Commvault: Fiscal 2Q22 Financial Results

Commvault: Fiscal 2Q22 Financial Results

Less than expected and decreasing Q/Q revenue, and much smaller net income

This is a Press Release edited by StorageNewsletter.com on October 27, 2021 at 2:02 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 171.1 | 177.8 | 344.1 | 361.3 |

| Growth | 4% | 5% | ||

| Net income (loss) | (41.7) | 1.7 | (38.7) | 15.6 |

Commvault Systems, Inc. announced its financial results for the second quarter ended September 30, 2021.

“During the quarter we saw a significant increase in new customer revenue,” said Sanjay Mirchandani, president and CEO. “Winning new customers and taking market share is foundational to meeting our longer-term financial objectives. At the same time, we did not meet our expectations for the quarter. We believe the impact was principally isolated to delayed software opportunities that are part of larger IT transformation projects. In addition, we believe industry-wide supply chain issues are impacting our customers sourcing of hardware components and associated software orders.”

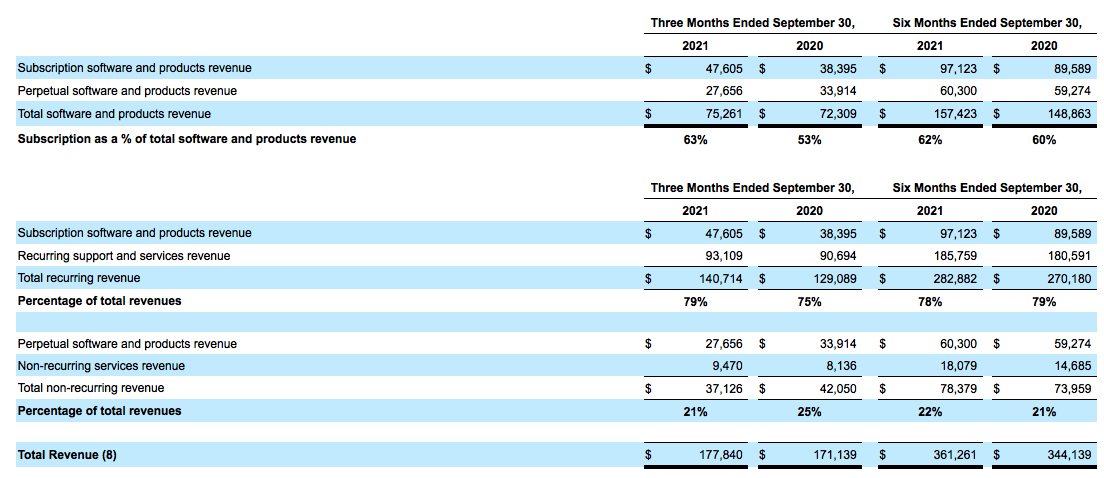

Total revenues for 2FQ22 were $177.8 million, an increase of 4% Y/Y. Total recurring revenue was $140.7 million, representing 79% of total revenue.

Annualized recurring revenue (ARR), which is the annualized value of all active recurring revenue streams at the end of the reporting period, was $542.6 million as of September 30, 2021, up 12% from September 30, 2020.

Software and products revenue was $75.3 million, an increase of yearly 4%. Excluding pass through hardware revenue, software revenue was up 9% Y/Y. The yearly increase in software and products revenue was driven by a 6% increase in larger deals (deals greater than $0.1 million in software and products revenue).

Larger deal revenue (deals with greater than $100,000 and software and products revenue) represented 67% of software and products revenue in the 3 months ended September 30, 2021. The number of larger deal revenue transactions increased 9% Y/Y to 163 deals for the 3 months ended September 30, 2021. The average dollar amount of larger deal revenue transactions was approximately $311,000.

Services revenue in the quarter was $102.6 million, an increase of 4% Y/Y. The increase in services revenue was driven primarily by the increase in Metallic software-as-a-service revenue.

On a GAAP basis, income from operations (EBIT) was $2.3 million for 2FQ22 compared to loss of $42.0 million in 1FQ22. Non-GAAP EBIT was $31.0 million in 2FQ22 compared to $28.9 million in 2FQ21.

Operating cash flow totaled $26.1 million for 2FQ22 compared to $27.0 million in the prior year quarter. Total cash and short-term investments were $295.8 million as of September 30, 2021 compared to $397.2 million as of March 31, 2021.

During 2FQ22, the company repurchased approximately 1,159,000 shares of its common stock totaling $90.0 million at an average price of approximately $77.70 per share.

Comments

For this quarter, revenue was expected to be $184.5 million, and at the end was only $177.8 million, +3.9% Y/Y and -3% Q/Q. It's the lower figure since 3FQ21.

President and CEO Sanjay Mirchandani explains that: "We believe industry-wide supply chain issues are impacting our customer sourcing of hardware components and associated software opportunities. While we don't believe this represents a long-term issue, we factored additional conservatism into our 3FQ22 guidance."

Total recurring revenue, which includes subscription software, maintenance support services and SaaS, was $141 million, representing 79% of total revenue in the quarter. This compares to 75% in 2FQ21.

The firm ended the quarter with $296 million in cash, and has no debt on the balance sheet.

Subscription and Metallic ARR of $278 million now represents 51% of total ARR and is growing at 40% Y/Y. 50% of subscription transactions were new logos for the vendor, and 60% of Metallic customers were new to Commvault.

The total number of transactions that involve more than one product increased 150% Y/Y. About half of 7-figure software transactions involve multiple products and services, and Metallic landed its largest transaction to date, a 6-figure deal that included multiple product offerings.

For 3FQ22, the firm expects software revenue of approximately $92 million as it is winning new business, including competitive displacements. This new business may take longer to close, especially if part of larger IT transformation projects. It is expected 3FQ22 total revenue of approximately $195 million, meaning up to 10% Q/Q and 4% Y/Y.

Revenue and net income (loss) for Commvault in $million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 | 176.2 | 6% |

(8.6) |

| 2Q19 | 169.1 | 1% |

0.9 |

| 3Q19 | 184.3 | 2% |

13.4 |

| 4Q19 |

181.4 | -2% |

(2.2) |

| FY19 | 711.1 | 2% |

3.6 |

| 1Q20 | 162.2 | -8% | (6.8) |

| 2Q20 | 167.6 | -1% |

(7.1) |

| 3Q20 | 176.4 | -4% | (0.7) |

| 4Q20 | 164.7 | -9% | (5.6) |

| FY20 |

670.9 |

-6% |

(5.6) |

| 1Q21 | 173.0 | 7% | 2.3 |

| 2Q21 | 171.1 | 2% | (41.2) |

| 3FQ21 | 188.0 | 7% | 1.7 |

| 4FQ21 | 191.3 | 16% | 6.3 |

| FY21 | 723.5 | 8% | (31.0) |

| 1FQ22 |

183.4 | 6% | 13.9 |

| 2FQ22 |

177.8 | 4% | 1.7 |

| 3FQ22 (estimations) | 195 | 4% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter