HPE: Fiscal 4Q22 Financial Results

HPE: Fiscal 4Q22 Financial Results

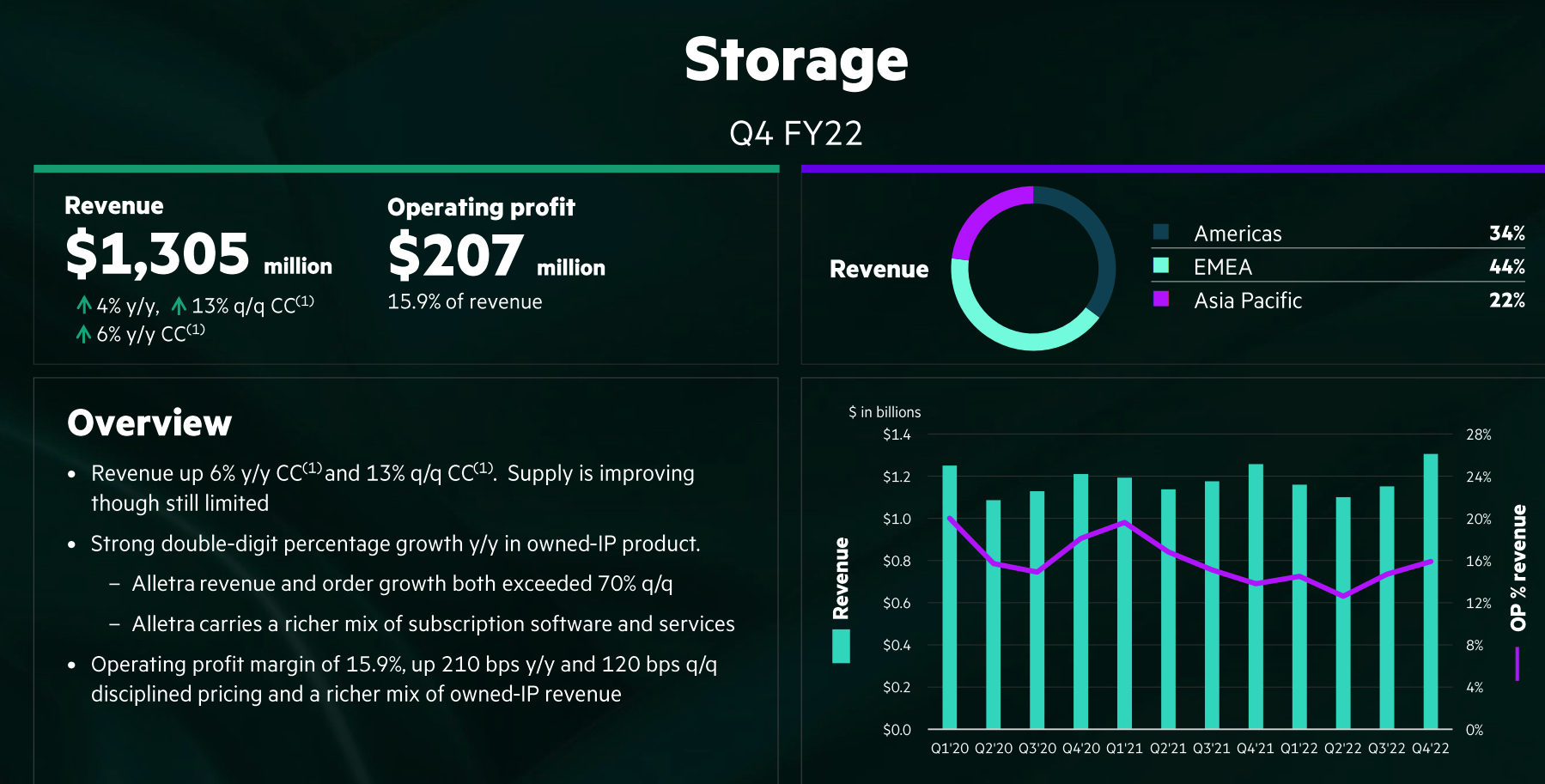

Storage up 4% Q/Q and 13% Y/Y at $1.3 billion, flat for FY22 at $4.7 billion

By Jean Jacques Maleval | December 1, 2022 at 2:02 pm| (in $ million) | 4FQ21 | 4FQ22 | FY21 |

FY22 |

| Revenue for storage only |

1,257 | 1,305 | 4,760 | 4,711 |

| Growth | 4% | -1% |

||

| Earnings before taxes | 173 | 207 | 775 | 682 |

The 3 WW biggest storage companies in subsystems recorded good results for their more recent financial quarter:

- NetApp in 2FQ23 got its highest historical quarterly revenue at $1,663 million since $1,680 million in 4FQ22.

- Dell storage revenue in 3Q23 was at $4.4 billion, up 11% Y/Y and 2% Q/Q, 3rd consecutive quarter of growth.

- It is also the case for HPE.

Hewlett Packard Enterprise Development LP announced financial results for the fourth quarter and full-year, ended October 31, 2022.

Representing 16% of global sales, storage revenue was $1.3 billion, up 13% Y/Y and up 4% from the prior-year period in actual dollars and 6% when adjusted for currency, with 15.9% operating profit margin, compared to 13.8% from the prior-year period, and up 120 basis points sequentially, with richer mix of owned-IP revenue.

It’s the best historical quarter in term of storage revenue since at least FY17.

Storage growth was led by AFA and HCI. Alletra is one of the fastest ramping new products ever and grew revenue 100% sequentially. In total, revenue from company’s own IP, margin-rich products rose strong double digits in 4FQ22 and contributed to an annual operating margin of 15.9%, which represents a yearly gain of 210 basis points and a sequential gain of 120 basis points.

With respect to Pointnext operational services, combined with storage services, orders grew sequentially and for the year rose mid-single digits in constant currency despite the exit of Russia and Belarus business.

In 2023, the manufacturer expects to see an acceleration of that portfolio to HPE Alletra, which had 100% growth sequential. And that comes also with a great attach of Pointnext OS. And also, the company drives that data protection strategy, the incremental value comes from backup and recovery and DR and ransomware offers. It has now those offers integrated into HPE GreenLake. And so that combination is what’s driving the mix shift to more software and services rich offers.

Revenue for HPE storage since FY17

(in $ million)

| Fiscal quarter |

Revenue |

Q/Q Growth |

Y/Y growth |

| FY17 | 3,280 | 3% |

|

| FY18 |

3,706 |

13% | |

| 1Q19 | 975 | 3% |

|

| 2Q19 | 942 | -3% |

|

| 3Q19 | 844 | -10% |

|

| 4Q19 | 848 | 0% |

|

| FY19 |

3,609 | -3% | |

| 1Q20* |

1,250 | -8% |

|

| 2Q20 | 1,086 | -18% |

|

| 3Q20 | 1,128 | -10% |

|

| 4FQ20 | 1,217 | 8% |

|

| FY20 | 4,681 | -10% | |

| 1FQ21 | 1,193 | -2% |

|

| 2FQ21 | 1,137 | -5% |

|

| 3FQ21 | 1,176 | 4% |

|

| 4FQ21 | 1,257 | 3% | |

| FY21 | 4,763 | 2% | |

| 1FQ22 | 1,156 | -8% | |

| 2FQ22 | 1,098 | -3% |

|

| 3FQ22 | 1,152 | 5% |

|

| 4FQ22 | 1,305 | 4% |

|

| FY22 | 4,711 | -1% |

* HPE changes its accounting results in 1FQ20.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter