Dell: Fiscal 4Q22 Financial Results

Dell: Fiscal 4Q22 Financial Results

Storage flat for 4FQ22 and FY22

This is a Press Release edited by StorageNewsletter.com on February 25, 2022 at 2:02 pm| (in $ million) | 4FQ21 | 4FQ22 | FY21 | FY22 |

| Revenue for storage only |

4,510 | 4,499 | 16,410 | 16,465 |

| Growth | -0% | 0% |

Dell Technologies, Inc. announces financial results for its fiscal 2022 fourth quarter and full year ended January 29, 2022.

FY22 revenue was a record $101.2 billion, up 17% over the prior year, fueled by record demand, execution, continued growth across all business units, and record PC shipments.

Following this announcement, shares fell sharply 4FQ22 missed expectations. They fell more than 6% in after-hours to $52.30.

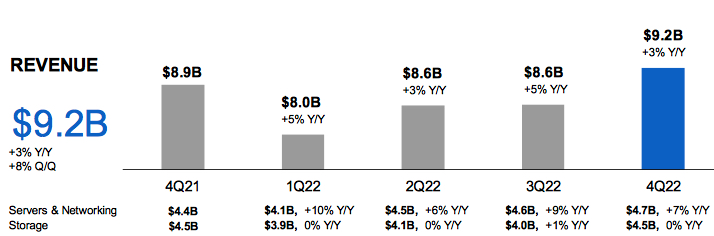

Infrastructure Solutions Group Revenue

Infrastructure Solutions Group revenue for 4FQ22 was $9.2 billion, up 3% Y/Y.

Storage revenue was $4.5 billion, while servers and networking revenue was $4.7 billion, up 7% Y/Y.

The companiy is ranked #1 in high-end, mid-range entry unstructured object, AFA, HCI and data protection, according to IDC.

Storage demand growth was up for a third consecutive quarter and in the high single digits.

Mid-range storage orders were up double digits in FY22 and PowerStore remains the fastest ramping storage product in firm’s history.

The company saw double-digit demand growth in the high end, driven by select enterprise customers, 25% demand growth for unstructured storage solutions and 8% growth for HCI. Within mid-range, PowerStore demand continued to ramp in 4FQ22, up 34% Q/Q and now approximately 50% of mid-range SAN mix. 26% of PowerStore buyers are new and 29% were repeat buyers.

Storage revenue was flat Y/Y due to the aforementioned backlog build and storage software and services content that gets deferred and amortized over time.

ISG operating income was $1.1 billion, down 7% due primarily to backlog growth, component inflation and logistics costs. Dell continue to take pricing actions to mitigate cost increases though component shortages and turbulent logistics markets remain risks.The vendor is still experiencing shortages of integrated circuits across a wide range of devices, including network controllers and micro controllers that go into its products and solutions. The result is an impact across client systems, servers and storage.

Noteworthy in 4FQ22 was the expansion of APEX Cloud Services portfolio with 2 new offers:

- APEX Multi-cloud Data Services, which deliver storage and data protection as a service with simultaneous access to all major public clouds through a single console. The solution allows customers to access the cloud services they want while maintaining control of their data on-premise, avoiding lock in and egress fees and enabling customers to meet regulatory and compliance requirements.

- APEX Backup Services, which provides scalable, secure data protection with centralized monitoring and management for SaaS applications, end points and hybrid workloads. The solution offers all-in-one protection with backup DR and long-term data retention and a 100% SaaS-based offering with no infrastructure to manage.

Storage revenue of Dell

(in $ million)

| Period | Revenue | Y/Y growth |

| FY11* |

2,295 |

5% |

| FY12* |

1,943 |

-15% |

| FY13* |

1,699 |

-13% |

| FY14* |

1,518 |

-11% |

| FY15* |

1,437 |

-5% |

| FY16* |

2,217 |

54% |

| FY17** |

8,942 |

303% |

| FY18 | 15,254 |

+71% |

| FY19 | 16,767 | +10% |

| 1FQ20 | 4,022 | -1% |

| 2FQ20 | 4,184 | 0% |

| 3FQ20 | 4,184 | +8% |

| 4FQ20 | 4,487 | -3% |

| FY20 | 16,767 | -0% |

| 1FQ21 |

3,758 | -7% |

| 2FQ21 |

4,011 | -4% |

| 3FQ21 |

4,149 | -7% |

| 4FQ21 |

4,409 | -2% |

| FY21 |

16,091 | -4% |

| 1FQ22 | 3,802 | 0% |

| 2FQ22 | 3,970 | -1% |

| 3FQ22 | 3.895 | 1% |

| 4FQ22 |

4,499 | -0% |

| FY22 |

16,465 |

0% |

* Without EMC

**without EMC for 1FQ17 and 2FQ17 following acquisition for $63 billion

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter