History (1998): ATL Now Quantum Company

Acquisition for $300 million

By Jean Jacques Maleval | February 3, 2022 at 2:01 pmQuantum has decided to take the plunge with DLT library activity, by acquiring one of the leaders in the field, ATL Products, for an all-stock transaction valued at approximately $300 million.

The acquisition is subject to ATL shareholders’ approval, which should come in September.

ATL will become a wholly-owned subsidiary of Quantum, whose existing library business will be integrated into its new subsidiary, reporting to Peter van Cuylenburg, president of Quantum’s storage p roducts group.

For Quantum, the acquisition could be seen in 2 lights, positive and negative.

Negative first

Will the sole manufacture of DLT drives now seek also to dominate the DLT library sectors, which currently numbers more than 10 companies in competition with each other? All those great Quantum customers could easily become much more suspicious of their furnisher from now on. If ever there is a shortage of DLT drives – something that’s occurred before – won’t Quantum be that much more likely to give priority to its own subsidiary, ATL?

Certain companies – ATL was once among them – are completely at Quantum’s mercy, for the price of drives for which Quantum enjoys a monopoly, for the quality production of its product line in only one facility (Colorado Springs, CO), for timely shipments of future generation products.

Quantum’s cannibalization of the DLT market could possibly benefit the future LTO, which anticipates several drive sources, with one of the cartridges, the Ultrium, very close physically to the DLT cartridge, and thus demanding very little change from DLT library designers who may be tempted to switch to a less risky technology.

Think back to the golden age of Exabyte, once in the identical situation to Quantum’s, with a single source of drives from a company that had its own line of 8mm libraries, a fact that did not impede the arrival of other 8mm library makers.

Then positive

For Quantum, it’s a sweet deal. Given that before the company offered only low end libraries with limited success, it now can cover the entire DLT library sector, from low to high end.

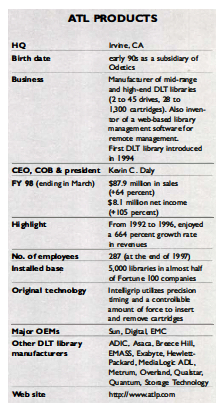

The compatibility of the 2 firms is clear. While Quantum was already realizing comfortable margins on its drive and media, it will now double the take each time it sells a library, with profits that are far from skimpy, as ATL’s financial results prove (see box below).

Better yet, the firm will be able to adapt its strategy perfectly to the market, and even gain a lead time on the competition since it will have, as it already has, a good knowledge of competitor library manufacturers’ sales.

It’s worth noting in conclusion that both companies are working with TeraStor, Quantum for the drives, ATL for the cartridge libraries.

This article is an abstract of news published on issue 125 on June 1998 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter