Macronix: Fiscal 2Q22 Financial Results

Macronix: Fiscal 2Q22 Financial Results

Flat sales but confortable net income

This is a Press Release edited by StorageNewsletter.com on August 2, 2022 at 2:02 pm| (in billion NT$) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 11.4 | 11.3 | 21.1 | 22.9 |

| Growth | -1% | 9% | ||

| Net income (loss) | 1.9 | 2.9 | 2.8 | 5.9 |

Macronix International Co., Ltd. announced the financial results for the second quarter ended June 30, 2022.

Summary

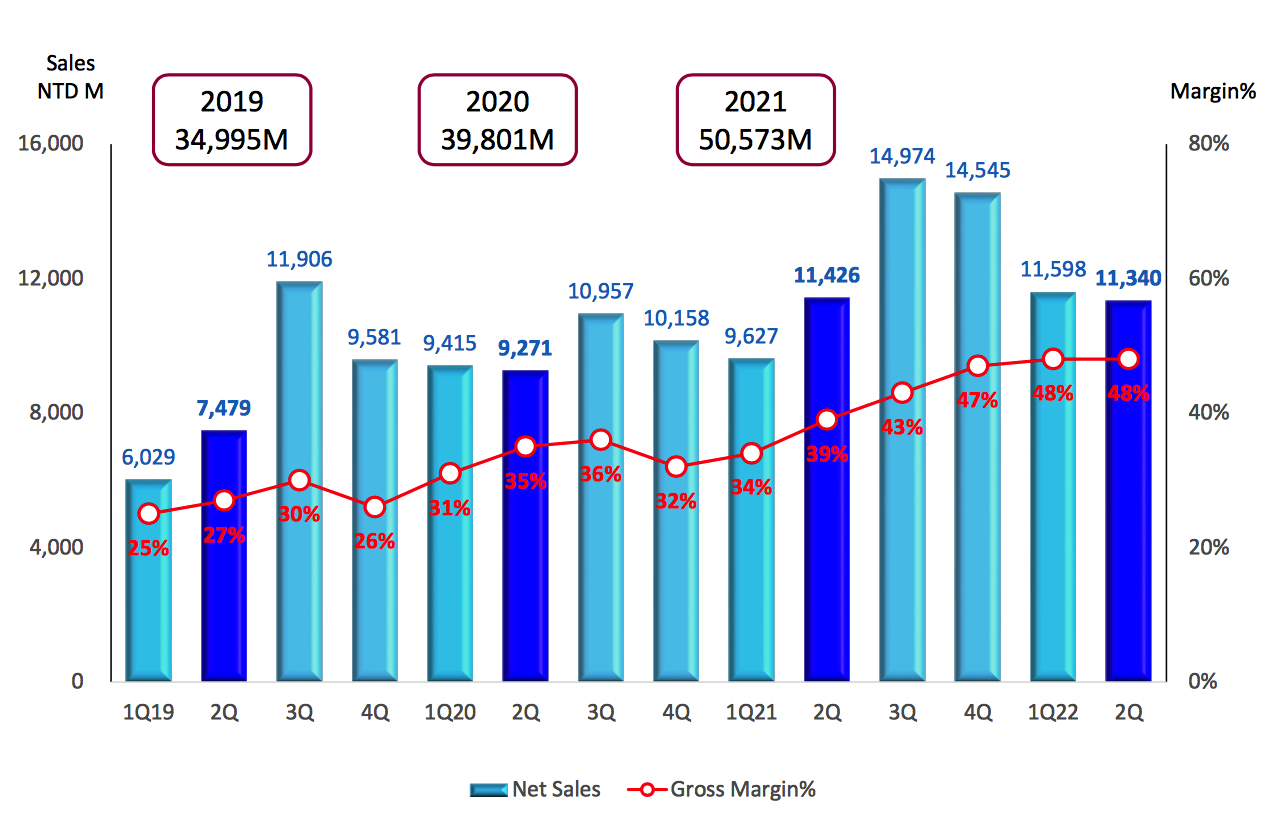

• Net sales was NT$11,340 million (US$385.5 million).

• Gross profit was NT$5,465 million (US$185.8 million) with 48.2% gross margin.

• Operating income was NT$2,980 million (US$101.3 million) with 26.3% operating margin.

• Net income was NT$2,935 million (US$99.8 million).

• EPS was NT$1.59; book value per share was NT$26.36.

In 2FQ22, net sales was NT$11,340 million (US$385.5 million), a decrease of 2% Q/Q and 1% Y/Y.

Gross profit and gross margin for this quarter was NT$5,465 million (US$185.8 million) and 48.2%, respectively. Gross profit decreased 2% Q/Q and increased 22% Y/Y.

Operating income for this quarter was NT$2,980 million (US$101.3 million), a decrease of 7% Q/Q and an increase 29% Y/Y.

Net income after tax was NT$2,935 million (US$99.8 million).

EPS was NT$1.59 (US$0.05).

The book value was NT$26.36 per share.

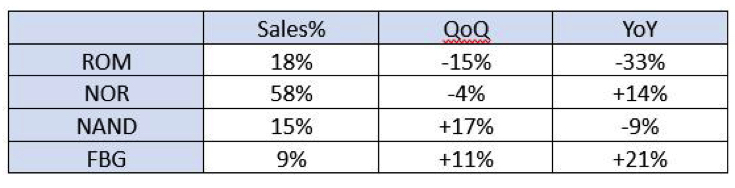

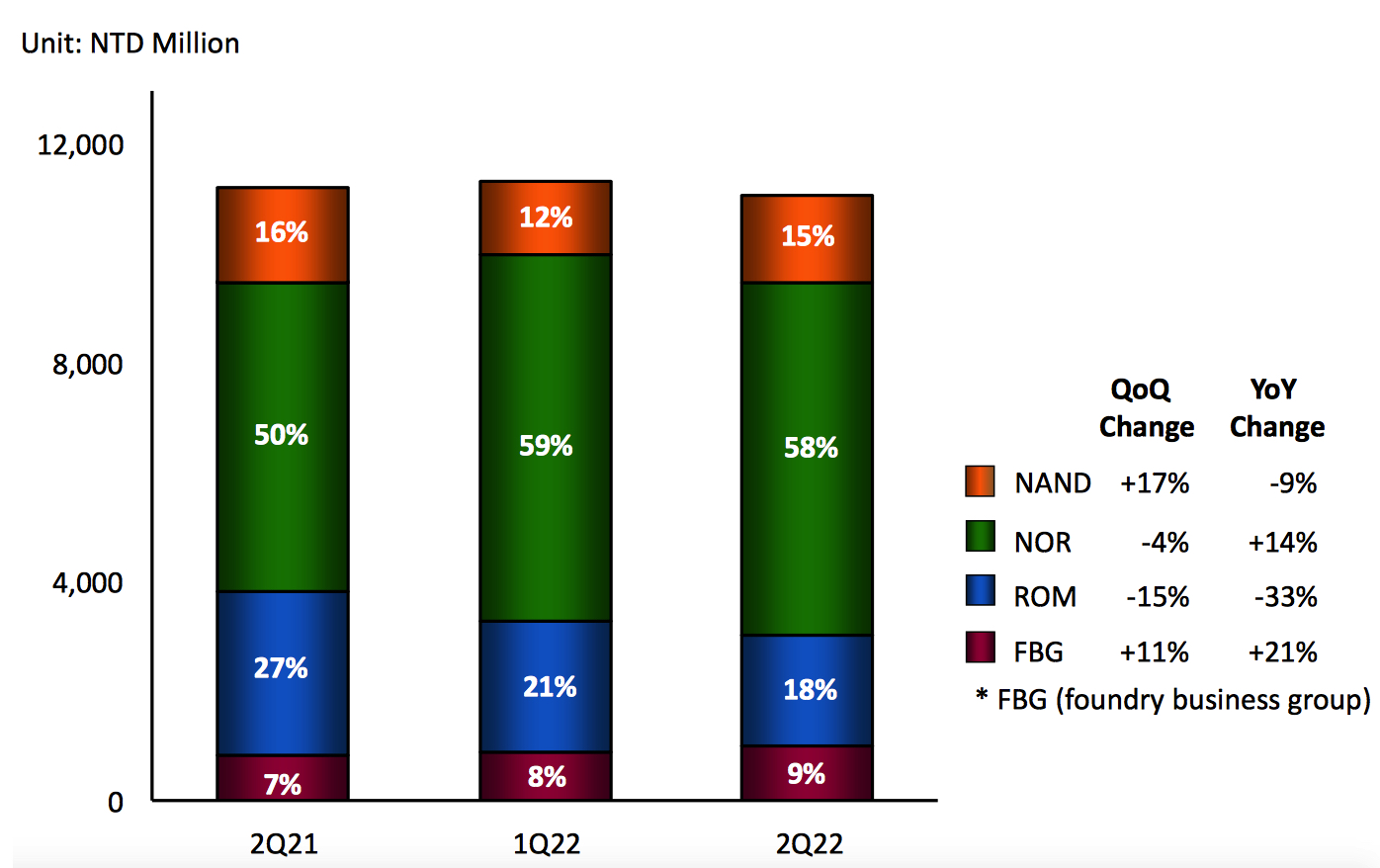

Quarterly sales breakdown

Comments

Sustainable sales and margin growths

Quarterly sales by products

ROM business

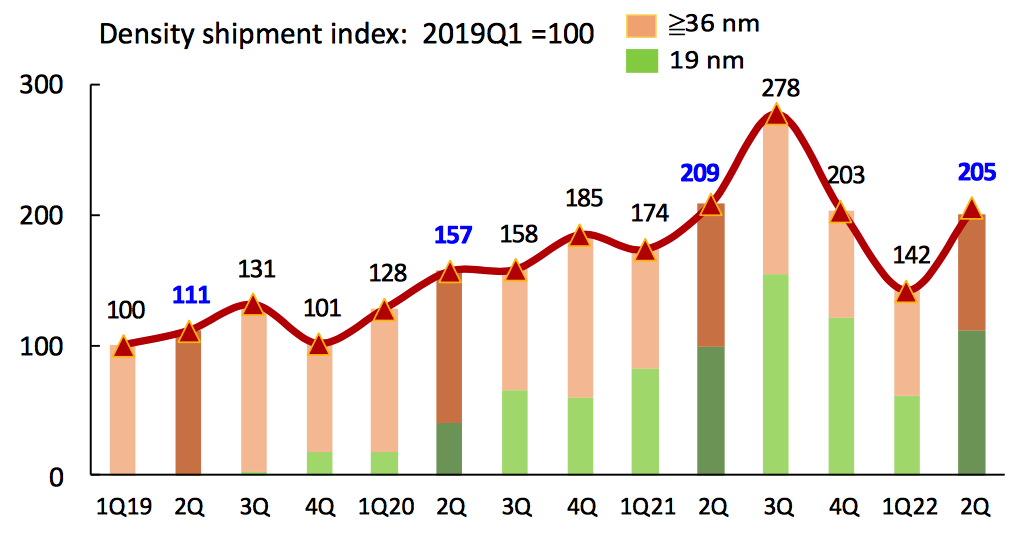

1H22 density shipments in-lined with historical seasonality

NOR business

- 2Q22 density shipments -10% Q/Q mainly due to China zero-Covid policy cause supply

chain disruption, and components shortage of automotive industry - Demand from USA, Europe, and Japan remains stable

- 55nm representing 58% of density shipments in 2Q22

- Continued to focus on developing high density products with more than 50% of revenue

ASP remained stable, driven by the demand from high-end application customers

SLC NAND

19nm represented 58% of density shipment in 2Q22.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter