Storage Market in Two Biggest Asian Countries: China and India

Single digit and 10% 2020-2025 CAGR, respectively

This is a Press Release edited by StorageNewsletter.com on October 8, 2021 at 1:32 pmHere are two market reports on the storage market into the two biggest Asian countries: China and India.

- Enterprise storage spending in China will reach $15.7 billion in 2025 corresponding to CAGR of 10% from 2020.

- 15% Y/Y growth was recorded in India for external storage systems market reaching at $73.7 million in 2Q21, and expected to grow at a single-digit CAGR for the 2020-2025.

Enterprise Storage Spending in China to Reach $15.7 Billion in 2025

CAGR of 10% from 2020

The total addressable market size of enterprise storage in China, in terms of spending opportunity, is poised to reach $15.7 billion in 2025, driven by the growing demand for secured, enhanced and faster storage solutions among the enterprises shifting towards digital infrastructure, according to GlobalData, a data and analytics company,

GlobalData Market Opportunity Forecasts to 2025: ICT in China reveals that innovations in storage solutions such as SDS, high performance capabilities, and faster access to data that can handle next-gen workloads for big data, AI and virtual infrastructure will boost enterprise storage market in the country over the next few years.

Saurabh Daga, technology analyst, comments: “As enterprises increase their investments in disruptive technologies like big data, AI, automation and blockchain as part of their digital transformation initiatives, the need for storage power necessary to capture huge data sets will increase going forward, helping drive enterprise storage spending in China to increase at a CAGR of 9.9% over the forecast period 2020-2025.“

China has emphasised on digital infrastructure spending within its ‘New Infrastructure Plan’, a 5-year plan for accelerating the implementation of key technologies, which also includes 5G networks, industrial Internet, data centers, and AI, all of which require a significant investment on upgrading the storage infrastructure.

Among the enterprise storage segments comprising hardware, software and managed storage services, enterprise spending on storage hardware is set to grow at the fastest CAGR of 11.7% over 2020-2025. NAS, all flash and hybrid arrays, and SAN represent the top 3 enterprise storage hardware categories in 2021, in terms of market size.

Daga continues: “With phasing out of legacy tape storage, and capability maturation of HDDs, the NAS storage is witnessing a surge in demand as it provides an efficient and scalable storage access for a distributed team from a centralized location. The growing popularity of NAS storage among the Chinese enterprises is also because the data access can be centrally controlled, a key feature considering the strict data security regulations in the country.”

SDS will account for second largest share of the overall enterprise storage opportunity through the forecast period. The need for simplified, scalable and cost-efficient storage infrastructure will drive the demand for SDS among the enterprises in China.

Daga concludes: “While the large enterprises segment (1,001+ employees) will account for largest share of the total enterprise storage spending in China through the forecast period, the combined spending from micro (1-50 employees), small and medium (51-1,000 employees) enterprises will increase at a marginally faster CAGR of 9.9% over the forecast period. The increasing trend of digitalization among SMEs in China and the institutional support to them in the form of easy loans and tax incentives on technology implementations and R&D will be the key drivers for growth in this segment.”

15% Y/Y Growth in India for External Storage Systems Market in 2Q21

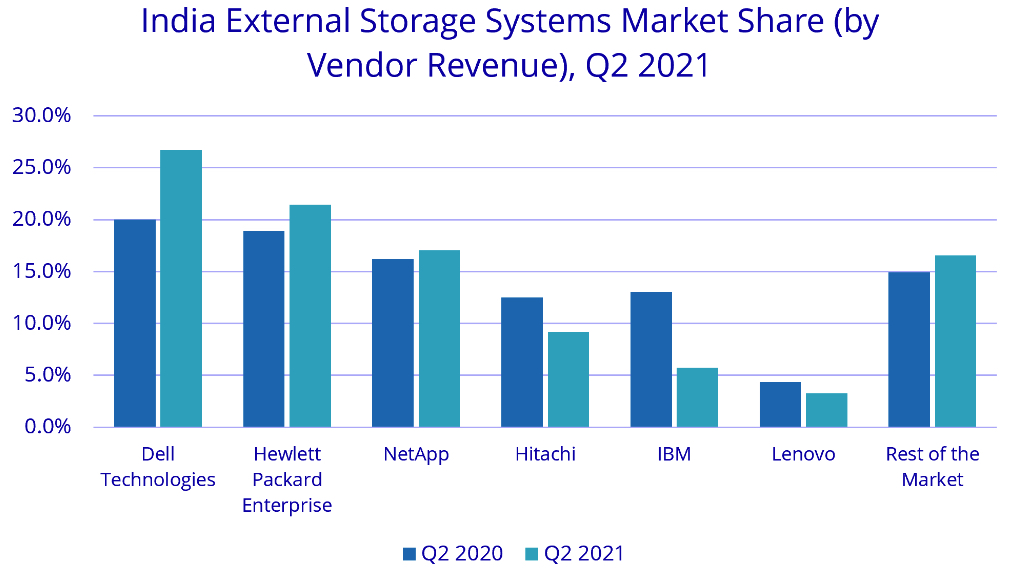

Dell leader with 27%, followed by HPE and Netpp, as Hitachi, IBM and Lenovo seeing decline

As per International Data Corporation‘s Worldwide Quarterly Enterprise Storage Systems Tracker 2Q21 release, India’s external storage market witnessed a growth of 14.8% Y/Y by vendor revenue and stood at $73.7 million for the period.

The quarter witnessed Y/Y growth in storage spending from the government, and manufacturing verticals, while observing a sharp decline in contribution from BFSI, professional services, and telecom verticals during the same period.

“Enterprises are forced to change their existing IT architectures to be adaptive and efficient while securing the workloads. Additionally, workloads are getting distributed to the edge, which is even more complicating things for organizations. Enterprises are looking for an infrastructure platform which offers complete end-to-end data services along with built-in security features,” says Dileep Nadimpalli, senior research manager, enterprise infrastructure, IDC India.

The adoption of AFAs is evident, contributing 34.4% to the overall external storage systems market in 2Q21. The emergence of NVMe flash media would further drive the AFA market due to better cost vs. performance ratio across verticals. HDD arrays saw a strong growth due to uptake of backup appliance for data protection needs.

Entry-Level storage systems grew by 65.4% Y/Y due to increased investments from banking, government, professional services, and manufacturing organizations in 2Q21. The high-end storage segment witnessed a Y/Y decline; however, it is expected uptake of this storage segment in the next couple of quarters.

Dell Technologies continued to be the market leader in 2Q21 the external storage systems market with a 26.7% market share by vendor revenue, followed by HPE and NetApp. Hitachi and IBM saw a Y/Y decline.

The external storage systems market is expected to grow at a single-digit CAGR for the 2020-2025 period. Furthermore, the external storage systems spending is expected to grow Y/Y in 2H21 due to large data localization projects in BFSI segment and large government deals.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter