not indicated on any map. Furthermore, the rather grim, gray building is unmarked, with not so much as a sign.

The U-shaped building is enormous, built on several floors. In the large entry hall on the ground level, in the rear, are 2 Quantum offices. The small entrance to the plant is located one floor higher. After successive fruitless requests to penetrate further, we left with a glossy, uninteresting brochure about the Matsushita Electric group.

Seagate: the world’s largest HDD factory

It has 3 operations sites in Singapore, the first for the R&D of certain HDDs (for example, the desktop U series) and manufacturing processes in Science Park, the second for the manufacture of rigid magnetic disk media in Woodlands, the third for PCBs and drive assembly in Ang Mo Kio, i.e. next door to Maxtor. In all, the company currently employs 8,500 people on the island, down from 19,400 in 1997.

The Woodlands plant was built in 1996, and began production in 1997. One of 2 factories (where once there were 5) belonging to Seagate’s RMO (Recording Media Operations) division, its sister plant can be found in Milpitas, CA. Together, they have combined production capacity of 90 million disks per year, split evenly between the 2.

The Singapore facility represents a $50 million investment for the 170,000 square foot building, and another $150 million for equipment. The site employs a thousand people, most of them Malaysian woman with an average age of 20. Using substrates shipped from Limavady, Northern Ireland, the factory is capable of producing magnetic disks of 64, 84 and 95mm.

“We have what we call islands of automation. There is still some material movement by people. But each tool has its own automation attachment,” said Phil Maher, VP of RMO Asia operations. “Servo-writing is very expensive. There is actually a group that is trying to combine a kind of servo-writing operation with our final test.”

As with the company’s HDA facility, the factory operates around the clock, in 4 shifts 7 days a week. Seagate’s Ang Mo Kio plant is the largest single HDD factory in the world, with one million square feet, including 120,000 square feet of cleanroom, on 4 floors. The operation employs 5,000 people for HDA and another 1,000 for PCBA. The company cafeteria is capable of feeding 1,000 people simultaneously!

In addition to disk drives, the plant use to turn out LTO tape drives, but this activity has since been transferred to Malaysia.

According to T.H. Chee, Seagate’s VP of Singapore drive ops, this is where the company manufactures all its SCSI and FC interface disk drives, as well as the 7,200rpm IDE units, with more than half of the components supplied locally. 5,400rpm units are launched here, before assembly is shipped to other sites for completion. This factory will also produce the forthcoming 2.5-inch mobile drives designed in Longmont, CO.

* The Dynamics of HDD Industry Development in Singapore, by Poh-Kam Wong, National University of Singapore, p. 66. From Silicon Valley to Singapore: Location and Competitive Advantage in the Hard Disk Drive Industry, by David McKendrick, Richard Doner, and Stephan Haggard, Stanford University Press, 370 pages, $22.95

SEAGATE’S FACTORY OF THE FUTURE

During our visit of Seagate’s Singapore operations, the company hid the most interesting features of the site, which we only learned after the fact, from a well-placed source within the company.

In fact, the factory boasts a unique robot capable of fully assembling HDDs, from A to Z. This extraordinary machine is automatically fed the necessary components and is capable of assembling the entire drive, including testing and adding the label to the final product.

Furthermore, the robot, currently used for the assembly of Cheetah X15 models, is adaptable to different designs. According to our source, the machine, which was designed in Minneapolis, is 50 feet long by 10 feet wide.

The HDD maker often mentions its “Factory of the future” project, but has until now offered few details on the subject. The news of this robot’s existence raises a few interesting points:

1) Seagate has succeeded at what seemed impossible before: the automated assembly of an entire drive. Even MKE, until know considered the main expert in automation, is far from perfecting such a system [4 years ago we had a chance to check out MKE’s factory in Ireland, since closed, which was modeled after the company’s Japanese production lines. Although the automation was highly developed, what we saw then was several robots with specific assembly tasks for the drives, which moved down a conveyer belt, and not just one machine capable of all the assembly.]

2) The high degree of automation no doubt partly explains the huge wave of lay-offs in the company over the past few months, which will most likely continue.

3) Why has the company not yet officially revealed the existence of this robot – which could easily inspire a new gen of offspring? No doubt such an announcement could have led to the revaluation of the company, which might have altered the terms of its recent privatization in favor of some of its former shareholders

WESTERN DIGITAL PREFERS MALAYSIA

Once a significant presence in Singapore, WD is the only HDD maker to have withdrawn and placed all its eggs in the same basket in Kuala Lumpur, Malaysia. We spoke with CEO Matt Massengill on the subject.

SN: After closing a plant in Singapore last year, all of your HDD assembly is now concentrated in one factory in Kuala Lumpur, Malaysia. Isn’t this a bit dangerous?

MM: I don’t think so. First of all, the Malaysian government is very stable. We have facilities essentially in 2 separate buildings, so the likelihood of a facility issue is not too great. We have been in Malaysia for almost 30 years as a corporation, and therefore have very good relationships with the Malaysian government. So we’re not too concerned about that. Really, in order to be successful in this business, I think, to have excess cost operating multiple facilities is really a greater risk to the business than having manufacturing all in one place. It’s highly efficient, we’ve saved money, pulling almost $300 million a year out of our expenses by consolidating into one factory, and that factory is now producing twice the drives it used to produce, with half the labor and overhead costs. Very efficient.

Why did you leave Singapore when IBM, Maxtor, Seagate and MKE remain, and even continue to invest there?

We think that the costs of doing business in Singapore are far greater than doing business in Malaysia, and we’re committed to having the lowest-cost manufacturing model in the industry. We think that there is more readily available talent in Malaysia, there are more workers in Malaysia, there are beginning to be more engineers in Malaysia, it’s a bigger country with more people. Many of our suppliers operate in and around Malaysia and Thailand. And there too, the cost structures are far more favorable.

Do you have an automation business plan for Malaysia?

No, we use a sort of semi-automated plan, so certain of our manufacturing steps involve operators managing the equipment, but the equipment does the assembly. We will consider automation if we reach a point where the designs and the products remain stable enough to amortize the capital invested in automation. But the changes now are so rapid that it would be very expensive from our perspective to automate completely. That could change, though, and we’re always open to new strategies.

NEXT HDD MAKER IN SINGAPORE: HALO

In theory, the first rival to IBM’s Microdrive should emerge from JIT’s factories in 4Q01, or nearly 2 years after its announcement by Halo Data Devices. This is the planned schedule however delayed of the San Jose-based company for the world’s smallest HDD, in a 1-inch form factor, 3.3mm thick, thus fitting into a CompactFlash I slot (IBM’s model is CFII). Halo passed an accord last year with the Singaporean subcontract manufacturer JIT, acquired in December 2000 by Flextronics, to assemble the drives in a 15,000 square foot semi-automatic plant with 300 employees and maximum production capacity that should reach 200,000 units per month. Halo has set up an office in the country for the purpose of implementing production, with 12 people in place, most of whom cut their teeth at Conner Peripherals. General manager C.T. Low revealed to us that the first model will have 250MB capacity with a single head for a target price of under $299, followed 6 months later by either a 500MB CFI unit or a 1GB CFII device. Originally, the planned rotational speed was to have been 5,400rpm, but Halo has since come down to 4,500rpm, like IBM, in order to reduce the drive’s power consumption. For component suppliers, the firm selected Nidec for the motors, MMC for glass substrates, Read-Rite for the GMR heads and Saturn for the flex. Halo’s intended market initially will be digital cameras, MP3 players (Creative Technology is an investor), followed by PDAs and portable jukeboxes (Aiwa has already expressed interest, apparently).

If the number of exports emanating from Singapore has decreased, there has been a simultaneous increase in value, due primarily to the fact that drives manufactured in the country are, more and more frequently, high end devices. With growing automation, the workforce’s part in the manufacture of a disk drive should continue to decrease. Consequently, the current downside of elevated salaries in Singapore, which is the primary argument working in favor of rival Southeast Asian countries, will become less and less significant, suggesting that the island’s share of WW production will likely not shrink, and may in fact increase once again.

This article is an abstract of news published on issue 161 on June 2001 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter