Nutanix: Fiscal 2Q22 Financial Results

Nutanix: Fiscal 2Q22 Financial Results

Net loss of $115 million (but decreasing sharply) for revenue growing 19% at $413 million, bad outlook

This is a Press Release edited by StorageNewsletter.com on March 4, 2022 at 2:02 pm| (in $ million) | 2Q21 | 2Q22 | Growth | 6-month 21 |

6-month 22 |

Growth |

| Revenue |

346.4 | 413.1 | 19% | 659.1 | 791.6 | 20% |

| Net income (loss) | (287.4) | (115.1) | (552.4) | (534.9) |

Nutanix, Inc. announced financial results for its second quarter ended January 31, 2022.

“Our second quarter reflected continued solid execution, demonstrating strong Y/Y top and bottom-line improvement,” said Rajiv Ramaswami, president and CEO. “We also see growing momentum towards adoption of hybrid multicloud models and believe the recent launch of our hybrid multicloud solution portfolio will strengthen our ability to deliver the solutions our customers need.“

“In our second quarter, we achieved record ACV billings, which grew 37% Y/Y, and saw 19% Y/Y revenue growth,” said Duston Williams, CFO. “We saw good execution on our building base of subscription renewals and generated positive free cash flow in the quarter – both reflections of continued progress on our subscription model.“

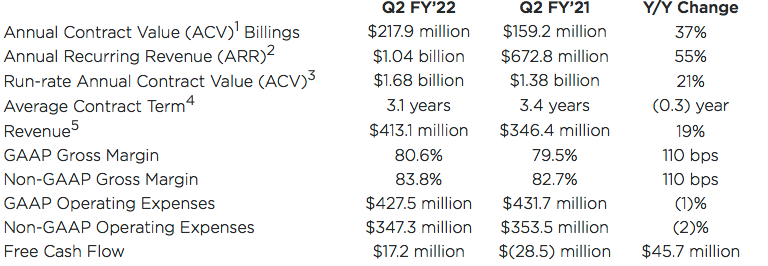

2FQ22 financial summary

3FQ22 outlook

ACV Billings: $195-$200 million

Revenue: $395-$400 million

Non-GAAP Gross Margin: Approximately 82%

Non-GAAP Operating Expenses: $365-$370 million

Weighted Average Shares Outstanding: Approximately 222 million

FY22 outlook

ACV Billings: $760-$765 million

Revenue: $1.625-$1.630 billion

Non-GAAP Gross Margin: Approximately 82.5%

Non-GAAP Operating Expenses: $1.465-$1.470 billion

Comments

Revenue for 2FQ22 was $413 million, a 19% Y/Y growth, above guidance range of $400 million to $410 million and ahead of the Street consensus number of $407 million.

Once more, the HCI leader never was profitable since as far as 2012 now with more than $3.1 billion cumulative loss.

ACV billings for 2FQ22 were $218 million, reflecting 37% Y/Y growth, above guidance range of $195 million to $200 million and ahead of the Street consensus number of $198 million.

Average contract term lengths overall stayed steady at 3.1, the same as in 1FQ22. ARR as of the end of 2FQ22 was $1.04 billion, growing yearly 55%.

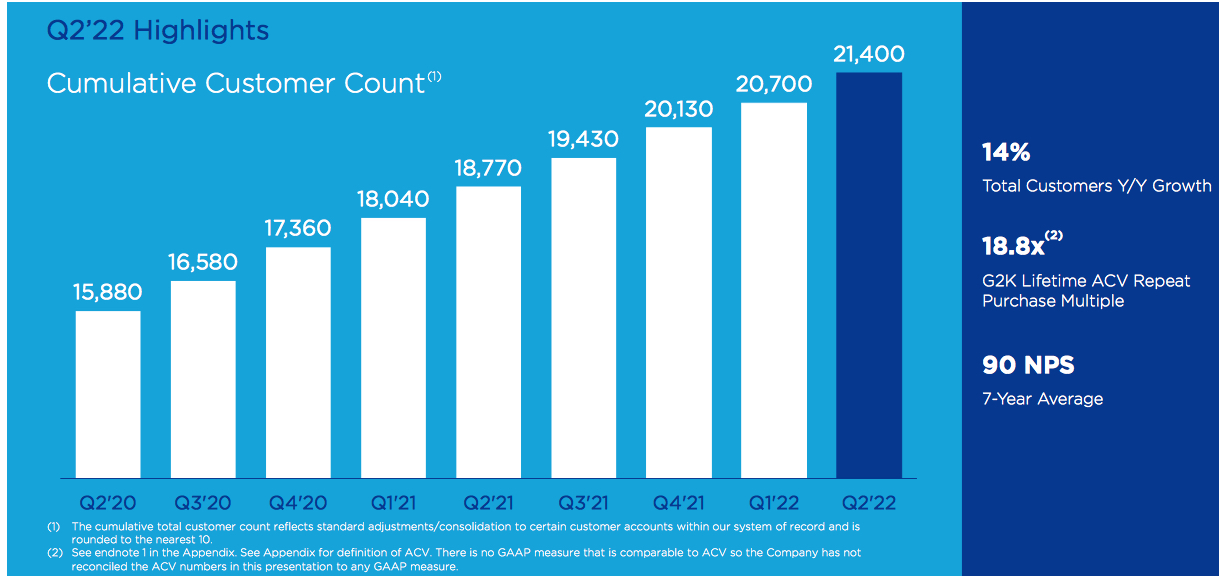

2FQ22 sales rep productivity was in line with forecast and net sales reps were flat in this quarter. The company adds of 700 new customers in 2FQ22 vs. 1FQ22 new ones of 560, and the 2FQ21 new logo count of 730.

The firm closed the quarter with cash and short-term investments of $1.29 billion, up from $1.28 billion in 1FQ22.

Customer growth

Next quarter, the company expects revenue between $395 and $400 million, down Q/Q 4% to 3%.

The revenue guidance of $1.625 billion to $1.630 billion or up yearly 16% to 17*%, compares to the previous guidance range of $1.615 billion to $1.630 billion and vs. the previous consensus estimate of $1.626 billion.

Revenue and loss of Nutanix

(in $ million)

| FY ended in July |

Revenue | Loss |

| 2012 | 6.6 | 14.0 |

| 2013 | 30.5 | 44.7 |

| 2014 | 127.1 | 84.0 |

| 2015 | 241.4 | 126.1 |

| 2016 | 444.9 | 168.5 |

| 2017 | 845.9 | 379.6 |

| 2018 | 1155 | 297.2 |

| 2019 | 1136 | 621.2 |

| 2020 | 1308 | 872.9 |

| 2021 |

1,394 | 1,034 |

| 1FQ22 |

378.5 | 419.9 |

| 2FQ22 |

413.1 | 115.1 |

| 3FQ22 (estim.) |

395-400 | NA |

| FY22 (estim.) |

1,625-1,630 | NA |

| Total | 3,144 |

($238 million IPO in 2016)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter