Commvault: Fiscal 3Q22 Financial Results

Commvault: Fiscal 3Q22 Financial Results

Record revenue increasing 8% Y/Y (but expected to be flat next quarter), and net income up 6x

This is a Press Release edited by StorageNewsletter.com on January 26, 2022 at 2:02 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 188.0 | 202.4 | 532.1 | 563.6 |

| Growth | -9% | 6% | ||

| Net income (loss) | 1.7 | 10.0 | (37.2) | 25.6 |

Commvault Systems, Inc. announced its financial results for the third quarter ended December 31, 2021.

“The team executed well across the board, delivering another record quarter,” said Sanjay Mirchandani, president and CEO. “Increasingly, customers are turning to us because we provide one platform for software and SaaS offerings to address a multitude of data management needs. This is fueling our growth and accelerating our journey to a cloud-first recurring revenue model.”

Total revenues for 3FQ22 were $202.4 million, an increase of 8% Y/Y. Total recurring revenue was $164.4 million, representing 81% of total revenue.

Annualized recurring revenue (ARR), which is the annualized value of all active recurring revenue streams at the end of the reporting period, was $561.2 million as of December 31, 2021, up 11% from December 31, 2020.

Software and products revenue was $98.6 million, an increase of 11% Y/Y. This yearly increase was driven by a 24% increase in larger deals (deals greater than $0.1 million in software and products revenue).

This larger deal revenue represented 76% of software and products revenue in 3FQ21. It increased 20% Y/Y to 225 deals for 3FQ21. The average dollar amount of this revenue transactions was approximately $332,000.

Services revenue in the quarter was $103.8 million, an increase of 4% Y/Y. The increase was driven primarily by the increase in Metallic software-as-a-service revenue.

On a GAAP basis, income from operations (EBIT) was $12.4 million for 3FQ22 compared to $2.7 million in 3FQ21. Non-GAAP EBIT was $43.1 million in 3FQ22 compared to $37.3 million in 3FQ21.

Operating cash flow totaled $26.8 million for 3FQ22 compared to $17.0 million in 2FQ22. Total cash and short-term investments were $233.7 million as of December 31, 2021 compared to $397.2 million as of March 31, 2021.

During 3FQ22, Commvault repurchased approximately 1.3 million shares of its common stock totaling $85.3 million at an average price of around $65.72 per share.

Comments

Commvault exceeded $200 million in quarterly total revenue for the first time in company history. $202.4 million is better than expected lass quarter ($195 million). Former record was $191.3 million in 4FQ21.

Commvault exceeded $200 million in quarterly total revenue for the first time in company history. $202.4 million is better than expected lass quarter ($195 million).

And non-GAAP EBIT was a record $43 million.

Also the company had the best quarter for new customer additions in years, including several Fortune 500 wins. It moved nearly 2.5EB of customer data to the cloud, representing approximately a 5x growth in the past 3 years.

And Metallic continue to set new financial and operating milestones. the firm added over 400 new Metallic logos, 60% of which were net new. Total customers increased approximately 40% Q/Q to nearly 1,500, and Metallic landed its first-ever 7-figure ACV deal. Over 40% of 3FQ22 deals involved more than one product. Over 50% of Metallic customers are using another company's product, and approximately 30% of Metallic customers are using multiple Metallic offerings.

f

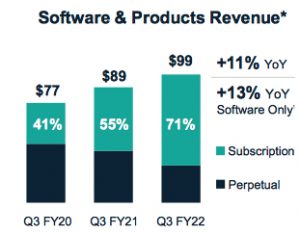

* does not include SaaS revenue

Subscriptions represented a record 71% of software and products revenue.

In FY22, the firm moved primarily to a software-only model. In Q3, software-only growth, excluding appliance pass through revenue, was approximately 13% Y/Y. Revenue from software transactions over $100,000 increased 24% Y/Y and represented a record 76% of software revenue. The volume of these transactions grew 20% Y/Y and the average deal size increased 3% to $332,000.

Third quarter subscription software revenue increased 45% Y/Y to $70 million. Subscription licenses represented 71% of total software revenue, an increase from 63% last quarter and 55% a year ago.

Total annual recurring revenue, or ARR, increased 11% Y/Y to $561 million. On a constant currency basis, ARR was up 13% Y/Y, is being driven by new subscription customers and Metallic.

Total recurring revenue, which includes subscription software, maintenance support services, and SaaS grew 17% Y/Y to $164 million. Recurring revenue represented 81% of total revenue in 3FQ22, an increase from 79% in 2FQ22 and 74% in 3FQ21.

Against this backdrop, Commvault are raising 4FQ22 revenue guidance. It expect now software revenue of approximately $97 million and total revenue flat at approximately $202 million. It means sales of around $765.6 million for FY22 or an increase of 6% compared to FY21.

And non-GAAP EBIT was a record $43 million.

Also the company had the best quarter for new customer additions in years, including several Fortune 500 wins. It moved nearly 2.5EB of customer data to the cloud, representing approximately a 5x growth in the past 3 years.

And Metallic continue to set new financial and operating milestones. the firm added over 400 new Metallic logos, 60% of which were net new. Total customers increased approximately 40% Q/Q to nearly 1,500, and Metallic landed its first-ever 7-figure ACV deal. Over 40% of 3FQ22 deals involved more than one product. Over 50% of Metallic customers are using another company's product, and approximately 30% of Metallic customers are using multiple Metallic offerings.

* does not include SaaS revenue

Subscriptions represented a record 71% of software and products revenue.

In FY22, the firm moved primarily to a software-only model. In Q3, software-only growth, excluding appliance pass through revenue, was approximately 13% Y/Y. Revenue from software transactions over $100,000 increased 24% Y/Y and represented a record 76% of software revenue. The volume of these transactions grew 20% Y/Y and the average deal size increased 3% to $332,000.

3FQ22 subscription software revenue increased 45% Y/Y to $70 million. Subscription licenses represented 71% of total software revenue, an increase from 63% last quarter and 55% a year ago.

Total annual recurring revenue, or ARR, increased 11% Y/Y to $561 million. On a constant currency basis, ARR was up 13% Y/Y, is being driven by new subscription customers and Metallic.

Total recurring revenue, which includes subscription software, maintenance support services, and SaaS grew 17% Y/Y to $164 million. Recurring revenue represented 81% of total revenue in 3FQ22, an increase from 79% in 2FQ22 and 74% in 3FQ21.

Against this backdrop, Commvault are raising 4FQ22 revenue guidance. It expect now software revenue of approximately $97 million and total revenue flat at approximately $202 million. It means sales of around $765.6 million for FY22 or an increase of 6% compared to FY21.

Revenue and net income (loss) for Commvault in $million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 | 176.2 | 6% |

(8.6) |

| 2Q19 | 169.1 | 1% |

0.9 |

| 3Q19 | 184.3 | 2% |

13.4 |

| 4Q19 |

181.4 | -2% |

(2.2) |

| FY19 | 711.1 | 2% |

3.6 |

| 1Q20 | 162.2 | -8% | (6.8) |

| 2Q20 | 167.6 | -1% |

(7.1) |

| 3Q20 | 176.4 | -4% | (0.7) |

| 4Q20 | 164.7 | -9% | (5.6) |

| FY20 |

670.9 |

-6% |

(5.6) |

| 1Q21 | 173.0 | 7% | 2.3 |

| 2Q21 | 171.1 | 2% | (41.2) |

| 3FQ21 | 188.0 | 7% | 1.7 |

| 4FQ21 | 191.3 | 16% | 6.3 |

| FY21 | 723.5 | 8% | (31.0) |

| 1FQ22 |

183.4 | 6% | 13.9 |

| 2FQ22 |

177.8 | 4% | 1.7 |

| 3FQ22 | 202.4 | 8% | 10.0 |

| 4FQ22 (estimations) | 202 | 4% | NA |

| FY22 (estimations) | 765.6 | 6% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter