Long-Time Partners Western Digital and Kioxia Could Merge in Deal Valued at $20 Billion

Comment by Trendfocus

By Jean Jacques Maleval | August 26, 2021 at 1:03 pmThis excellent article was written by Trendfocus, Inc.www.Trendfocus.com, an analyst firm specialized in HDDs and SDDs, and then knowing quit well Western Digital and Kioxia.

Reports of a Possible Merger Between Western Digital and Kioxia

The Wall Street Journal broke a story on August 25, 2021, indicating that Western Digital was in advanced talks to merge with Kioxia Holdings.

Both are long-time partners in the flash Ventures JV, dating back to the SanDisk and Toshiba Memory days.

The article suggested that the deal could be valued at $20 billion and that Western Digital’s current valuation is roughly $19 billion – the merged companies would likely be run by Western Digital’s CEO, David Goeckeler.

According to the Journal, the transaction would be an all-stock deal, however, if the deal were to not come to fruition, Kioxia Holdings would be continuing down the path of an IPO. Kioxia’s IPO attempt last fall was received poorly by the market given the uncertainties surrounding the Covid-19 pandemic’s effect on the memory market. Since then, however, the pandemic has fueled significant acceleration in electronic device demand which has, in turn, fueled NAND demand. The unexpected jump in device demand created a whip-saw effect in the supply chain, where semiconductor component makers fell short in production output in response to surging end-market demand for electronics products. Despite the component supply chain impact, end demand is so strong and broad-based – spanning consumer, commercial and hyperscale markets – that NAND supply continues to fall short, even as component shortages prevent the production of some finished products. 2Q21 earnings results clearly illustrated the impact on the NAND market, with vendors achieving higher margins on elevated pricing and improved gross margins.

While a deal may not transpire and Kioxia may continue to pursue and IPO if talks between it and Western Digital fail, any merger would face significant regulatory approval hurdles, especially from China. The Journal article noted that several recent high-profile technology mergers and acquisitions have been met with resistance from regulators, especially out of China, a country that has significant aspirations in becoming a global semiconductor force and would likely seek to block unfavorable mergers on anti-trust grounds. NAND is clearly on the radar for China as China-based Yangtze Memory Technologies Company, Ltd. (YMTC), seeks to become a major NAND vendor. A combined Western Digital and Kioxia would strengthen its competitiveness in NAND, with their combined share coming within a couple%age points of Samsung, who has consistently been the top NAND vendor with more than one-third of the worldwide NAND market on a regular basis. With this potential merger, the remaining vendor landscape would be (or will be shortly), Samsung, SK Hynix/Intel, WDC/Kioxia, Micron, and to a much smaller extent, YMTC, totaling essentially 5 vendors.

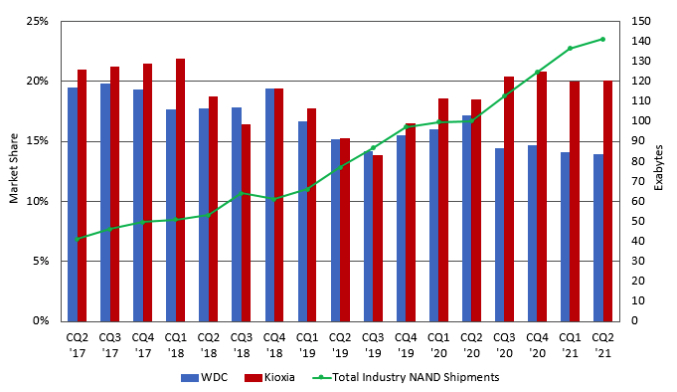

The following chart illustrates the NAND bit share of both Western Digital and Kioxia (and its predecessor, Toshiba Memory Corporation) over the past few years and includes the total NAND market bit shipments over the same period. Assuming the 2 companies retain the majority of their respective shares following a merger, the combined entities could become the largest NAND producer in the world.

For a combined SSD market share, a merger between WDC and Kioxia would put WDC in an even stronger position, with a combined 25% share for all SSD exabytes worldwide, cutting the gap to Samsung’s 35% share by approximately 8pts. There would be various overlapping product and market segments, but as with most all mergers, the 1+1 share gain would most likely not be realized across the board, though the combined company would still be formidable!

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter