Quantum: Fiscal 2Q22 Financial Results

Quantum: Fiscal 2Q22 Financial Results

Q/Q revenue and net loss up as usual, 9% and 12% respectively for 3-month period

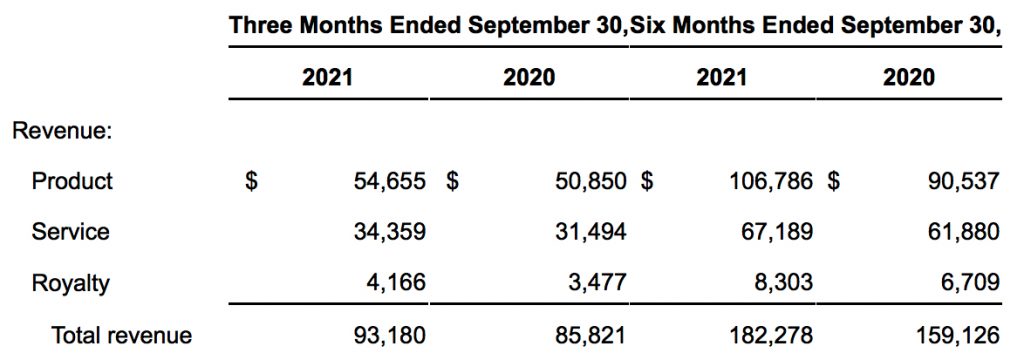

This is a Press Release edited by StorageNewsletter.com on November 8, 2021 at 2:02 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 85.8 | 93.2 | 90.5 | 106.8 |

| Growth | 9% | 18% | ||

| Net income (loss) | (4.6) | (9.3) | (15.3) | (13.4) |

Quantum Corporation announced financial results for its fiscal second quarter ended September 30, 2021.

2FQ22 Financial Summary and Recent Highlights

- Revenue grew 9% Y/Y to $93.2 million, exceeding the high-end of the guidance range

- GAAP net loss was $9.3 million, or ($0.16) per share; adjusted non-GAAP net income was $0.1 million, or $0.00 per diluted share

- Ended the quarter with $50.0 million in backlog, compared to $30.0 million in the prior quarter

- Software and recurring licensing customers grew 30% sequentially, while bookings were up greater than 70%

- Adjusted EBITDA was $5.3 million, exceeding the high-end of the guidance range

- Acquired EnCloudEn, a hyperconverged software start-up, expanding presence in video surveillance and driving shift towards recurring software revenue model

Jamie Lerner, chairman and CEO, commented: “Our second quarter results exceeded the high-end of our guidance range across all key metrics, supported by strong customer demand while increasing backlog to over $50 million. Orders from our hyperscale customers grew sequentially for the third consecutive quarter, and while not all orders will ship in the subsequent quarter, visibility into revenue contribution from this growing base has improved dramatically relative to a year ago. The ongoing industry supply constraints improved during the quarter, but still restricted our ability to meet all end customer demand. We anticipate supply chain constraints will see further improvement in 3FQ22, which should allow the company to see a sequential reduction in current backlog levels.

“Also, during the quarter, software and recurring licensing revenue increased, with our CatDV software delivering a second consecutive quarter of increased bookings, driven by strong adoption across sports, entertainment and enterprise markets. Our recurring software and services customer base continued to accelerate with bookings 2 times greater than customers in the quarter, demonstrating a growing backlog of higher margin recurring revenue. Additionally, the integration of Pivot3 has progressed well, and we have begun to cross-sell these video surveillance software solutions to our current customer base. Further, the recent launch of our ActiveScale Cold Storage, which combines tape architecture and storage-as-a -service software, offers hyperscale-level archive storage options for the enterprise and cloud providers, broadening the company’s available market and cross-selling opportunities.”

He concluded: “Our team’s continued execution during these ongoing supply chain constraints has been exceptional. The underlying fundamentals of our business, as well as the overall demand environment, are the strongest they have been since I joined the company. We are building an organization that over the long-term can support higher levels of revenue, while shifting to a higher mix of recurring revenue. We look forward to sharing more details about our transition to a recurring revenue model at our upcoming virtual Analyst Day on November 9.”

2FQ22 vs. 1FQ22

Revenue was $93.2 million, representing an increase of 4.6% sequentially from $89.1 million last quarter. Gross profit was $38.4 million, or 41% of revenue, compared to $37.3 million, or 42% of revenue, in the prior quarter.

Total operating expenses were $39.3 million, or 42% of revenue, compared to $37.3 million, or 42% of revenue, in the prior quarter. Selling, general and administrative expenses were $26.9 million, compared to $25.8 million in 1FQ22. R&D expenses were $12.4 million compared to $11.3 million last quarter.

GAAP net loss was $9.3 million, or ($0.16) per share, which included a debt extinguishment charge of $15 million partially offset by a gain of $10 million for the forgiveness on the PPP loan, compared to a net loss of $4.2 million, or ($0.07) per share, 1FQ22. Excluding stock compensation, restructuring charges and other non-recurring costs, non-GAAP adjusted net income was $0.1 million, or $0.00 per diluted share, compared to adjusted net income of $0.1 million, or $0.00 per diluted share, last quarter.

Adjusted EBITDA was $5.3 million, compared to $5.4 million in the prior quarter.

Balance Sheet and Liquidity

- Cash and cash equivalents including restricted cash was $23.2 million as of September 30, 2021, compared to $24.6 million as of June 30, 2021.

- Outstanding long-term debt as of September 30, 2021, excluding the $10 million drawn on the revolver, was $91.4 million. This compares to $81.3 million of outstanding debt as of June 30, 2021.

- Total interest expense was $3.1 million, compared to $3.9 million for the three months ended June 30, 2021.

Outlook

Given the expected improvements in the supply chain for 3FQ22, the company expects the following guidance range:

- Revenue of $104 million, plus or min $5 million

- Non-GAAP adjusted net income of breakeven, plus or min $1 million

- Non-GAAP adjusted net income per share of $0.00, plus or min $0.02djusted EBITDA of $5 million, plus or min $1 million

For FY22, the firm expects revenue of $380 to $420 million, determined by the timing of supply chain improvements.

Comments

For this quarter, Quantum exceeds the high-end of its guidance range with revenue at $93.2 million, up 8.6% Y/Y and 4.6% Q/Q which includes the expected $2 million from Pivot3.

It's the 4th 3-month period with revenue increasing, but with 7 quarters of consecutive net loss.

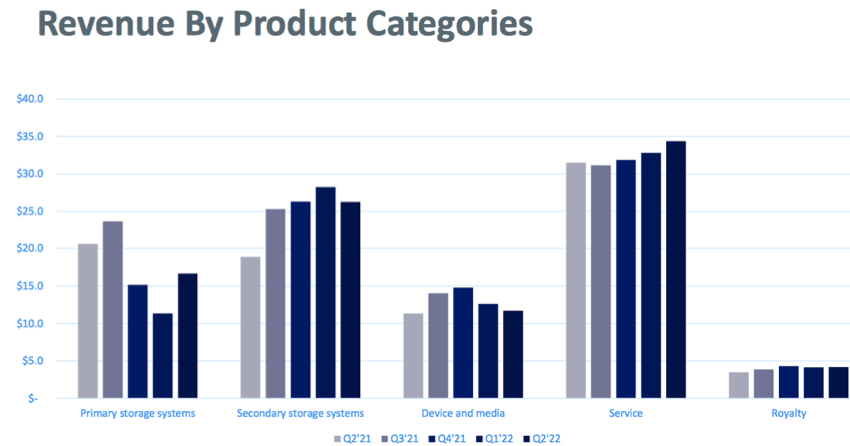

By businesses, Q/Q sales of primary storage systems and services were up, secondary storage systems and device and media down.

Chairman and CEO Jamie Lerner commented: "Customer demand remained robust during the quarter, demonstrated by the material increase in our backlog, which grew sequentially to $50 million from $30 million last quarter. Increased traction with our hyperscale customers continued as we delivered a third consecutive quarter of sequential order growth."

He added: "We also demonstrated progress in our software businesses and saw continued momentum in our subscription and services backlog. The ongoing industry supply constraints improved during the quarter but still restricted our ability to meet all end customer demand. We anticipate supply chain will see further improvement in 3FQ22, which should allow the company to see a sequential reduction in current backlog levels. In 2FQ22, we saw another quarter of revenue acceleration within our software and subscription customers, which grew 30%, albeit from a small base, but equally impressive was our bookings, which grew more than 70% sequentially."

The 2FQ22 revenue doesn't include $15 million of orders that were requested by customers in the quarter, but could not be fulfilled due to supply constraints, bringing total backlog to $50 million as compared to $30 million in 1FQ22. Secondary storage revenues in the quarter were sequentially slightly down as ongoing industry supply constraints continue to restrict firm's ability to meet all near-term customer demand. Primary storage system saw a meaningful sequential increase in revenue due to continued recovery in M&E and federal verticals during 2FQ22. Both verticals have seen multiple headwinds over the last year driven by Covid and other impacts.

The slight sequential decrease in devices and media, similar to 1FQ22, were impacted by the supply constraints.

Just over 85% of the backlog was related to tape products, with just over 70% of the backlog, specifically related to hyperscaler customers. Approximately two-thirds of the backlog is expected to be shipped in 2FH22 and the remaining one-third of the backlog has shipped as early in FY23.

The company have roughly 200 customers utilizing software and subscription services and it anticipatesfuture levels of adoption will continue to accelerate.

For 3FQ22, the company expects revenue of $104 million, ± $5 million or +6% to 17%, and confirmed FY22 revenue of $380 to $420 million, a yearly increase of 9% to 20%.

Fiscal year ended March 31

| (in $ million) | Revenue | Y/Y Growth | Net income (loss) |

| 1998 | 1,189.8 | NA |

170.8 |

| 1999 | 1,302.7 | 9% | (29.5) |

| 2000 | 1,418.9 | 9% | 40.8 |

| 2001 | 1,405.8 | -1% | 160.7 |

| 2002 | 1,087.8 | -23% | 42.5 |

| 2003 | 870.8 | -20% | (264.3) |

| 2004 | 808.3 | -7% | (62.0) |

| 2005 | 794.2 | -2% | (3.5) |

| 2006 | 834.3 | +5% | (41.5) |

| 2007 | 1,016.2 | +22% | (64.1) |

| 2008 | 975.7 | -4% | (60.2) |

| 2009 | 809.0 | -17% | (356.1) |

| 2010 | 681.4 | -16% | 16.6 |

| 2011 | 672.3 | -1% | 4.5 |

| 2012 | 652.4 | -3% | (8.8) |

| 2013 | 587.6 | -10% | (52.4) |

| 2014 | 553.2 | -6% | (21.5) |

| 2015* | 543.7 | -2% | 15.4 |

| 2016* | 479.8 | -12% | (75.6) |

| 2017* | 493.1 | 3% | (2.4) |

| 2018 |

437.7 |

-11% | (43.3) |

| 2019 |

402.7 |

-8% | (42.8) |

| 1FQ20 |

105.6 |

-2% | (3.8) |

| 2FQ20 |

105.8 |

18% | (2.3) |

| 3FQ20 |

103.3 | 1% | 4.7 |

|

4FQ20 |

88.2 |

-15% | (3.8) |

| 2020 |

402.9 |

0% | (5.2) |

| 1FQ21 |

73.3 |

-31% | (10.7) |

| 2FQ21 | 85.8 |

-19% | (4.6) |

| 3FQ21 |

98.0 |

5% | (2.7) |

| 4FQ21 |

92.4 | 5% | (17.5) |

| 2021 |

349.6 | -13% | (35.5) |

| 1FQ22 |

89.1 | 22% | (4.2) |

| 2FQ22 |

93.2 |

9% | (9.3) |

| 3FQ22 (estim.) |

104±5 |

6%-17% | NA |

| 2022 (estim.) |

380-420 | 9%-20% | NA |

* figures as restated

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter