Enterprise SSD Revenue Slid to $5.22 Billion for 3Q22

And will fall by another 20% for 4Q22.

This is a Press Release edited by StorageNewsletter.com on December 13, 2022 at 2:02 pm![]() This market report, published on December 5 2022, was written by Bryan Ao, senior analyst at market intelligence firm TrendForce Corp.

This market report, published on December 5 2022, was written by Bryan Ao, senior analyst at market intelligence firm TrendForce Corp.

The analyst company reports that the recent easing of tight supply for components has led to rising shipments for enterprise servers. Furthermore, ODMs for the most part have been able to sustain the momentum of data center build-out with the demand from ByteDance and the tenders issued by Chinese telecom companies.

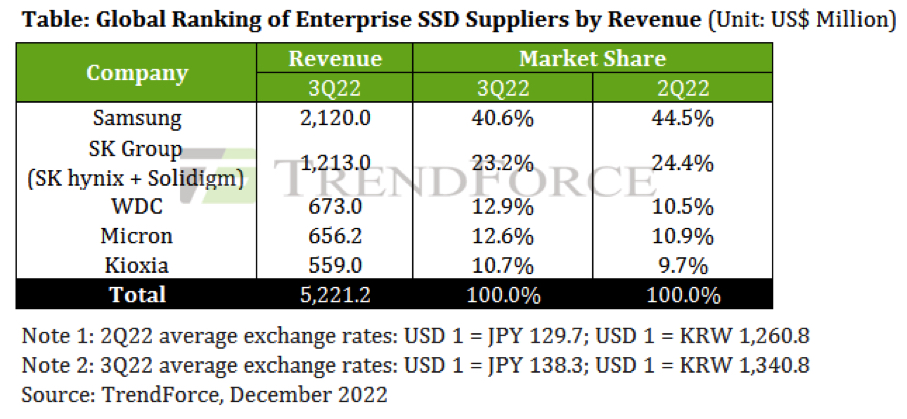

Nevertheless, the performance of the enterprise SSD market on the whole has been impacted by falling NAND flash prices. For 3Q22, the NAND flash industry’s enterprise SSD revenue dropped by 28.7% Q/Q to $5.22 billion.

Furthermore, all enterprise SSD suppliers recorded a negative performance for the period as well.

Regarding individual enterprise SSD suppliers’ revenue figures for 3Q22, Samsung posted around $2.12 billion. Its market share also shrank to 40.6% from 44.5% in 2Q22. Its performance was mainly dragged down by the decline in its NAND flash ASP. In the aspect of product development, SSDs featuring 128L NAND flash and PCIe 4.0 will remain its main offerings for enterprise storage during 2023.

Going forward, Samsung and its competitors could use the opportunities provided by the diversification of server CPUs to raise SSD shipments. Presently AMD is expanding its market share for server CPUs thanks to the widening adoption of its solutions among CSPs and ODMs. At the same time, CSPs are starting to develop their own CPUs. Also, penetration rate is climbing for server CPUs based on the ARM architecture, and new CPUs will support higher data transfer rates for storage solutions. Another noteworthy development is the Open Compute Project (OCP). The portion of enterprise SSDs that conform to the specs set under OCP is expected to grow in the future. All in all, there are new sources of demand that Samsung can tap into. However, the competition in the enterprise SSD market will intensify as well, so the company will face difficulties in keeping its market share at almost 50%.

SK Group (encompassing SK hynix and Solidigm) saw its enterprise SSD revenue dropped to about $1.21 billion for 3Q22. It is in the process of acquiring Intel’s NAND flash and SSD business, and the resulting benefits will become much more apparent next year. Solidigm will start mass producing PCIe 5.0 SSDs that support OCP specs in 2023. This will create opportunities for greater cooperation between SK Group and some North American CSPs. Also, samples of PCIe OCP products are now being qualified by server OEMs, so the demand for them is expected to keep rising. In addition to these developments, SK Group is close to completing its plan for developing a comprehensive line-up of enterprise SSDs and establishing market positions for these products. With a full range of flexibly priced TLC, QLC, and PLC offerings, It should be able to raise its market share for enterprise SSDs in the future.

WDC posted $673 million in enterprise SSD revenue for 3Q22. Even though it only began focusing on enterprise SSDs last year and has yet to finish customer sampling for its PCIe 4.0 products, the supplier has expanded its partnerships with North American clients and formulated a proactive pricing strategy. Therefore, it has a good chance to surpass most of its competitors in revenue for 4Q22. On the other hand, an examination of its client base reveals that the manufacturer apparently has no substantial follow-up plan for the development of products featuring the SAS interface. Furthermore, the revenue performance of its PCIe 3.0 products in 2023 is not expected to be as decent as it has been this year because customers will be making upgrades in order to obtain a higher data transfer rate. Therefore, the firm has to quickly get more clients to qualify its PCIe 4.0 products so that it can effectively retain its market share for enterprise SSDs.

Micron‘s enterprise SSD revenue slid to around $656.2 million for 3Q22 due to a marginal downward correction to server OEMs’ demand. Regarding product development, the company already launched 176L PCIe 4.0 enterprise SSDs early on, but customer sampling took longer than initially anticipated for these products. Thus, the supplier is also progressing slower than originally expected in ramping up shipments of PCIe enterprise SSDs as a whole, and SATA currently remains as the mainstay in supplier’s offerings. TrendForce believes raising shipments of PCIe 4.0 products will be one of Micron’s priorities for next year. With market growth gradually slowing down for SATA products, the vendor will be more constrained in its attempt to increase enterprise SSD revenue.

Kioxia began stepping up shipments of its PCIe 4.0 products in 3Q22. Meanwhile, demand was holding steady for its SAS products. Hence, the supplier’s enterprise SSD revenue came to about $559 million. Looking ahead, the firm will commence mass production for PCIe 5.0 SSDs near the end of this year. Moreover, the supplier has made sure that the specs of its PCIe products support OCP. As for 2023, it has a chance to raise its enterprise SSD revenue over the quarters as more clients qualify its PCIe products. TrendForce also believes Kioxia will be able to grow its market share due to having a comprehensive range of offerings that encompass SATA, PCIe, and SAS. However, the manufacturer has to further improve the flexibility of its supply chain. Resolving this urgent issue will determine whether the supplier can maintain stability in meeting clients’ demand.

Moving into 4Q22, economic headwinds have compelled companies across most sectors to scale back equipment-related expenditure. Meanwhile, server OEMs have taken steps to rein in the rising inventory, so the momentum of their procurement activities have slowed down noticeably. Looking specifically at China, a turnaround in its demand situation is not expected to occur in the near future as there will not be another wave of server-related tenders coming forth. With supply glut rapidly worsening across the whole NAND flash market, the overall average contract price (or the ASP) of enterprise SSDs is projected to fall by more than 20% Q/Q for 4Q22. This, in turn, will also lead to a Q/Q decline of more than 20% in enterprise SSD revenue.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter