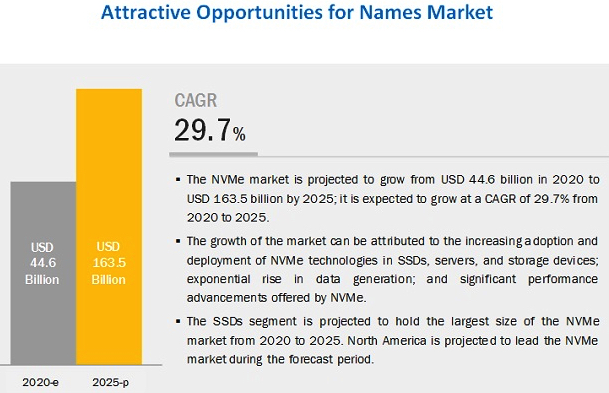

NVMe Market to Grow From $44.6 Billion in 2020 to $163.5 Billion by 2025

29.7% CAGR

This is a Press Release edited by StorageNewsletter.com on January 6, 2022 at 2:02 pmMarketsandMarkets Research Private Ltd. published a 132-page report on the NVMe market by product (SSDs, servers, AFAs, adapters), deployment location (on-premise, remote, hybrid), communication standard (Ethernet, FC, IB), vertical, and region, with forecast to 2025.

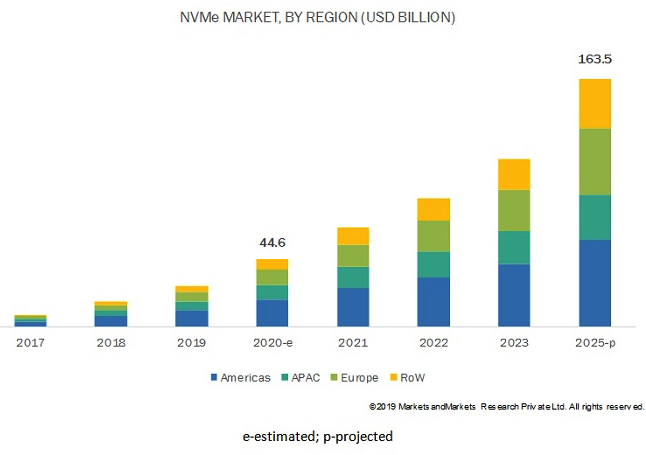

The global NVMe) market size is projected to grow from $44.6 billion in 2020 to $163.5 billion by 2025 or a CAGR of 29.7%.

The major factors driving the growth of the market include the increasing adoption of NVMe technologies in SSDs, servers, and storage appliances; exponential rise in data gen and evolving demand for storage and processing infrastructure and significant performance advancements offered by NVMe.

NVMe SSDs projected to hold largest share in NVMe market during forecast period

They hold the largest market because they are adopted widely as a storage solution in most of the verticals. This widespread adoption is mainly due to the benefits provided by NVMe SSDs. SSDs were introduced into the market as a storage device that provides faster R/W operations and reduced latency compared with HDDs. NVMe is an interface that was designed specifically for SSDs, and NVMe SSDs were introduced to provide better storage and processing operations, and the lowest latency possible when compared with HDDs and traditional SSDs (SATA and SAS). Due to these benefits, SSDs hold the largest share of the NVMe market.

Hybrid deployments expected to grow at highest CAGR during forecast period

A hybrid system is a combination of both on-premise and remote deployments, where active data are stored in the on-premise system, and inactive data are shifted to remote location-based systems. This is also known as DR management. The adoption of hybrid deployment model is increasing as companies need to keep a backup of the crucial data in case any mishap happens on the premise. This type of deployment comprises the advantages and disadvantages of both on-premise and remote deployments. Hybrid NVMe servers and storage solutions are opted by enterprises that want to leverage the benefits provided by other deployment types while keeping the capital expenditure lesser than on-premise deployment.

North America held largest size of NVMe market in 2019

North America, being an early adopter of storage technologies, captures the largest share of the NVMe market, followed by Europe and APAC. Every industry in North America is being digitized and demands advanced storage solutions. North America is a key market for notebooks, laptops, and tablets. The dynamics of computing have changed for the developers of notebooks, tablets, and laptops in this region, with more emphasis on saving the time of consumers by speeding up data transfer. Hence, there has been a strong push for using NVMe SSDs in these devices to save time, speed up data transfer, and achieve high performance levels. Moreover, USA is home to leading storage companies such as Dell, NetApp, HPE, Hitachi, Western Digital, and Intel.

Key Market Players

Key players in the NVMe market include Samsung Electronics Co., Ltd., Western Digital Corporation, Intel Corporation, Dell EMC, and Hewlett Packard Enterprise.

Intel is a leading player in the global NVMe market. It has adopted a virtuous cycle of growth, which enables the expansion of memory, cloud, data centers, and connected devices. The demand for storage is increasing as a large number of components and devices are becoming increasingly connected to each other. This is being effectively addressed by the company’s advanced memory technologies and storage devices solutions. To be technologically competitive, the company invests mainly in R&D. For instance, in 2018, Intel invested approximately $13.5 billion in R&D. These efforts help the company constantly upgrade and expand its portfolio of products and services, gain an edge over its competitors, and exploit new opportunities. In addition, Intel focuses on product launches as an effective strategy to expand its SSD business WW. For example, in February 2018, the company launched SSD DC P4510 Series and P4511 Series for data center applications. In March 2018, the company launched the Optane SSD 800P, which is available in the M.2 22890 form factor with NVMe PCIe 3.0 interface.

Covered companies: Samsung Electronics Co., Ltd., Western Digital Corporation, Intel Corporation, Dell EMC, Hewlett Packard Enterprise, Broadcom Inc., Micron Technology, Inc., Cisco Systems, Inc., Toshiba Corporation, NetApp, Inc., IBM Corp., Microchip Technology Inc., Marvell Technology Group, Seagate Technology LLC, SK hynix Inc., Renesas Electronics Corporation, Mellanox Technologies Ltd., Pure Storage, Inc., Super Micro Computer, Inc., and Huawei Technologies Co., Ltd

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter